Seez is a Dubai-based automotive AI company that helps car dealers sell better using data, automation, and omnichannel tools. The company started as a consumer app and evolved into a full SaaS platform used by dealers, OEMs, and automotive groups worldwide.

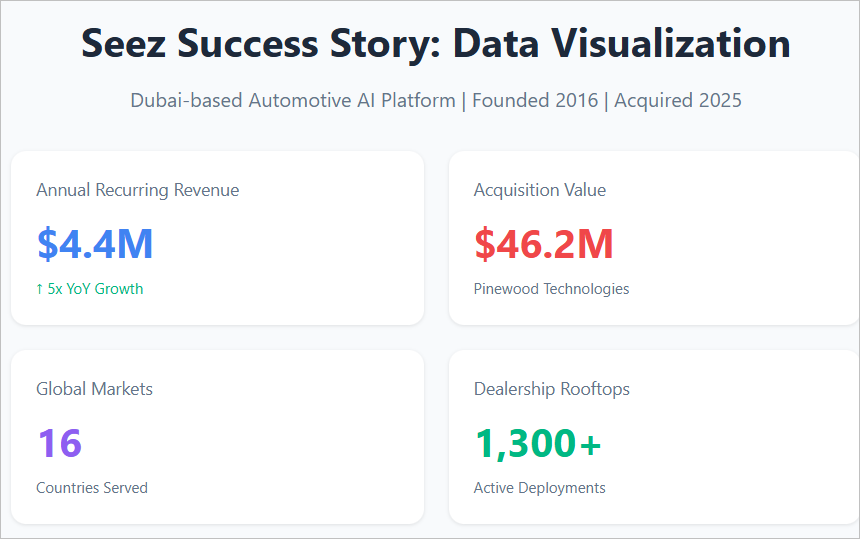

Seez stands out for its strong pivot, fast global expansion, and deep focus on AI. Its proposed acquisition by Pinewood Technologies Group PLC, valued at USD 46.2 million, marks a major milestone. The deal positions Seez as a core AI layer inside a global automotive software ecosystem.

In this case study, we break down Seez’s journey, products, business model, growth, funding, and acquisition story.

TL;DR – Seez Case Study

- Founded in Dubai in 2016 as an AI-first automotive startup

- Pivoted from a consumer app to a dealership-focused SaaS platform

- Expanded operations across 16 global markets

- Reached USD 4.4 million in annual recurring revenue by December 2024

- Raised USD 4.2 million in funding to expand into the US market

- Proposed acquisition by Pinewood.AI valued at USD 46.2 million

Seez Highlights

| Attribute | Details |

| Company Name | Seez |

| Headquarters | Dubai, UAE |

| Sector / Industry | Automotive AI, SaaS, Omnichannel Retail |

| Founders | Tarek Kabrit, Andrew Kabrit |

| Year Founded | 2016 |

| Company Size | 11 to 50 employees |

| Markets | 16 countries |

| Proposed Acquirer | Pinewood Technologies Group PLC |

| Official Website | https://www.seez.co |

What is Seez, and what does the startup do?

Seez is an automotive AI and SaaS company based in Dubai. It helps car dealers and automotive businesses digitize sales, marketing, and showroom operations through a single connected platform. The company focuses on turning more customer interactions into completed car sales.

Founding story and current status

Seez was founded in 2016 by Tarek Kabrit and Andrew Kabrit. It started as a consumer mobile app that could identify cars from a single photo. The app gained strong traction, reaching nearly 3 million users. After this early success, the founders shifted focus to a bigger opportunity in dealership technology. Today, Seez operates as a B2B SaaS company serving dealers, OEMs, and automotive groups across 16 global markets.

What problem does it solve?

Car dealerships often use many disconnected systems for sales, marketing, finance, and showroom operations. This creates slow processes, lost leads, and poor customer experience. Seez solves this by bringing online buying, in-store sales, AI marketing, analytics, and customer engagement into one platform. Dealers get better visibility, faster sales cycles, and full ownership of customer data.

Evolution of the product and services

Seez evolved from a single consumer app into a full automotive SaaS suite. The platform now includes online car buying tools, digital showroom software, AI-powered marketing, advanced analytics, and a virtual sales assistant. This evolution allows dealers to sell cars online, in-store, or across both channels without breaking the customer journey.

Explore our other startup breakdowns:

What is the size of the automotive software market in the UAE?

Size of the market Seez operates in

Seez operates in the UAE automotive software market, which is already at a meaningful scale. In 2024, the market generated USD 463.6 million in revenue. This includes dealership software, AI platforms, digital retail tools, and connected automotive systems. As car dealers invest more in digital sales, data, and automation, this market is expected to expand steadily over the next few years.

Growth trends in the UAE market

The UAE automotive software market is projected to reach USD 1,324.4 million by 2030, growing at a 19.1% CAGR between 2025 and 2030. This growth is driven by rising demand for digital car buying, AI-driven pricing, predictive analytics, and omnichannel retail. Segments such as autonomous driving software and AI-based systems are expected to grow the fastest during this period.

Seez positioning and target audience

Seez positions itself within the fast-growing AI and dealership software segment of this market. Its target audience includes car dealers, dealer groups, OEMs, and automotive enterprises that want to modernize sales and operations. By combining online car buying, showroom tools, AI marketing, and analytics, Seez directly aligns with the UAE market’s shift toward data-driven and software-led automotive retail.

Who are the founders and core team members of Seez?

Tarek Kabrit – Co-founder and CEO

Tarek Kabrit is the co-founder and CEO of Seez. After nearly 20 years in strategy consulting, investment banking, and venture capital, he left the corporate world to start Seez in 2016. His career includes roles at Booz Allen, Deutsche Bank, and Mubadala. The idea for Seez came from a real-life gap he experienced, which led him to build an AI-driven, data-first automotive platform. Alongside leading Seez, he is a Venture Partner at Nuwa Capital, sits on the Investment Committee of Flat6labs, and mentors founders through Endeavor.

Andrew Kabrit – Co-founder

Andrew Kabrit is the co-founder and Chief Product Officer of Seez. He has been part of the company since its early days and has played a central role in building the product and technology stack. Andrew helped develop the original AI-based car recognition app and later led the transition toward enterprise automotive software. With a background in business administration and information systems from Copenhagen Business School, he focuses on AI, data, and scalable product design. Today, he leads product strategy across Seez’s SaaS platform, AI tools, and omnichannel solutions.

How did Seez start? Background story

The original idea and early days

Seez started in 2016 with a simple but powerful idea. The founders wanted to eliminate inefficiencies in the buying and selling of cars. The first product was a consumer mobile app that could identify any car from a single photo. The app used AI, image recognition, and pricing data to show similar cars nearby and estimate fair market value. This solved a real problem for buyers who spent hours researching prices and models.

Initial challenges and the pivot

While the app gained strong user interest, scaling a consumer automotive platform proved difficult. Monetization was limited, and long-term value was clearer on the dealership side. The team made a strategic pivot from B2C to B2B. This shift required rebuilding the product, sales approach, and roadmap to serve dealers rather than consumers. The challenge was moving from millions of users to a small number of high-value enterprise customers.

Early traction and growth momentum

The early consumer app reached nearly 3 million users, validating demand for AI-driven automotive data. This traction helped Seez gain credibility with dealers and partners. After the pivot, early enterprise customers adopted the platform for online sales and AI tools. This marked the beginning of Seez’s growth as a global automotive SaaS company, later expanding across multiple international markets.

How does Seez make money? Business model and revenue streams

B2B SaaS business model

Seez operates a B2B SaaS business model. Its customers are car dealers, dealer groups, OEMs, and automotive enterprises. The company does not sell directly to consumers. Instead, it provides software and AI tools that help dealerships increase sales efficiency, reduce costs, and improve customer experience across online and showroom channels.

Subscription-based platform access

The core revenue stream comes from recurring subscriptions. Dealers pay monthly or annual fees to access the Seez platform, including digital showroom tools, online car buying features, and core operations software. This subscription model creates predictable recurring revenue and long-term customer relationships.

Online car sales and omnichannel modules

Seez generates revenue from modules like SeezClick and SeezPad. These tools enable full online car buying, financing, insurance, and digital contracts. Dealers pay for these modules based on usage, number of showrooms, or enterprise-level deployments.

AI-powered marketing services

Through SeezBoost, the company offers managed AI-driven marketing. Revenue comes from campaign management fees and performance-focused services. The platform optimizes ad spend, creates dynamic ads, and improves conversion rates for dealerships.

AI analytics and data-driven add-ons

SeezNitro provides advanced AI analytics for pricing, inventory optimization, residual value prediction, and market insights. These tools are sold as premium add-ons, increasing average contract value for enterprise clients.

Enterprise and multi-rooftop deployments

Large dealer groups and OEMs deploy Seez across multiple locations. These enterprise agreements generate higher contract values and long-term commitments. This model supports scalable growth as clients expand usage across regions and markets.

Funding and Investors of Seez

Seez has raised USD 4.2 million in funding to scale its AI platform and expand into the United States. The funding round, announced in September 2024, focused on accelerating product development, enterprise sales, and global partnerships. In February 2025, Seez announced a proposed acquisition by Pinewood Technologies Group PLC for an equity value of USD 46.2 million, structured as a cash-and-shares deal. The deal gives Seez access to global dealer networks. Pinewood’s parent, Lithia Motors Inc., plans to deploy Seez’s AI tools across its worldwide dealerships.

What are the growth metrics and revenue figures of Seez?

- USD 4.4 million in annual recurring revenue as of December 2024, showing strong demand for Seez’s AI-powered SaaS platform.

- 5x year-over-year revenue growth, driven by enterprise dealership adoption and expansion across global markets.

- Revenue projected to triple by December 2025, supported by AI product expansion and entry into the US market.

- Active presence in 16 international markets, including the GCC, Europe, Australia, and North America.

- More than 1,300 dealership rooftops are using Seez products across multiple regions.

- Nearly 3 million users reached during the early consumer app phase, validating the platform’s AI capabilities and market fit.

Mergers, Acquisitions & Investments of Seez

Proposed acquisition by Pinewood Technologies Group PLC

In February 2025, Seez announced a proposed acquisition by Pinewood Technologies Group PLC for an equity value of USD 46.2 million, structured as a mix of cash and shares. The transaction is designed to combine Seez’s AI capabilities with Pinewood’s automotive software footprint. The share component of the deal is expected to double in value over the next three years, highlighting long-term growth confidence.

Strategic integration with Lithia Motors Inc.

As part of the proposed acquisition, Lithia Motors Inc., Pinewood’s parent company and the world’s largest dealer group, plans to deploy Seez’s AI Virtual Assistant across its global dealership network. This move significantly expands Seez’s enterprise reach and positions its AI products at scale within a global automotive retail ecosystem.

What are the products and service offerings of Seez?

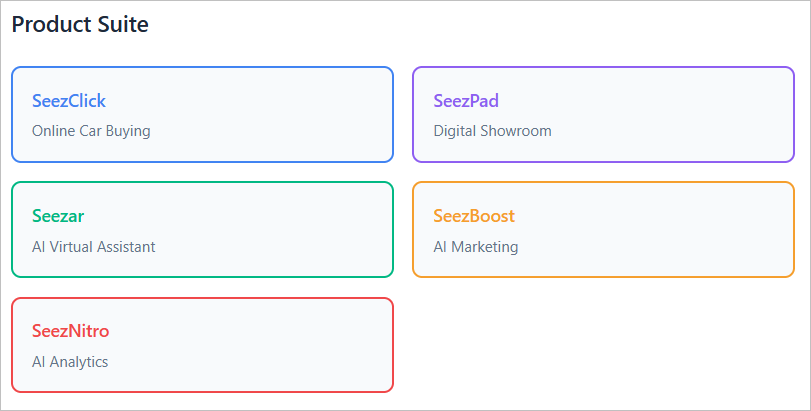

SeezClick – Online car buying and omnichannel sales

SeezClick turns a dealership website into a full online sales channel. Customers can browse inventory, apply for finance and insurance, and sign documents digitally in one flow. The tool supports new, used, and leasing vehicles. Dealers can launch quickly with minimal code changes and keep full control of branding. SeezClick connects online and showroom journeys, so a customer can start at home and finish in store, or vice versa. This reduces drop-offs and shortens the sales cycle.

SeezPad – Digital showroom and sales operations platform

SeezPad is the core operations platform for dealerships. It replaces fragmented tools with one system for orders, inventory, leads, and customer interactions. Sales teams use QR codes on cars to let customers start orders on their own. Real-time updates keep both sides informed. SeezPad also integrates with existing dealer systems, removing data silos. The platform improves efficiency, saves sales staff time, and enables a smooth transition between online and in-person sales.

Seezar – AI virtual sales assistant

Seezar is a 24/7 AI virtual assistant built for automotive sales. It engages customers on dealership websites, answers questions, and qualifies leads. Unlike basic chatbots, Seezar is designed to support real sales conversations. It uses automotive data and dealer integrations to guide buyers toward the right vehicle and next steps. Enterprise dealer groups plan to deploy Seezar at scale to increase response speed, capture more leads, and support sales teams without adding headcount.

SeezBoost – AI-powered marketing and demand generation

SeezBoost helps dealerships run smarter marketing campaigns using AI. The platform manages Meta ads, dynamic product ads, remarketing, and spend optimization. It creates audience personas, tests creatives, and adjusts budgets in real time. Dealers use SeezBoost to reduce cost per sale and improve lead quality. The service combines software with managed execution, allowing dealerships to focus on sales while Seez handles campaign performance and optimization.

SeezNitro – AI analytics and market intelligence

SeezNitro provides advanced analytics for pricing, inventory, and risk decisions. Features include car attractiveness scoring, dynamic pricing, residual value prediction, and grey market dashboards for the UAE and KSA. The platform supports dealers, insurers, and finance companies. By leveraging machine learning across large datasets, SeezNitro helps users accurately price cars, reduce inventory risk, and identify profitable opportunities. It adds a strong data advantage to the overall Seez platform.

Who are the main competitors of Seez, and how do they compare?

CDK Global

CDK Global is a well-known dealer management system used by large dealer groups. It focuses on core operations like inventory, billing, and compliance. However, it relies heavily on legacy workflows and offers limited AI-driven sales and omnichannel capabilities. Seez competes by offering AI-first tools and full online-to-showroom sales journeys.

Reynolds and Reynolds

Reynolds and Reynolds provides dealership software for operations and back office management. Its strength lies in long-term dealer relationships and stability. Its platforms are slower to adapt to AI, digital retail, and real-time customer engagement. Seez differentiates through faster innovation and AI-powered automation.

DealerSocket

DealerSocket focuses on CRM and customer management for dealerships. While strong in lead tracking and follow-ups, it does not fully cover online transactions, pricing intelligence, or AI marketing. Seez offers an end-to-end platform that connects CRM, sales, marketing, and analytics.

Cox Automotive

Cox Automotive operates a large ecosystem that includes listings, data, and dealer tools. Its platforms are powerful but often fragmented across products. Seez competes by offering a unified platform where AI, online buying, showroom tools, and analytics work together.

AutoTrader

AutoTrader focuses on listings and lead generation for car buyers and sellers. It helps dealers gain visibility but does not support the full transaction flow or in-store integration. Seez goes beyond listings by enabling complete digital and omnichannel sales.

CarGurus

CarGurus provides pricing insights and marketplace exposure. Its tools help buyers compare cars, but stop at lead generation. Seez competes by giving dealers control over pricing, AI insights, and the entire buying process.

How Seez stands apart

Seez’s key advantage is ownership of the full sales lifecycle. It combines AI, online buying, showroom operations, marketing, and analytics into a single platform, eliminating the need for separate vendors.

| Competitor | Core Focus | Seez Advantage |

| CDK Global | Dealer operations | AI-first omnichannel platform |

| Reynolds and Reynolds | Back office systems | Faster innovation and automation |

| DealerSocket | CRM | Full transaction and pricing flow |

| Cox Automotive | Broad ecosystem | Unified AI-driven platform |

| AutoTrader | Listings | End-to-end car sales |

| CarGurus | Pricing and leads | Dealer-controlled AI insights |

What are the future plans for Seez?

Scaling through the Pinewood acquisition

Seez’s immediate future is centered on its proposed acquisition by Pinewood Technologies Group PLC. The goal is to embed Seez’s AI products deeply into Pinewood’s automotive software ecosystem. This allows Seez to move faster, reach larger dealer groups, and operate at enterprise scale rather than growing market by market on its own.

Expansion across large dealer networks

A key priority is large-scale rollout across global dealer networks, especially in North America. With support from Lithia Motors Inc., Seez plans to deploy its AI virtual assistant and SaaS tools across hundreds of dealership rooftops. This shifts the company from growth through small pilots to growth through enterprise-wide adoption.

Product focuses on AI-led automation

Seez will continue building AI-driven products that reduce manual work for dealers. This includes smarter virtual sales agents, better pricing intelligence, and deeper automation across sales and marketing workflows. The focus is not on launching many new products, but on making existing AI tools more autonomous and effective.

Explore our other startup stories:

FAQs

When did Seez start?

Seez started in 2016. The company was founded in Dubai with the goal of using AI and data to reduce inefficiencies in the buying and selling of cars. Tarek Kabrit and Andrew Kabrit started it after identifying major inefficiencies in automotive retail and dealership workflows.

How does Seez make money?

Seez makes money through a B2B SaaS model. It earns recurring revenue from subscriptions, AI modules, online car sales tools, marketing services, and enterprise dealership deployments.

What is Seez?

Seez is an AI-powered SaaS platform for the automotive industry. It helps car dealers digitize their online sales, showroom operations, marketing, pricing, and customer engagement through a single connected system.

What is Seez’s net worth?

Seez announced a proposed acquisition valued at USD 46.2 million by Pinewood Technologies Group PLC in February 2025, which reflects its latest disclosed valuation benchmark.

Where does Seez operate?

Seez operates across 16 international markets, including the GCC, Europe, Australia, and North America, serving dealer groups and automotive enterprises.

Who uses Seez?

Seez is used by car dealers, dealer groups, OEMs, and automotive enterprises seeking AI-driven, omnichannel tools to improve sales efficiency and the customer experience.

Author

-

Rafiqul is a storyteller with a founder’s mindset. At UAE Startup Story, he crafts deep-dive narratives, interviews, and features that decode what makes startups succeed in the UAE and beyond. He works closely with entrepreneurs to capture lessons, failures, and turning points that can inspire others on their own journeys.