NymCard builds the core infrastructure that powers modern payments across MENA and Pakistan. The company helps banks, fintechs, and enterprises launch card programs, embedded lending, and money movement through a single API-driven platform. NymCard stands out because it owns its payment processing and switching technology instead of relying on third parties.

The company reached a major milestone in 2025 after raising $33 million in Series B funding led by QED Investors, which strengthened its role in the regional fintech ecosystem. NymCard now supports large-scale financial products across multiple regulated markets.

In this case study, we break down how NymCard started, scaled its platform, and became a key enabler of embedded finance in the Middle East.

TL;DR – NymCard Case Study

- NymCard builds payment and embedded finance infrastructure for banks, fintechs, and enterprises across MENA and Pakistan.

- The company launched in 2018 to solve regional gaps in card issuing, lending, and money movement.

- NymCard owns its core payment processing and switching technology, giving clients greater control and faster processing.

- A $33 million Series B round in 2025 marked a major growth milestone and regional validation.

- The platform now supports card issuing, embedded lending, and cross-border payments at scale.

NymCard Highlights

| Attribute | Details |

| Company Name | NymCard |

| Headquarters | Dubai, United Arab Emirates |

| Sector / Industry | Fintech, Payments Infrastructure, Embedded Finance |

| Founders | Omar Onsi, Ayman Chalhoub |

| Year Founded | 2018 |

| Number of Customers | 50+ banks, fintechs, and enterprises |

| Parent Organization | Independent company |

| Official Website | https://www.nymcard.com |

Read more startup stories:

- Altibbi Success Story: How It Built MENA’s Top Health App

- Seez Startup Story: An AI Platform for Car Dealers Across 16 Markets

What is NymCard, and what does the startup do?

Founding story and current status

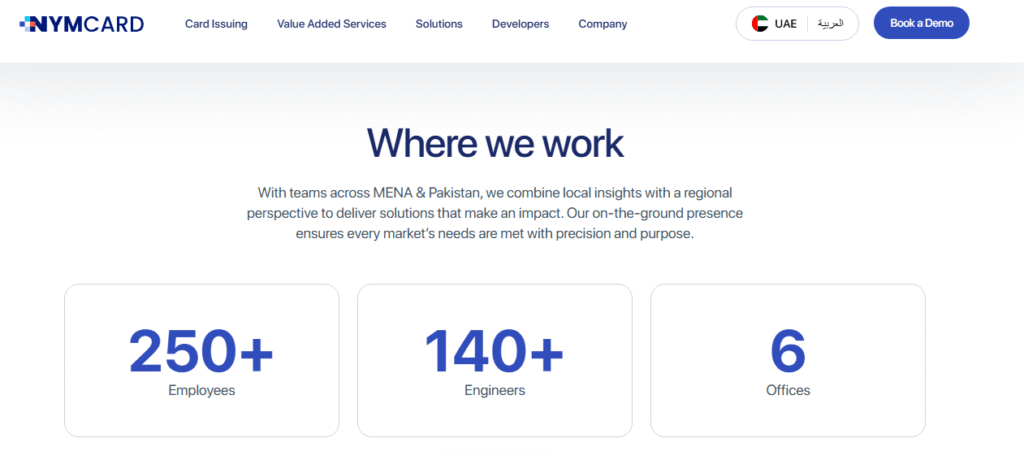

Omar Onsi founded NymCard in 2018 to modernize payment infrastructure across the MENA region. He built the company in the UAE to support banks and fintechs that struggled with slow legacy systems and complex regulations. Today, NymCard operates across MENA and Pakistan with offices in Dubai, Riyadh, Cairo, Beirut, Karachi, and Lisbon. The company operates as a regulated payments infrastructure provider and supports large-scale financial programs for banks, fintechs, telecom companies, and enterprises.

What problem does NymCard solve?

NymCard solves the problem of building and running compliant payment systems in fragmented markets. Many companies want to issue cards, move money, or offer credit, but lack the technical and regulatory capacity to do so. NymCard removes this barrier by providing a licensed, ready-to-deploy platform. Clients avoid long development cycles, reduce compliance risk, and launch financial products faster without managing direct relationships with card networks and regulators.

Evolution of the product and services

NymCard started as a card issuing and processing platform for prepaid and debit programs. The company later expanded into credit cards, embedded lending, and cross-border money movement. It built its proprietary nCore processing and switching platform to give clients full control and flexibility. Today, NymCard offers card issuing, embedded credit, open finance, and real-time payments through modular APIs that scale across multiple countries and use cases.

What is the size of the embedded finance market in the UAE?

Size of the market NymCard operates in

The UAE embedded finance market reached about USD 5.68 billion in 2024. Research forecasts show the embedded finance market will grow to USD 6.27 billion by 2025. Analysts expect the market to expand further, reaching nearly USD 8.38 billion by 2030. This market covers embedded payments, lending, banking, insurance, and wealth products. Strong demand comes from digital payments, card issuing, BNPL, and Banking-as-a-Service platforms. The UAE serves as a regional hub for embedded finance infrastructure, thanks to strong regulation and high digital adoption.

Growth trends in the UAE embedded finance market

The UAE’s embedded finance market grew at a CAGR of 14.9% between 2021 and 2025. Forecasts show steady growth at a 7.5 percent CAGR from 2026 to 2030. Digital banking, BNPL adoption, open finance APIs, and instant payment systems continue to drive growth. Banks, fintechs, super apps, and government platforms actively embed payments and credit into daily services. National programs like FIT and UAE PASS also push adoption by enabling secure onboarding, real-time payments, and regulated data sharing across platforms.

NymCard’s positioning and target audience

NymCard operates as an embedded finance infrastructure provider within this growing UAE market. The company targets banks, fintechs, telecom operators, enterprises, and digital platforms that want to launch regulated payment and lending products. NymCard focuses on card issuing, embedded lending, and money movement rather than consumer apps. Its Central Bank of the UAE license, proprietary processing technology, and API-first platform position it as a core enabler for businesses that need scalable, compliant, and region-ready embedded finance solutions.

Who are the founders and core team members of NymCard?

Omar Onsi – Founder and Chief Executive Officer

Omar Onsi founded NymCard after building and scaling telecom and consumer technology businesses across MENA for more than 15 years. Before NymCard, he founded Nymgo, a D2C VOIP platform that served over 3 million users and raised capital from Intel Capital and Abraaj. Omar identified similar infrastructure gaps in payments and banking and launched NymCard in 2018 to solve them. He leads company strategy, regulation alignment, and platform vision. Omar studied at Harvard Business School and Stanford GSB and holds deep experience in scaling regulated technology businesses.

Ayman Chalhoub – Co-Founder

Ayman Chalhoub co-founded NymCard alongside Omar Onsi to modernize financial services delivery in the region. He brought strong regional market knowledge and helped shape NymCard’s early product vision. Ayman focused on aligning technology capabilities with real-world banking and fintech needs. In the early years, he supported product development, partnerships, and market-entry efforts. His work helped position NymCard as an infrastructure provider rather than a consumer fintech. Over time, leadership responsibilities evolved as the company scaled and expanded.

Core Leadership Team and Key Roles

NymCard’s leadership team includes experienced executives across product, technology, finance, and business growth. Shiraz Ali leads commercial strategy as Chief Business Officer. Mario Wehbe drives product direction as Chief Product Officer. Srikanth Achanta oversees platform architecture and scalability as Chief Technology Officer. Nikolai Tsipas manages financial planning and governance as Chief Finance Officer. The company strengthened leadership over time to support regional expansion, regulatory complexity, and large-scale enterprise partnerships.

How did NymCard start?: Background story

How it all started

Omar Onsi saw a clear gap in MENA’s payment infrastructure after years of building telecom platforms. Banks and fintechs struggled to launch cards, lending, and wallets without heavy legacy systems. In 2018, he started NymCard in the UAE to solve this problem. The goal stayed simple. Build a modern, API-driven payment infrastructure designed for local regulations. NymCard focused on cards, money movement, and embedded finance from day one. The company positioned itself as an infrastructure layer rather than a consumer brand.

Initial challenges and pivots

NymCard faced strong regulatory and trust barriers in its early years. Banks demanded full compliance, security, and local control. Global processors failed to meet regional needs. The team invested early in owning its processing and switching technology rather than licensing third-party systems. This decision increased costs and complexity but gave NymCard long-term control. The company also shifted its focus to B2B infrastructure rather than building end-user products. This pivot helped NymCard earn regulator and bank confidence faster.

Early growth and momentum

Early traction came through partnerships with regional banks and fintechs that needed faster card launches. NymCard gained momentum as digital wallets, BNPL, and neobanks grew across the UAE and MENA. Central Bank licensing in the UAE boosted credibility and deal flow. Banks adopted NymCard to launch prepaid, debit, and credit programs at speed. Expansion into Saudi Arabia, Egypt, and Pakistan followed. Each new market reinforced demand for localized embedded finance infrastructure built for scale.

What is the meaning behind NymCard’s name, tagline, and logo?

Meaning behind the name

The name NymCard comes from the word “nym,” which signals identity and uniqueness. The name reflects the company’s focus on powering branded financial products rather than owning the customer relationship. NymCard enables banks and fintechs to issue cards and financial services under their own identity. The name also links back to the founder’s earlier company, Nymgo, which emphasized owned infrastructure and control over technology. NymCard continues that philosophy in the payments space.

Tagline evolution

NymCard uses the tagline “The infrastructure behind modern payments.” The line clearly positions the company as a backend enabler, not a consumer app. The messaging evolved as embedded finance expanded across MENA. Early communication focused on card issuing. Later messaging expanded to lending, money movement, and full-stack payment infrastructure. The tagline reinforces trust, scale, and compliance. It also speaks directly to banks, fintechs, and enterprises that need reliable payment foundations.

Logo design and identity

The NymCard logo features a clean, minimal design that conveys stability and security. The visual identity avoids complex symbols and bright consumer colors. This choice aligns with its role as regulated financial infrastructure. The logo supports credibility with banks, regulators, and enterprise partners. Over time, the brand expanded its design system across product dashboards and APIs while maintaining the core logo. The identity signals trust, precision, and long-term reliability.

How does NymCard make money? Business model and revenue streams

B2B embedded finance infrastructure model

NymCard operates as a B2B infrastructure company. It sells payment, card issuing, lending, and money movement capabilities to banks, fintechs, telecom firms, and enterprises. Clients use NymCard APIs to launch branded financial products. NymCard does not serve end consumers directly. This model allows the company to scale across markets without customer acquisition costs. Banks and platforms pay NymCard for infrastructure, compliance, and ongoing program management.

Card issuing and processing fees

Card issuing forms a core revenue stream. NymCard earns fees for issuing prepaid, debit, credit, and commercial cards on Visa and Mastercard networks. Clients pay setup fees, per card issuance fees, and transaction-based processing fees. NymCard also charges for tokenization, card lifecycle management, dispute handling, and settlement services. High card volumes from banks and fintechs create predictable recurring revenue.

Embedded lending and BNPL infrastructure

NymCard generates revenue by powering embedded lending and BNPL programs. Banks and platforms pay for access to their credit decision engine, scoring logic, repayment workflows, and reporting tools. Clients earn lending income while NymCard earns platform and usage fees. This model allows partners to launch lending products without building in-house risk and compliance systems. Lending infrastructure increases contract value and long-term stickiness.

Money movement and cross-border payments

NymCard earns fees from domestic and cross-border payment flows. Clients pay for transfers through card networks, local rails, and international partners like Visa Direct and Mastercard Cross Border. Revenue comes from transaction fees, FX margins where applicable, and volume-based pricing. This stream grows as clients expand payouts, remittances, supplier payments, and gig worker transfers across markets.

Program management and compliance services

NymCard monetizes full program management services. Banks and fintechs pay for regulatory reporting, AML screening, fraud monitoring, dispute management, and operational support. These services reduce client risk and speed up regulatory approvals. Compliance-driven revenue adds defensibility because clients depend on NymCard to stay licensed and operational. This layer differentiates NymCard from pure API providers.

Subscription and long-term contracts

NymCard uses long-term contracts and platform subscriptions for enterprise clients. Customers pay recurring fees for API access, dashboards, analytics, and support. Multi-year contracts improve revenue visibility and retention. Clients rarely switch providers due to regulatory complexity and deep system integration. This structure creates stable, compounding revenue rather than one-time setup income.

Funding and investors of NymCard

NymCard has raised over 40 million dollars in funding to build and scale embedded finance infrastructure across MENA and Pakistan. The company closed a 22.5 million dollar venture round in 2022, followed by a 33 million dollar Series B round in March 2025. QED Investors led the Series B, marking its first major investment in the Gulf region.

Existing investors such as Shorooq Partners, Dubai Future District Fund, Mashreq Bank, Lunate, Endeavor Catalyst, Reciprocal Ventures, FJ Labs, Knollwood, DisruptAD, and Oraseya Capital participated in the rounds. This investor group brought deep expertise in fintech, banking, and regulation. The capital supported market expansion, product development, and long-term regulatory growth.

What are the growth metrics and revenue figures of NymCard?

- NymCard operates across 10+ markets in MENA and Pakistan, showing steady regional expansion driven by bank and fintech adoption.

- The company partners with 50+ banks, fintechs, and enterprises, including major institutions in the UAE, KSA, Egypt, Qatar, and Pakistan.

- NymCard employs 250+ people, with 140+ engineers, highlighting a product and infrastructure-heavy growth model.

- The platform supports card issuance, embedded lending, and cross-border payments at scale through its proprietary nCore processing system.

- NymCard raised $33 million in Series B funding in 2025, following earlier rounds including a $22.5 million venture round in 2022, reflecting strong investor confidence.

- The company does not publicly disclose revenue figures, but continued funding, regional expansion, and enterprise partnerships indicate strong commercial traction in the regulated fintech infrastructure market.

Mergers, Acquisitions & Investments of NymCard

Spotii Acquisition

NymCard acquired Spotii in June 2023 to launch a BNPL-in-a-Box solution for banks and financial institutions. Spotii brought over one million registered users and 1,500+ merchants across the UAE, KSA, and Bahrain. The acquisition added BNPL technology, risk engines, and credit decision systems to NymCard’s platform. Banks and fintechs can now launch installment-based credit products faster using a fully configurable, compliant, and region-ready embedded lending stack.

What partnerships has NymCard formed recently?

easypaisa Digital Credit Card Partnership

NymCard partnered with easypaisa to launch Pakistan’s first fully digital credit card program. The partnership enables easypaisa users to access instant, app-based credit cards powered by NymCard’s card-issuing and compliance infrastructure. This collaboration expands digital credit access in Pakistan and shows how embedded finance can scale in regulated markets.

Visa Direct Collaboration

NymCard partnered with Visa Direct to enable faster and more secure cross-border transfers. Banks, fintechs, and enterprises can now send payouts and business payments across multiple countries using real-time settlement. This partnership strengthens NymCard’s money movement capabilities across MENA and Pakistan.

Faysal Bank Banking as a Service Alliance

NymCard formed a partnership with Faysal Bank to support Banking-as-a-Service use cases in Pakistan. The collaboration helps fintechs launch compliant financial products by combining Faysal Bank’s regulatory license with NymCard’s embedded finance platform.

Banque Misr Digital Payments Partnership

NymCard partnered with Banque Misr to support digital card issuing and payment innovation in Egypt. The partnership enables Egyptian financial institutions to launch modern card programs faster while meeting local regulatory requirements.

Dubai Islamic Bank Corporate Card Partnership

NymCard worked with Dubai Islamic Bank and ChargeUp to launch corporate expense and payment card solutions. This partnership focuses on business spend management and supports enterprises that need controlled, Sharia-compliant payment products.

What are the Products and Service offerings of NymCard?

Card Issuing and Processing Platform

NymCard offers a full-scale card issuing and processing platform for banks, fintechs, and enterprises. Clients can launch prepaid, debit, credit, and commercial cards under their own brand. The platform supports physical, virtual, and tokenized cards on Visa and Mastercard networks. NymCard handles transaction processing, settlement, fraud controls, and lifecycle management. Regulated infrastructure provided by the Central Bank of the UAE enables clients to scale securely across MENA and Pakistan without building core card systems in-house.

Money Movement and Payments Infrastructure

NymCard enables local and cross-border money movement through cards, accounts, and wallets. The platform supports payouts, merchant payments, bill payments, and remittances via regional rails and global networks, including Visa Direct and Mastercard. Businesses use these services for supplier payments, salary disbursements, and customer refunds. Real-time processing and programmable controls help clients manage high-volume payment flows while staying compliant with local regulations.

Embedded Lending and BNPL Solutions

NymCard provides embedded lending tools that allow banks and platforms to offer credit directly inside their apps. After acquiring Spotii, NymCard launched BNPL-in-a-box for financial institutions. The solution includes credit decision engines, risk scoring, loan management, collections, and repayment controls. Clients can design installment plans, approval rules, and credit limits without building lending infrastructure from scratch. This offering supports both consumer and SME credit use cases.

Nym4Business for SME Banking

Nym4Business helps banks serve small and medium businesses through modern digital tools. The platform offers branded business cards, expense management, approvals, and reconciliation. SMEs gain better control over spending, while banks strengthen relationships and generate new revenue streams. Modular design allows banks to roll out features gradually based on market needs.

APIs, SDKs, and White Label Platforms

NymCard offers flexible integration options via APIs, SDKs, no-code tools, and white-label apps. Clients choose full API access or ready-made portals based on speed and complexity needs. This approach allows fast launches while supporting deep customization. Over time, NymCard expanded its platform to support open finance, identity verification, compliance tools, and advanced analytics, making it a complete embedded finance stack.

What challenges has NymCard faced?

Navigating strict financial regulations

NymCard operates in highly regulated markets across the UAE, KSA, Egypt, and Pakistan. Each country enforces different rules for payments, lending, and data security. NymCard had to secure licenses, meet audit standards, and align products with local regulators. The company invested early in compliance teams, legal expertise, and regulatory reporting systems to avoid delays and protect long-term expansion.

Building trust in a bank-led ecosystem

Banks and large financial institutions move slowly and demand proven reliability. NymCard needed to earn trust as a young infrastructure provider. The team focused on certifications, secure architecture, and partnerships with Visa and Mastercard. The Central Bank of the UAE regulation also helped NymCard position itself as a safe and credible partner for enterprise clients.

Scaling technology across multiple markets

NymCard supports high-volume transactions across many countries with different currencies and rails. Rapid growth increased pressure on platform stability and uptime. The company responded by owning its core processing and switching technology. This decision reduced dependency on third parties and improved performance, control, and scalability.

Competing with global and regional players

Global processors and regional fintechs compete in the same embedded finance space. Many rivals offer single products, such as BNPL or card issuing. NymCard faced pressure on pricing and differentiation. The company focused on full-stack infrastructure, local compliance, and modular APIs to stand out as a long-term platform partner.

Integrating acquisitions and new products

The Spotii acquisition added BNPL capabilities but also increased integration complexity. Teams had to align technology stacks, risk models, and operations. NymCard addressed this by unifying platforms and expanding product modules in stages. This approach reduced disruption while strengthening the embedded lending offering.

Who are the main competitors of NymCard, and how do they compare?

Network International

Network International is one of the largest payment processors in the Middle East. It works closely with major banks and handles large-scale card issuing and acquiring. The company focuses on traditional banking clients and enterprise volumes. Compared to NymCard, Network International offers less flexibility for fintechs that want fast launches and modular embedded finance APIs.

M2P Fintech

M2P Fintech provides card issuing, lending, and payment infrastructure across multiple regions, including MENA. It serves banks and fintechs with a wide product range. However, M2P operates as a global provider. NymCard differentiates by building region-specific compliance, local regulatory alignment, and infrastructure designed only for MENA and Pakistan.

Marqeta

Marqeta is a global card-issuing platform known for its developer-friendly APIs and strong presence in the US and Europe. It supports major fintech brands worldwide. In the MENA region, Marqeta relies more on partnerships. NymCard holds an advantage through local licensing, direct scheme membership, and deeper regional market knowledge.

Solaris

Solaris offers banking-as-a-service infrastructure primarily across Europe. It enables embedded finance products like cards, accounts, and lending. Solaris focuses on EU regulations and markets. NymCard competes by offering similar infrastructure but with direct coverage of the UAE, KSA, Egypt, and Pakistan, where Solaris has limited reach.

Hubpay and regional processors

Several regional processors and bank-owned platforms offer card issuing and payment services. Most focus on single markets or limited product sets. NymCard competes by offering a full-stack platform that combines card issuance, embedded lending, and money movement under a single, regulated system.

What are the future plans for NymCard?

Upcoming product launches

NymCard plans to expand its embedded finance stack with deeper credit, lending, and open finance capabilities. The company focuses on improving its BNPL-in-a-box offering following the Spotii acquisition. It also works on faster cross-border payouts, smarter credit decision engines, and stronger fraud controls. These launches aim to help banks and fintechs build credit cards, lending, and payment products faster using one platform.

Expansion plans across markets and products

NymCard plans to expand into more than 10 markets across MENA and Pakistan. The company targets a stronger presence in Saudi Arabia, Egypt, and Pakistan, where demand for digital banking and embedded finance continues to rise. It also plans to serve more sectors, including telecom, mobility, marketplaces, and SMEs. The platform roadmap includes more localized compliance tools and region-specific payment rails.

IPO or acquisition outlook

NymCard has not announced IPO plans yet. The company focuses on scaling revenue, partnerships, and regional coverage before any public listing. Strong backing from global investors like QED Investors signals long-term growth intent. Strategic acquisitions similar to Spotii remain possible, especially in lending, risk, or data infrastructure. These moves would help NymCard strengthen its full-stack payments and embedded finance position.

Related Startup stories you might be interested in:

FAQs

When did NymCard start?

NymCard started operations in 2018. The company launched to modernize payment infrastructure across MENA and Pakistan. It focused early on card issuing, processing, and embedded finance for banks and fintechs. Since then, NymCard has expanded across multiple markets with regulatory approval and strong enterprise adoption.

How does NymCard make money?

NymCard makes money through B2B infrastructure services. It earns revenue from card issuing, transaction processing, embedded lending, BNPL infrastructure, and money movement APIs. Banks, fintechs, and enterprises pay platform fees, usage-based charges, and program management costs for using NymCard’s regulated payment stack.

What is NymCard?

NymCard is a payment infrastructure and embedded finance platform. It helps banks, fintechs, and businesses launch cards, credit products, and payment services using APIs. The platform supports prepaid, debit, and credit cards, BNPL, lending, and cross-border payments under a single regulated system.

What is NymCard’s net worth?

NymCard does not publicly disclose its net worth. The company raised over $55 million across multiple funding rounds, including a $33 million Series B in 2025. Investors value NymCard as a high-growth fintech infrastructure company in MENA.

Is NymCard regulated?

NymCard operates as a licensed entity under the Central Bank of the UAE. It also holds PCI DSS compliance and works as a certified partner of Visa and Mastercard. This allows clients to launch regulated payment and credit products faster.

Who uses NymCard’s platform?

Banks, fintech startups, telecom companies, and enterprises use NymCard. Clients rely on the platform to issue cards, offer BNPL, manage lending, and move money securely across MENA and Pakistan.

What markets does NymCard operate in?

NymCard operates across the UAE, Saudi Arabia, Egypt, Pakistan, and other MENA markets. The company continues to expand into new countries where demand for embedded finance and digital payments is growing.

Author

-

Rafiqul is a storyteller with a founder’s mindset. At UAE Startup Story, he crafts deep-dive narratives, interviews, and features that decode what makes startups succeed in the UAE and beyond. He works closely with entrepreneurs to capture lessons, failures, and turning points that can inspire others on their own journeys.