The Eat App success story is one of smart innovation and bold expansion. Founded in Bahrain and now based in Dubai, this restaurant tech startup transformed the way hospitality teams manage reservations and guest experiences.

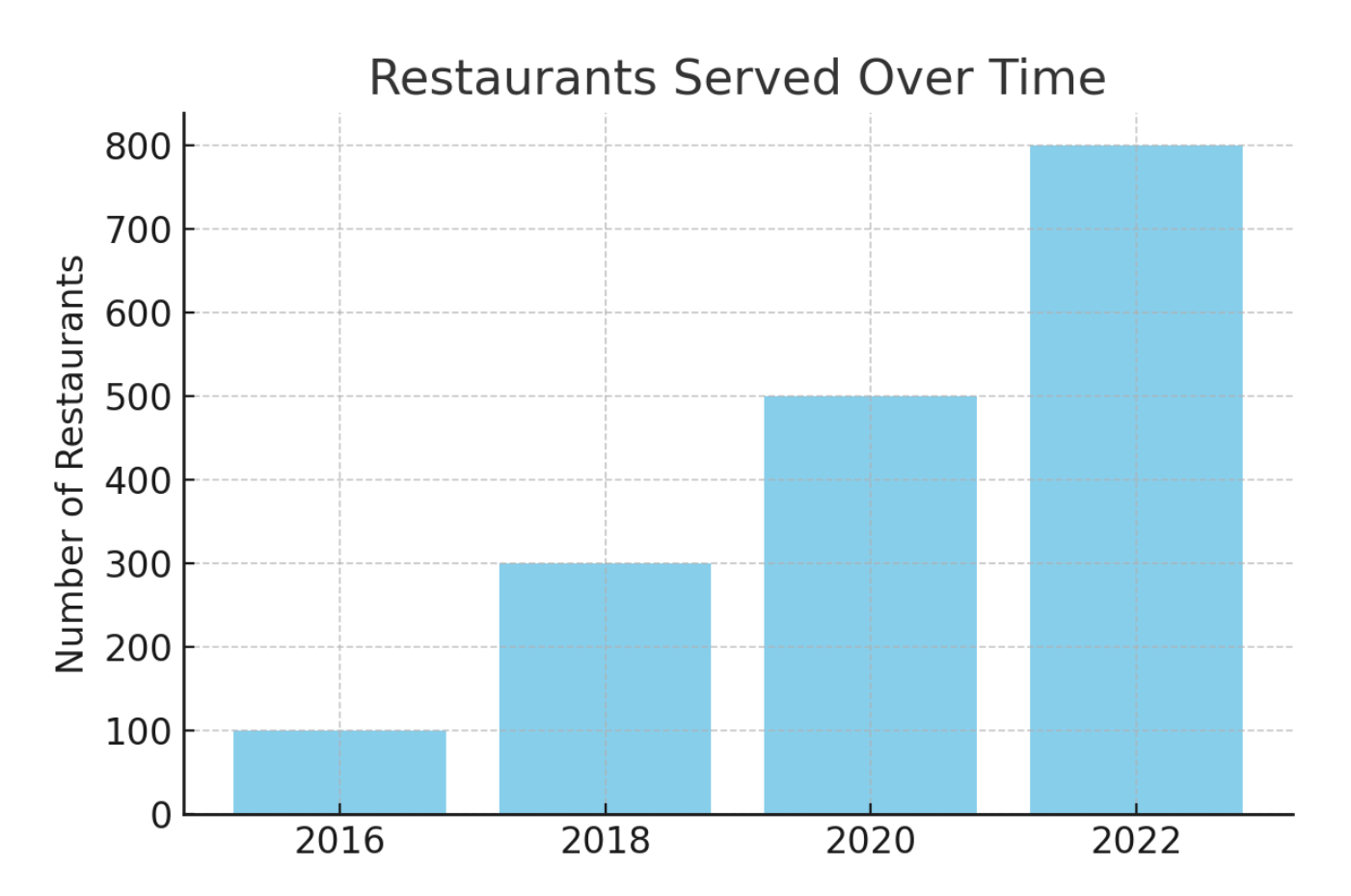

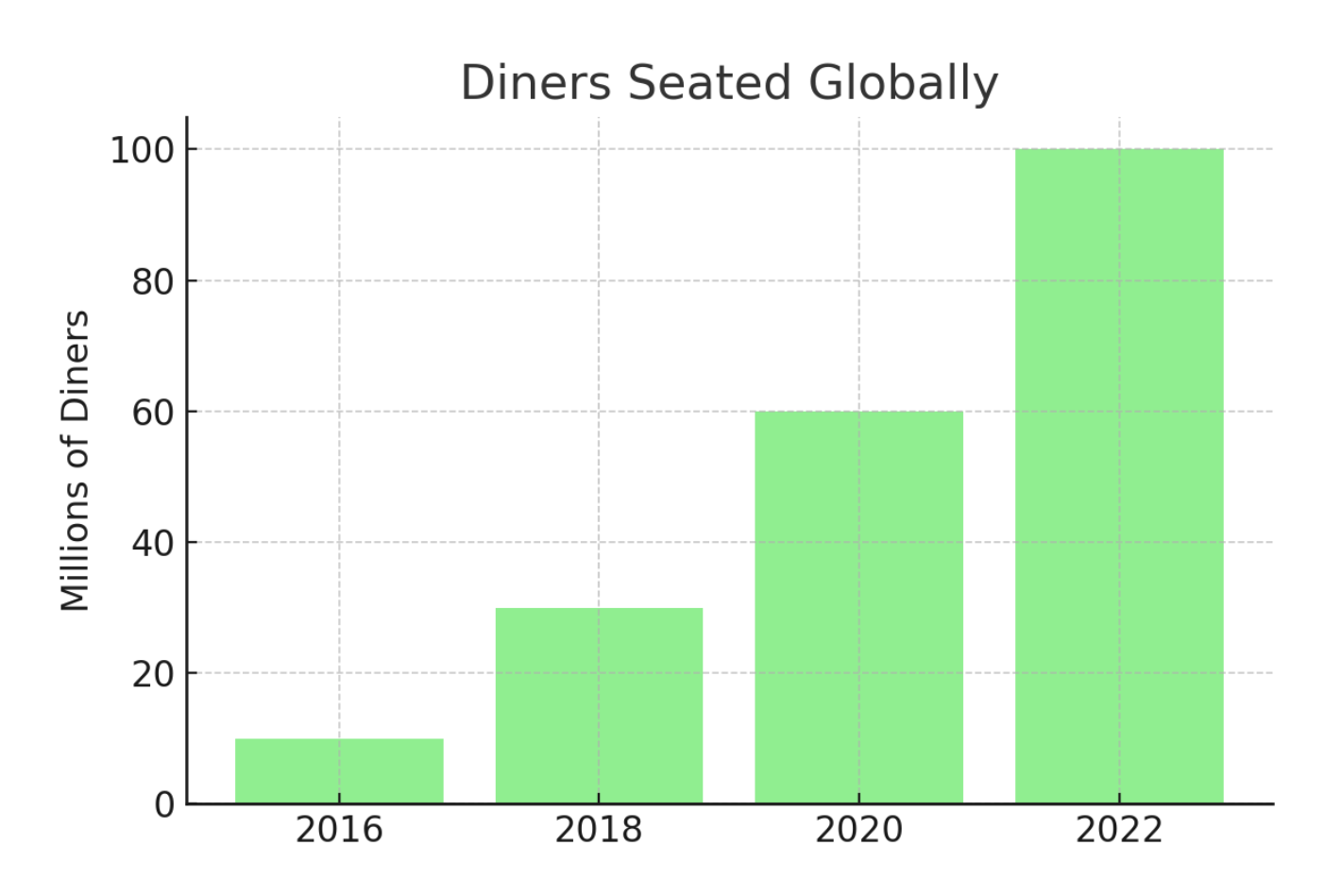

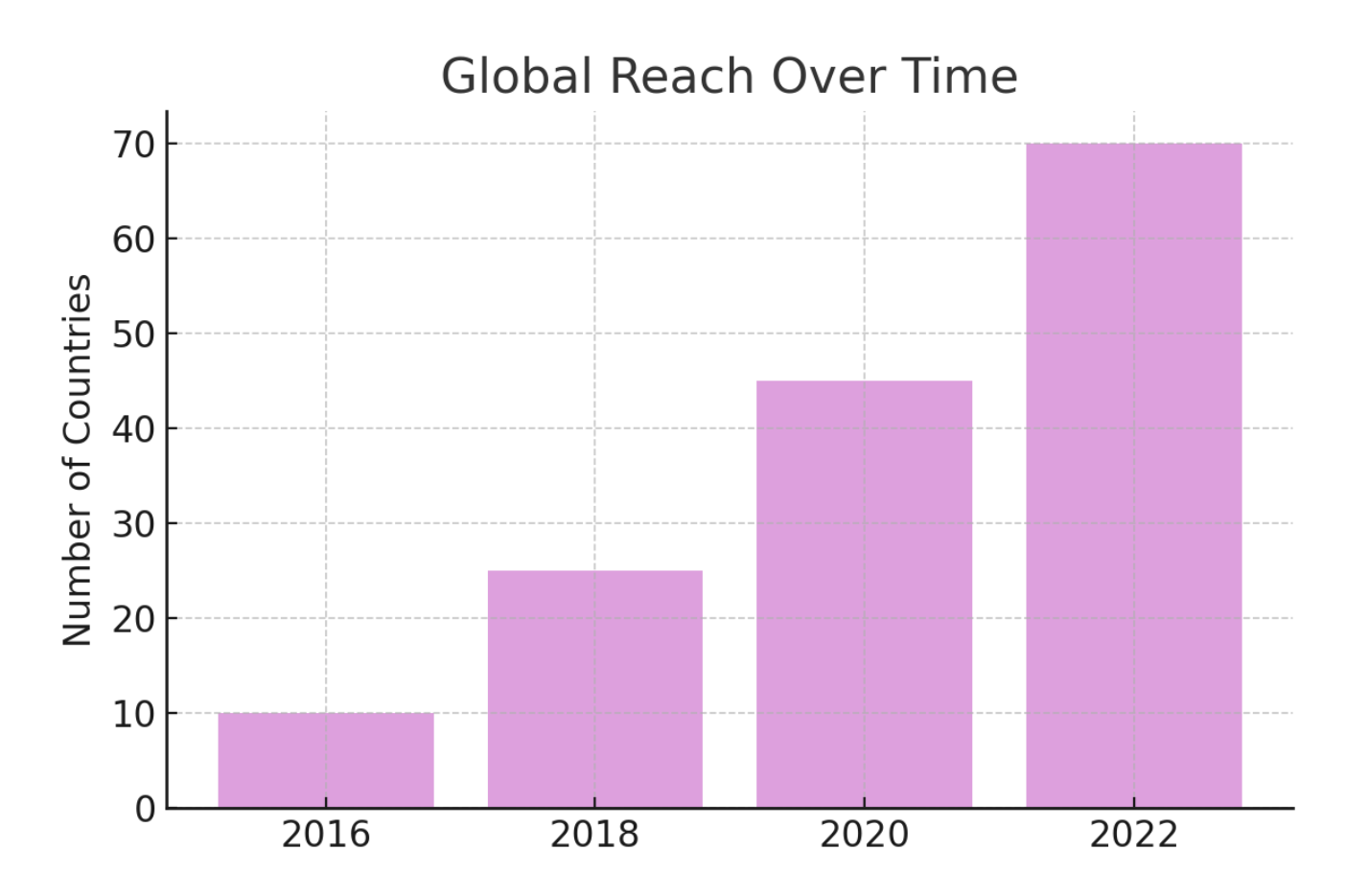

With over 100 million diners seated and 800+ restaurants served across 70 countries, Eat App’s journey from a regional tool to a global SaaS leader showcases how vision, technology, and market fit can power startup growth in the MENA region and beyond.

TL;DR – Eat App Case Study

- Eat App is a Dubai-based restaurant tech startup founded in 2014, offering reservation and table management software.

- It has seated over 100 million diners and serves 800+ restaurants across 70+ countries.

- The platform includes features like CRM, POS integration, guest analytics, and marketing tools.

- Strategic partnerships with Google, TripAdvisor, Instagram, and leading POS providers fuel its global reach.

- Backed by $20M+ in funding from top investors like MEVP, 500 Startups, and Derayah VC.

- Eat App plans to expand further in Saudi Arabia, North America, and the UK, with an eye on future IPO or acquisition.

Company highlights

| Attribute | Details |

| Company Name | Eat App |

| Headquarters | Dubai, UAE (originally Manama, Bahrain) |

| Sector/Industry | Restaurant Tech (Reservations & Table Management SaaS) |

| Founders | Nezar Kadhem (CEO), David Feuillard (COO) |

| Year Founded | 2015 |

| Parent Organization | None |

| Official Website | https://eatapp.co |

Eat App: About the startup

Eat App was co-founded by Nezar Kadhem and David Feuillard to solve the lack of modern reservation systems in the MENA region. Originally started as a consumer-facing reservation app in Bahrain, it quickly evolved into a full-stack SaaS platform for restaurants.

The startup expanded to Dubai ahead of schedule to counter competitive threats and scaled its operations with a strong cloud infrastructure and AI features. Today, Eat App operates globally and serves restaurants in over 70 countries.

Restaurant tech industry and market size

Size of the market

The UAE’s hotel and restaurant sector was valued at $12.3 billion in 2021, with over 30,000 food outlets across the nation. Dining is culturally important in the region, and tech adoption in hospitality is accelerating, especially post-pandemic.

Growth trends

The COVID-19 pandemic catalyzed the shift to digital tools for reservations and guest management. As online dining reservations became the norm, platforms like Eat App saw a surge in demand. In 2021, MENA’s food-tech sector attracted $900M in funding.

Positioning and target audience

Eat App focuses on mid to high-end restaurants, hotel chains, and hospitality groups in the MENA region and beyond. It positions itself as a tech partner for digital-first dining experiences.

Founders and team of Eat App

Nezar Kadhem

Originally from Bahrain, Nezar studied in San Francisco and holds a Master’s in Global Entrepreneurship. His previous startup in Paris was acquired, giving him early experience with reservation tech and exits. At Eat App, he handles vision and fundraising.

David Feuillard

David is the technical brain behind Eat App’s platform. With a background in software engineering, he leads product and operations. Under his guidance, the system scaled to serve 800+ restaurants by 2022.

Team structure

Eat App has a distributed team of 50–100 people, with operations in the UAE and the USA. Key leadership includes heads of engineering, customer success, and sales. Advisors from 500 Startups and other VCs contribute strategic guidance.

Key leadership chart

| Name | Role |

| Nezar Kadhem | Co-founder & CEO |

| David Feuillard | Co-founder & COO |

| Hasan Haider | Board Member (500 Startups) |

| Pinnacle Capital | Lead Investor (Post-seed round) |

| MEVP | Lead VC Partner |

| Derayah Ventures | Series B Investor |

| Dallah Albaraka | Strategic Investor (Series B) |

Background story of Eat App

How it started

Eat App was founded in 2014 when Nezar Kadhem returned to Bahrain after studying in San Francisco. Seeing a lack of digital reservation systems, he teamed up with David Feuillard to create a simple app for the local market. Their plan was to refine the model in Bahrain before expanding regionally.

Early challenges

In 2015, Zomato’s move into reservations pushed Eat App to fast-track its UAE launch. Nezar relocated to Dubai and personally pitched to restaurants, helping the startup gain traction in a competitive market with limited resources.

Growth pivot

Realizing restaurants needed more than just reservations, Eat App evolved into a full SaaS platform with CRM, table management, and analytics. It later added a consumer app for diners, becoming both a software provider and a marketing channel for restaurants.

Mission and vision of Eat App

Empowering hospitality

Eat App’s mission is to equip restaurants with easy-to-use technology that enhances operations and elevates the guest experience.

Seamless guest experience

The company envisions a dining journey where booking, seating, and service are fully digital, efficient, and delightful for both guests and staff.

Expanding reservations culture

Eat App aims to normalize online table reservations, especially in regions where walk-ins are still the norm, helping both diners and restaurants plan better.

Supporting restaurant operators

By automating manual tasks like guest tracking and waitlist management, Eat App enables restaurant staff to focus on food, service, and customer care.

Using data to personalize dining

Eat App leverages AI and guest data to help venues offer more personalized experiences, from remembering preferences to suggesting return visits.

Becoming a global platform

Eat App’s long-term vision is to be the leading reservation and guest management platform across the Middle East and new international markets.

Business model and revenue streams: How does Eat App make money?

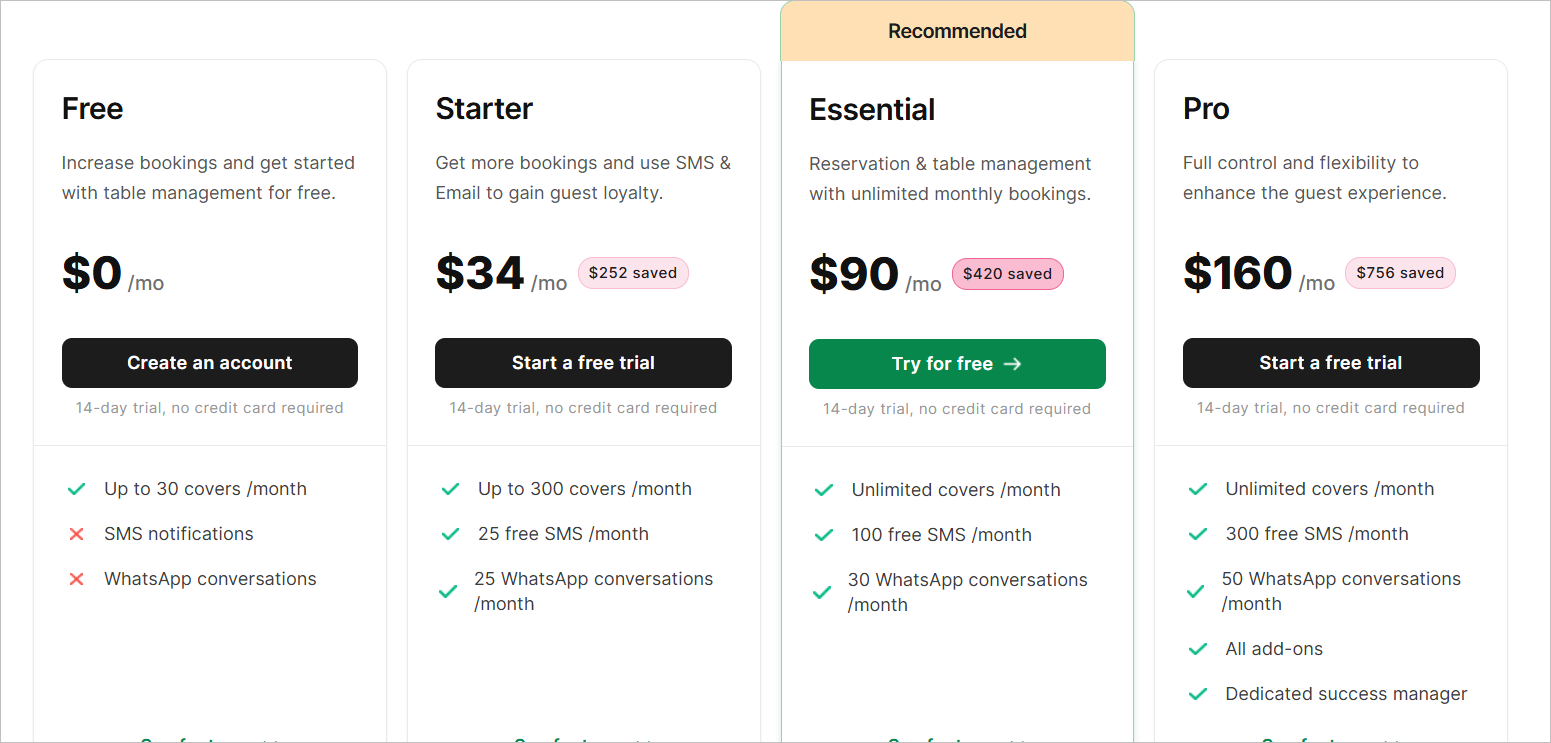

1. Subscription-Based SaaS Model

Eat App offers tiered subscription plans ranging from $34 to $160 per month.

These plans provide access to features such as reservation management, customer relationship management (CRM), analytics, and automation tools. This predictable, recurring revenue stream is central to Eat App’s financial model.

2. Freemium Model

To attract smaller restaurants and encourage adoption, Eat App provides a free plan with basic functionalities. As these establishments grow or require more advanced features, they are encouraged to upgrade to paid tiers, facilitating customer conversion and retention.

3. Marketplace Booking Fees

Restaurants can receive bookings through Eat App’s consumer-facing website and mobile application. While specific fee structures are not publicly disclosed, it’s common in the industry for platforms to charge referral or commission fees for such bookings.

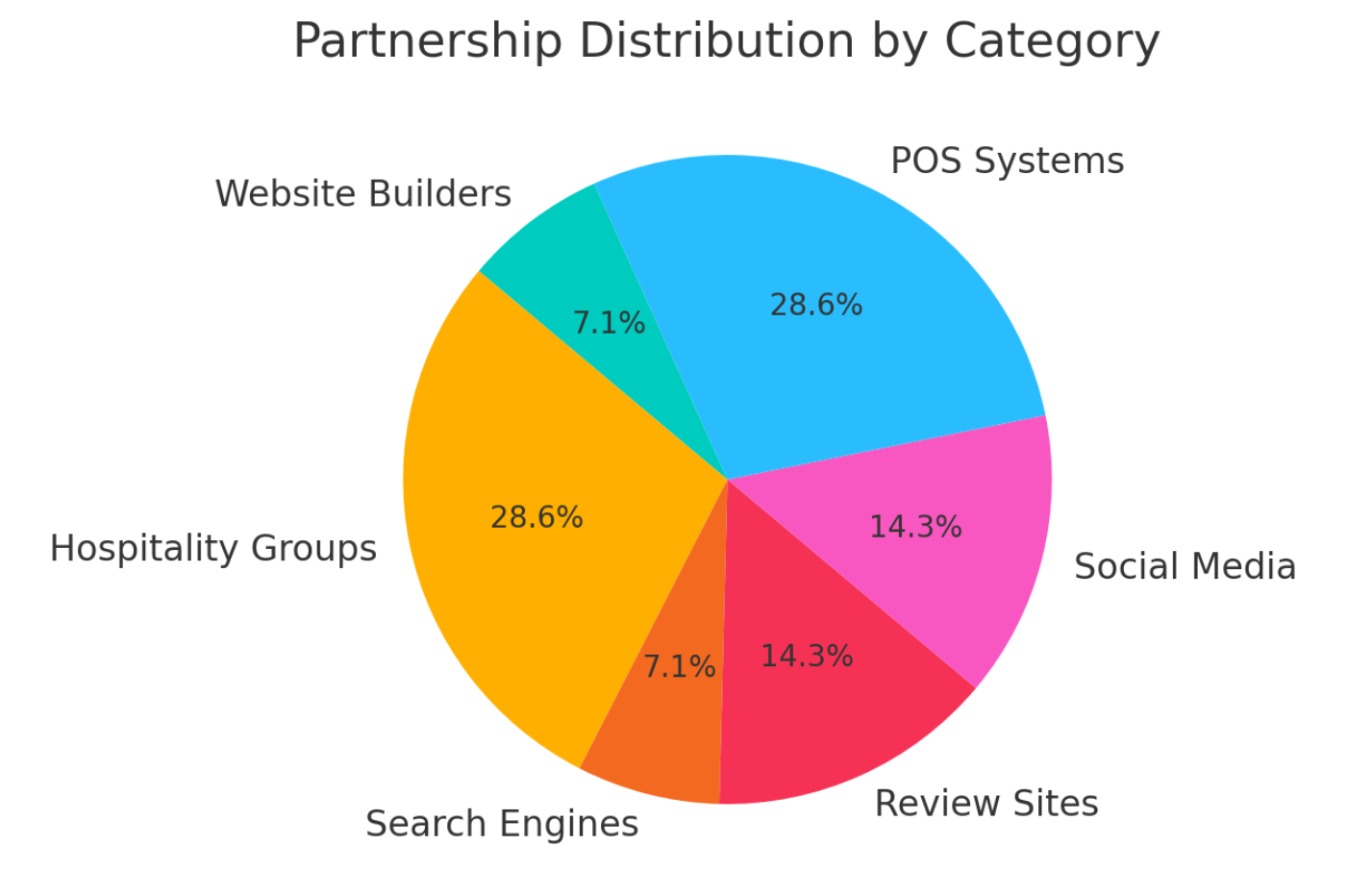

4. Integrations and Strategic Partnerships

Eat App integrates with various platforms, including Google Search and Maps, TripAdvisor, Instagram, Facebook, and point-of-sale (POS) systems like Toast, Square, and Lightspeed. These integrations enhance the platform’s value proposition and may generate additional revenue through referral deals or premium integration services.

5. Enterprise Solutions

For large hospitality groups and hotel chains, Eat App offers customized solutions, including white-label applications, loyalty program integrations, and dedicated support. These enterprise deals often come with higher-value contracts, contributing significantly to revenue.

6. Future Analytics and Data Products

With a vast amount of diner data, Eat App has the potential to develop advanced analytics products or industry reports. Monetizing these insights can open new revenue streams, offering value-added services to restaurant partners seeking data-driven decision-making tools.

Funding and investors of Eat App

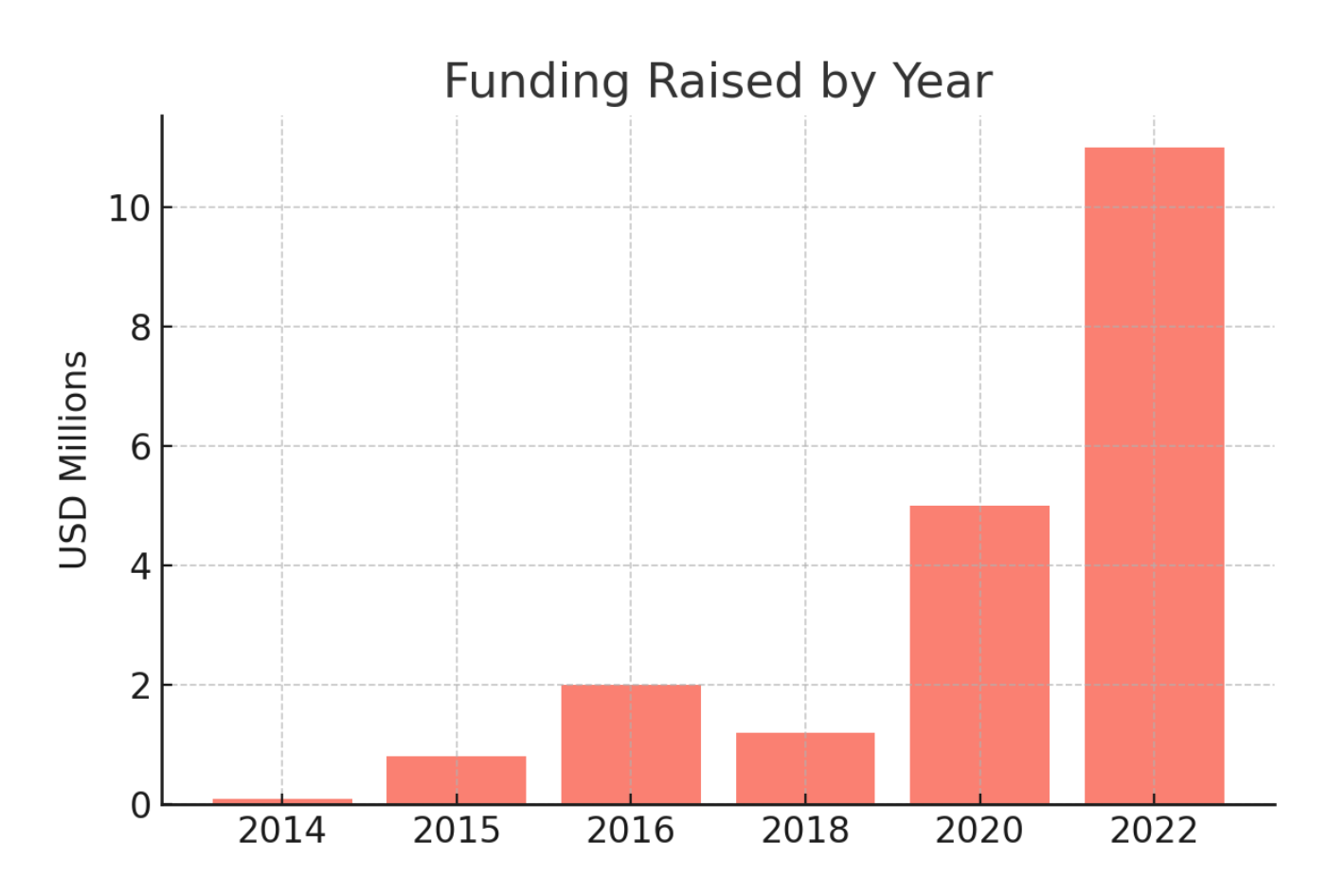

Eat App has raised approximately $20 million over several funding rounds, supported by a blend of local and international investors who believe in its mission to modernize hospitality tech in the MENA region and beyond.

- 2014 – Pre-seed Funding: $100,000 from Tenmou (Bahrain)

- 2015 – Seed and Extended Seed: $800,000 from GCC and European angels

- 2016 – Post-seed Round: $2 million led by Pinnacle Capital and 500 Startups

- 2018 – Series A Completion: $1.2 million from MEVP

- 2020 – Series B (Part 1): $5 million led by 500 Startups, Derayah VC, and MEVP

- 2022 – Series B Extension: $11 million led by MEVP and joined by Dallah Albaraka and others

These investments have enabled Eat App to scale its team, enhance its product offerings, and expand into new geographies including Saudi Arabia, the UK, and North America. Strategic partners like 500 Startups and MEVP continue to provide mentorship and regional expertise, reinforcing Eat App’s strong position in the food-tech sector.

Growth metrics and revenues

Eat App has demonstrated remarkable growth and sustained traction across global markets since its inception. The platform’s user base, client portfolio, and operational scale reflect a strong product-market fit in the competitive restaurant tech space.

- 800+ restaurants actively using the platform as of 2022, spanning independent outlets to luxury hotel groups.

- 100M+ diners seated globally, showcasing Eat App’s ability to handle high-volume operations efficiently.

- Presence in over 70 countries, with a particularly strong foothold in the Middle East, and growing adoption in North America and Europe.

- Trusted by premium clients including Four Seasons, Ritz-Carlton, Taj Hotels, and Emaar Hospitality, reinforcing its credibility and enterprise-grade reliability.

- $42M in diner-generated revenue processed through Eat App in a single month (December 2020), underlining its business impact and transactional capacity.

These figures underscore Eat App’s traction in the competitive restaurant tech space and its ability to deliver value to both independent operators and large enterprise groups.

Mergers, acquisitions & investments of Eat App

As of now, Eat App has not engaged in any mergers, acquisitions, or made investments in other companies. The company’s growth strategy has primarily focused on organic expansion through product development, strategic partnerships, and scaling its operations across various markets.

Key Points:

- No Mergers or Acquisitions: Eat App has not been involved in any mergers or acquisitions to date.

- Strategic Partnerships: Instead of pursuing mergers or acquisitions, Eat App has formed strategic partnerships with platforms like Google, TripAdvisor, and Zomato to enhance its reservation capabilities and reach.

- Organic Growth: The company has focused on expanding its services and client base organically, serving over 3500 restaurants across 75+ countries.

Eat App’s growth has been driven by internal development and strategic collaborations rather than mergers, acquisitions, or external investments.

Business Partnerships of Eat App

Eat App has formed a robust network of partnerships that enhance its product functionality and broaden its global reach:

Hospitality giants

Eat App is trusted by leading hospitality brands such as Four Seasons, Ritz-Carlton, Emaar Hospitality, and Taj Hotels, offering customized solutions to manage high guest volumes and expectations.

Google Reserve

Through its integration with Google Search and Maps, Eat App allows diners to book tables directly from search results, enhancing restaurant visibility and convenience.

TripAdvisor & TheFork

Eat App powers reservations from TripAdvisor and TheFork, helping restaurants capture traffic from global review and dining discovery platforms.

Social media booking

Restaurants can enable reservations through Instagram and Facebook by integrating Eat App’s booking widget into their profiles, converting followers into confirmed diners.

POS system integrations

Eat App seamlessly connects with major point-of-sale (POS) systems such as Toast, Square, Lightspeed, and Revel. This integration ensures real-time sync between table reservations and in-house operations.

Website builders

Eat App is listed on platforms like Wix App Market, allowing small and mid-sized restaurants to easily embed reservation widgets on their websites without development expertise.

These partnerships play a critical role in Eat App’s mission to create an all-in-one digital ecosystem for restaurant operations and guest engagement.

What are the products and service offerings of Eat App?

Online Reservation System

Eat App’s flagship product is its commission-free reservation system. It allows restaurants to accept bookings directly from their website, Google Search, Google Maps, Instagram, and Facebook. It includes automated confirmations, reminders, and notifications—reducing no-shows and improving guest communication.

Table Management Tool

Restaurants can visually manage their floor plans using real-time table updates, waitlist management, and walk-in tracking. This helps hosts and managers optimize seating, increase table turnover, and deliver a smoother front-of-house experience.

Guest CRM and Profile Management

Eat App builds rich guest profiles by tracking reservation history, preferences, visit frequency, and average spend. This enables restaurants to deliver personalized experiences and tailor promotions for high-value customers.

Marketing and Loyalty Tools

The platform supports email campaigns, promotional offers, and event marketing. It also integrates with loyalty programs, helping restaurants drive repeat visits and improve customer retention.

Reporting and Analytics

Real-time dashboards provide insights into key performance metrics such as reservations, guest frequency, peak hours, and revenue generated. These reports help owners make data-driven decisions to grow their business.

POS System Integrations

Eat App integrates seamlessly with leading POS systems like Toast, Square, Lightspeed, and Revel. This ensures smooth syncing of guest and order data, allowing restaurants to unify operations across platforms.

Website and Mobile Compatibility

The system is optimized for mobile and is available on the web, making it accessible for staff and managers anytime, anywhere. It also integrates easily with website builders like Wix, enabling fast and hassle-free onboarding.

Challenges faced by Eat App

- Global competition

Eat App entered a market already being eyed by global giants. One of its earliest threats came from Zomato’s entry into the reservation space, which prompted Eat App to accelerate its expansion plans to secure a first-mover advantage in the UAE.

- Fundraising in a nascent ecosystem

Raising capital in the early years was difficult due to the underdeveloped venture ecosystem in the MENA region. The startup had to rely heavily on angel investors and accelerator networks before attracting institutional backing.

- Restaurant onboarding and adoption

Many traditional restaurants were slow to adopt digital solutions. Convincing operators to replace manual systems with Eat App’s software required significant sales efforts, product demos, and ongoing education.

- Pandemic-related disruptions

The COVID-19 pandemic caused temporary drops in restaurant operations and revenue. However, it also highlighted the need for digital solutions, eventually accelerating Eat App’s long-term adoption across the industry.

- Regional competition

Eat App faced stiff rivalry from regional players like ReserveOut, which had an established presence in the GCC. However, Eat App’s superior technology, flexible pricing, and strong customer success team helped it gain market share.

Eat App competitors and comparison

ReserveOut

A regional competitor based in Dubai, ReserveOut was one of the first movers in the MENA restaurant reservation space. It had strong early adoption, especially among premium restaurants.

However, its pace of innovation has slowed, allowing Eat App to gain market share through better technology, faster onboarding, and a superior support model.

OpenTable

OpenTable is a globally recognized restaurant reservation platform with dominance in North America and parts of Europe. However, its presence in the Middle East remains limited.

Eat App capitalizes on this gap by offering regionally adapted tools, localized support, and integrations tailored to the operational needs of MENA-based restaurants.

Resy & Quandoo

Both Resy and Quandoo are strong players in the US and European markets. They offer sleek user experiences and integrations, but lack focus on MENA-specific dynamics. Their limited regional presence gives Eat App an advantage in local market understanding, language support, and regional partnerships.

Foodics

Foodics is primarily a POS (Point of Sale) provider, but its growing footprint in the hospitality tech ecosystem occasionally overlaps with Eat App’s services.

While not a direct competitor, its expansion into table management could pose a future challenge. Eat App, however, retains its advantage as a specialized reservation and guest management platform.

Zomato

Initially a major competitive threat with its aggressive entry into the reservations space, Zomato has since shifted focus away from B2B SaaS solutions. This has left space for Eat App to dominate the reservation tech segment in the region, particularly by serving restaurants that require comprehensive backend features.

What Sets Eat App Apart

- Local Know-How: Tailored for MENA dining habits like late hours and Ramadan.

- Unified Platform: Combines reservations, CRM, and analytics in one tool.

- Cost-Friendly: No per-cover fees and a free plan for smaller venues.

- Smart Integrations: Early adopters of WhatsApp, Google, and POS tools.

- Trusted Relationships: Built loyalty through direct, hands-on onboarding.

Future plans: What’s next for Eat App?

Expansion into Saudi Arabia

Eat App is investing in a strategic regional expansion by opening a dedicated office in Riyadh. Backed by Series B funding, this move targets Saudi Arabia’s booming hospitality sector and positions the company closer to key enterprise clients and partners.

Growth in North America and the UK

To establish itself as a global player, Eat App is actively expanding into North America and the UK. The focus is on self-serve onboarding, seamless integrations with local POS systems, and building relationships with hospitality groups looking for reliable, customizable SaaS platforms.

AI-powered product innovation

Eat App plans to integrate more AI-driven features into its platform. These include predictive table availability, smart guest insights, and automated feedback analysis to help restaurants streamline operations and improve guest engagement.

Strengthening strategic partnerships

The company aims to broaden its ecosystem by partnering with more POS providers, payment gateways, and loyalty platforms. These integrations will help restaurants manage their tech stack more effectively and deliver a unified guest experience.

IPO or acquisition prospects

With a strong foundation and consistent growth, Eat App is exploring long-term exit strategies. It may pursue an initial public offering (IPO) or consider acquisition offers from larger hospitality tech players within the next 3–5 years, depending on market dynamics and strategic alignment.

FAQs

What is Eat App?

Eat App is a Dubai-based restaurant tech startup offering AI-powered reservation and table management software. Founded in 2015, it has seated over 100 million diners and serves 800+ restaurants across 70+ countries.

Who founded Eat App?

Eat App was co-founded by Nezar Kadhem and David Feuillard in 2015. Nezar focuses on vision and fundraising while David leads product and operations with a background in software engineering.

How does Eat App make money?

Eat App makes money through SaaS subscriptions, booking commissions, enterprise solutions, and POS integrations. It also uses a freemium model and plans to monetize analytics and data products in the future.

What features does Eat App offer restaurants?

Eat App offers reservation management, table planning, guest CRM, marketing tools, POS integration, and analytics dashboards. These tools help restaurants streamline operations and enhance guest experiences.

What partnerships does Eat App have?

Eat App partners with Google, TripAdvisor, Instagram, Facebook, and POS systems like Toast and Lightspeed. It also serves hospitality brands like Four Seasons, Ritz-Carlton, and Emaar.

What challenges has Eat App faced?

Eat App faced early funding difficulties, regional competition, slow tech adoption among restaurants, and disruptions during COVID-19. It overcame these with strong tech, partnerships, and rapid scaling.

How large is the market Eat App operates in?

Eat App operates in a hospitality tech market valued at $12.3 billion in the UAE alone, with accelerating digital adoption post-pandemic and a growing global demand for restaurant tech solutions.

What is Eat App’s mission?

Eat App’s mission is to empower restaurants with easy-to-use technology that enhances operations, personalizes dining, and promotes digital-first guest experiences worldwide.

Where is Eat App expanding next?

Eat App is expanding into Saudi Arabia, North America, and the UK. It aims to scale with AI-powered innovation, deeper integrations, and potential IPO or acquisition in the next 3–5 years.

How much funding has Eat App raised?

Eat App has raised over $20 million across multiple rounds, backed by investors like 500 Startups, MEVP, and Derayah Ventures. This funding supports its product development and global expansion.

Authors

-

Himanshu is a builder at heart who loves turning raw ideas into structured systems. At UAE Startup Story, he focuses on the tech, research, and operations behind every feature and founder story. He’s passionate about spotlighting startups that solve real problems and inspiring the next wave of entrepreneurs across the region.

-

Rafiqul is a storyteller with a founder’s mindset. At UAE Startup Story, he crafts deep-dive narratives, interviews, and features that decode what makes startups succeed in the UAE and beyond. He works closely with entrepreneurs to capture lessons, failures, and turning points that can inspire others on their own journeys.