Careem is one of the most important tech companies to emerge from the Middle East. It began in Dubai as a ride-hailing service and grew into a Super App that helps millions of people move, eat, shop, and pay across the region.

Careem stands out because it solved mobility gaps in MENA, created new earning opportunities, and became the region’s first tech unicorn. Its $3.1 billion acquisition by Uber remains a major milestone for the regional startup ecosystem.

In this case study, we break down Careem’s growth, services, business model, impact, and future plans.

TL;DR – Careem Case Study

- Founded in Dubai in 2012 with a mission to simplify and improve lives across the Middle East.

- Became the region’s first tech unicorn and was acquired by Uber for $3.1 billion in 2019.

- Serves 50 million+ customers across 80+ cities in 10 countries, with 2 million+ captains.

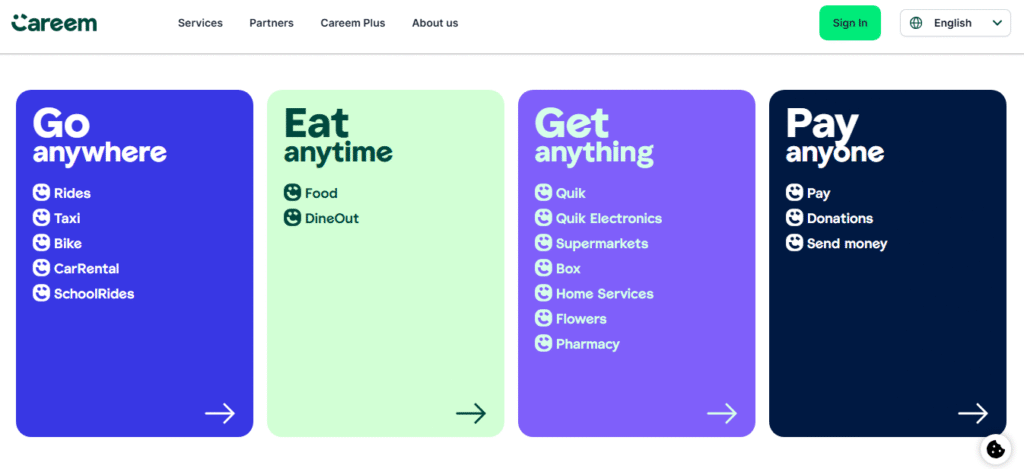

- Offers a full Super App with rides, food delivery, groceries, bill payments, remittances, courier services, and subscriptions.

- Received a $400 million investment from e& to scale the Careem Super App.

- Alumni went on to build 100+ startups, strengthening the regional tech ecosystem.

Careem Business Highlights

| Attribute | Details |

| Company Name | Careem |

| Headquarters | Dubai, UAE |

| Sector / Industry | Mobility, Food Delivery, Grocery Delivery, Fintech, Super App |

| Founders | Mudassir Sheikha, Magnus Olsson, Abdullah Elyas |

| Year Founded | 2012 |

| Number of Customers | 50 million+ |

| Number of Captains | 2 million+ |

| Parent Organization | Uber (acquired in 2019); e& (strategic investor in Super App) |

| Official Website | https://www.careem.com |

What is Careem and What Does the Startup Do?

Careem is a Super App that enables people to move, eat, shop, and pay on one platform. It started as a ride-hailing service focused on reliability and safety in a region with limited organized transport options. Over time, Careem added food delivery, groceries, payments, remittances, subscriptions, and courier services. The company now operates across the UAE, Saudi Arabia, Egypt, Pakistan, Jordan, Iraq, Kuwait, Morocco, Qatar, and Bahrain.

Its purpose is simple: to make everyday life easier while creating earning opportunities at scale

What is the Size of the Super App Market in the UAE?

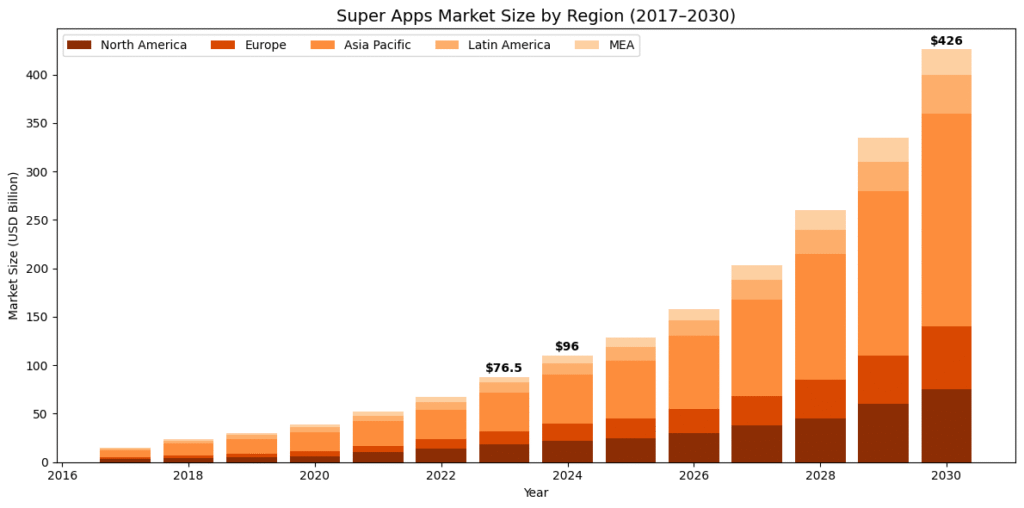

Size of the market Careem operates in

The UAE operates within the fast-growing Middle East and Africa super app market, which Grand View Research projects to grow at a 28.3% CAGR through 2030. Globally, the super app market was valued at USD 76.5 billion in 2023 and is expected to reach USD 426 billion by 2030.

The UAE is a key contributor to the region due to high smartphone penetration, strong adoption of digital payments, and government support for fintech. Platforms combining mobility, food, payments, and commerce align directly with how users in the UAE prefer to transact daily.

Growth trends in the UAE market

The UAE is rapidly transforming into a digital payments hub, with expansive app-based adoption across rides, deliveries, and remittances. The mobile payments market in the UAE is estimated to reach USD 80.37 billion by 2025. It can grow to USD 135.94 billion by 2030, driven by double-digit annual growth as consumers increasingly prefer contactless and digital transactions.

The broader payments ecosystem, including digital wallets and online transactions, was valued at around USD 18.7 billion in 2024 and is expected to reach USD 34.2 billion by 2032.

Careem’s positioning and target audience

Careem positions itself as a full-service Super App that simplifies daily life. Its core audience includes residents, tourists, office workers, families, and people relying on delivery services. The company targets customers who value convenience, safety, and predictable service quality. It also supports businesses through corporate rides and B2B delivery solutions. This broad positioning helps Careem serve many daily needs in a single app and remain competitive across both consumer and enterprise markets.

Who Are the Founders and Core Team Members of Careem?

Mudassir Sheikha – Co-founder and CEO

Mudassir Sheikha is the co-founder and CEO of Careem. He launched the company in 2012, intending to simplify daily life in the Middle East through technology. Before Careem, he worked at McKinsey & Company and was part of the founding team at DeviceAnywhere in the United States.

Mudassir holds a master’s degree in computer science from Stanford University and a dual degree in economics and computer science from the University of Southern California. Under his leadership, Careem expanded across 70+ cities in 10 countries, served over 75 million customers, and created earning opportunities for more than 3.5 million captains.

Magnus Olsson – Co-founder and Chief Product Architect

Magnus Olsson is the co-founder and Chief Product Architect of Careem. He helped start Careem in 2012 after a career in management consulting and technology leadership. Before joining Careem, he worked as an Engagement Manager at McKinsey & Company, advising clients on strategy, growth, and business-building across the Middle East, Europe, and the US. Magnus also founded and led an IT consultancy in Sweden before exiting successfully. He holds a master’s degree in computer science and engineering from Lund University and studied finance at Harvard University. At Careem, he played a key role in building the product, technology platform, and Super App vision.

Abdullah Elyas – Co-founder

Abdulla Nadeem Elyas is a co-founder of Careem and played a key role in shaping the company’s regional growth. He joined Careem after founding Enwani, a location-based addressing platform that Careem later acquired. Abdulla holds a PhD in business administration and a master’s degree in computer science from RWTH Aachen University. At Careem, he served as Co-founder and Managing Director, with a strong focus on operations and market expansion across Saudi Arabia and the UAE. He has also held board roles at organizations such as Bupa Arabia and MonshaatSA, contributing to broader ecosystem development in the region.

How Did Careem Start? Background Story

Early Inspiration

The idea for Careem came to the founders when they realized how inconsistent transportation was across the region. They wanted to build a reliable service for both consumers and corporate clients. The company was founded on the first day of Ramadan in 2012. The first line of code was written in Pakistan, reflecting the founders’ regional vision from day one.

Building the Platform

Careem started as a simple car-booking website before transforming into a real-time ride-hailing app. In 2013, it introduced on-demand rides instead of only scheduled bookings. Early growth was fast, with trips increasing 60% month on month. By serving businesses first, Careem built trust and scaled quickly across key cities.

A Defining Moment

One major turning point was the 2014 tech outage. When systems went down, employees moved operations to a building hallway where power sockets still worked. This quick response became part of Careem’s culture of resilience. Another defining moment came when the company entered Saudi Arabia, enabling thousands of women to access safe transportation.

What is the Meaning Behind Careem’s Name, Tagline, and Logo?

Name Meaning

The name “Careem” comes from the Arabic word “كريم,” which means generous. The founders chose this name to reflect the human side of the business. From the beginning, Careem aimed to support drivers with a steady income and provide customers with reliable service. The name represents care, dignity, and trust, values that shaped how the company built its platform across the Middle East.

Tagline Evolution

Careem’s taglines evolved as the company expanded beyond rides. Early phrases like “Simplifying lives” captured its focus on everyday convenience. As Careem added food, payments, and delivery services, the tagline “The Everything App” emerged. This shift showed how Careem moved from a transport app to a single platform that supports daily needs in one place.

Logo Changes

Careem’s logo changed as the company matured. It started with a functional ride-hailing design focused on transport. Over time, the logo evolved into the friendly “wink” symbol. This design reflects simplicity, approachability, and confidence. The wink also signals ease and familiarity, showing Careem’s intent to feel helpful and human, not just transactional.

How Does Careem Make Money? Business Model and Revenue Streams

Careem operates a multi-vertical Super App model with several revenue sources.

Ride-Hailing

Careem offers multiple ride categories, including Comfort, Executive, Max, Kids, Taxi, and Bike. It earns revenue through commissions on trips. The focus is on reliability, safety, and on-time arrivals. Corporate rides also provide recurring revenue from businesses that need transportation for staff and clients.

Food Delivery

Careem Food partners with more than 9,000 restaurants. Revenue comes from delivery fees, commissions, and Careem Plus subscriptions. The platform supports 24/7 orders and offers priority delivery for members. Restaurant partners benefit from visibility, performance insights, and dedicated onboarding support.

DineOut

DineOut helps restaurants boost foot traffic by offering deals and discounts to Careem users. Careem charges a partnership fee and earns from increased customer activity. Restaurants receive customer insights and marketing exposure, while users save up to 50% at selected venues.

Quik – Grocery and Dark Stores

Quik provides ultra-fast grocery delivery in as little as 15 minutes. Careem operates its own dark stores and earns through product margins, delivery fees, and Careem Plus incentives. Quality checks and refunds strengthen trust. The model reduces food waste and improves last-mile logistics.

Supermarkets & Electronics

Careem partners with supermarkets and electronics retailers to offer same-day delivery. Revenue comes from commissions, service fees, and merchant partnerships. Users benefit from fast delivery and high product availability.

Careem Pay

Careem Pay is a licensed fintech platform offering bill payments, peer-to-peer transfers, wallet features, and international remittances to 30+ countries. Revenue comes from exchange rate margins, bill settlement fees, and payment partnerships. The Central Bank of the UAE has approved it.

Box – Courier & Delivery

Careem Box enables users to send packages across cities. Careem charges a delivery fee and uses optimized routing through its captain network. The platform supports e-commerce businesses and individuals who need fast courier services.

Home Services, Flowers, Pharmacy

Users can order home cleaning, flowers, medicines, and small services directly through the app. Careem earns through partnerships and commissions. These services help expand app usage and increase customer engagement.

Careem Plus Subscription

Careem Plus is a monthly plan that gives users free delivery on food and groceries, discounts on rides, cashback, and access to exclusive offers. This creates predictable recurring revenue and increases loyalty.

Enterprise Services

Corporate packages offer scheduled rides, simplified billing, travel dashboards, and fleet management for companies. Revenue comes from enterprise subscriptions, ride commissions, and service fees.

Funding and Investors of Careem

Careem started as a high risk startup and raised its first USD 1.7 million from early angel investors. At that time, the founders clearly told investors that the business was risky but growing fast. The company showed strong early traction with 60 percent month on month growth. As Careem expanded across the region, more investors supported its vision. In 2019, Uber acquired Careem for USD 3.1 billion, making it the largest technology acquisition in Middle East history and a major success story for regional startups.

What Are the Growth Metrics and Revenue Figures of Careem?

- 50 million+ customers: Careem serves tens of millions of users across the region who rely on the app for daily transport, food, deliveries, and payments.

- 2 million+ captains: The platform has created earning opportunities for over two million captains, offering flexible work and more predictable income across multiple markets.

- Present in 80+ cities and 10 countries: Careem operates at a regional scale, with strong coverage across major cities in the UAE and expansion throughout MENA and South Asia.

- 6.06 billion kilometers covered: Careem rides have collectively traveled over six billion kilometers, showing the scale and reliability of its mobility network.

- 12,190 colleagues built the company: Thousands of employees across engineering, operations, and support functions helped grow Careem from a startup into a Super App.

- 100+ startups founded by alumni: Former Careem employees have launched more than 100 startups, strengthening the regional tech ecosystem.

- Longest recorded ride was 20 hours: This highlights Careem’s ability to support long-distance and cross-city travel use cases.

- Largest food order reached $938: High-value food orders show strong trust in Careem Food for premium and group dining needs.

- Impact across 10 regional markets: Careem operates across the UAE, KSA, Egypt, Pakistan, Jordan, Iraq, Morocco, Kuwait, Qatar, and Bahrain, driving digital adoption and economic participation.

Mergers, Acquisitions & Investments

Swapp – Expanding into Car Rentals

Careem acquired a minority stake in Swapp to extend its mobility offerings beyond ride-hailing. This move allowed Careem to integrate car rentals directly into the Super App, giving users more control over how they travel. Customers can choose short-term or long-term rentals based on their needs, without switching platforms. For Careem, the investment supported its goal of becoming a complete mobility solution. It also strengthened the app’s appeal for users who need flexible travel options for work, family, or extended stays in UAE cities.

JustLife – Entry into Home Services

Careem partnered with JustLife to introduce home services, such as cleaning and beauty appointments, within the Super App. This partnership marked one of Careem’s early steps beyond transport and delivery. By working with an established service provider, Careem reduced execution risk while expanding into high-demand daily services. Users gained the convenience of booking trusted home services through the same app they already used for rides and food. The partnership helped Careem test and validate its Everything App strategy in the UAE market.

What Partnerships Has Careem Formed Recently?

Global and Regional Brand Partnerships

Careem works closely with global and regional brands to power its delivery, logistics, and commerce services across the UAE and wider MENA region. Partnerships with companies like IKEA, Amazon, Zara, Papa John’s, Pizza Hut, KFC, and Landmark Group allow Careem to handle high order volumes with speed and reliability. These brands use Careem’s fleet, routing technology, and real-time tracking to reach customers faster. For Careem, these partnerships strengthen its role as a logistics backbone for large enterprises operating at scale.

Food and Restaurant Partnerships

Careem has built a strong network of restaurant partners through Careem Food and DineOut. Thousands of restaurants use the platform to reach new customers, manage peak demand, and grow repeat orders. Well-known brands such as Paul, Cinnabon, KFC, Bakerist, Allo Beirut, and local favorites rely on Careem for delivery, discovery, and in-app promotions. These partnerships help restaurants increase visibility while allowing Careem to offer variety, faster delivery, and consistent quality to users across major UAE cities.

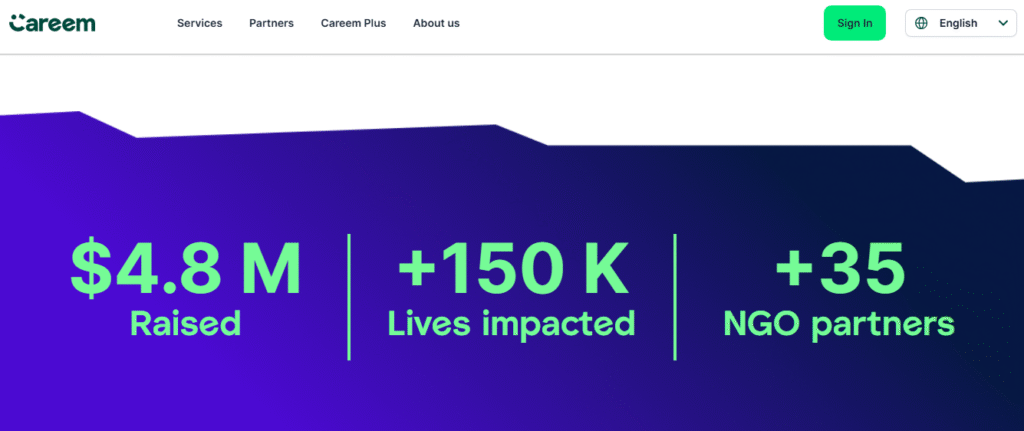

NGO and Humanitarian Partnerships

Careem works with non-profit organizations to extend its impact beyond commerce. One of the most notable partnerships is with the World Food Programme, where Careem supported food aid deliveries in Gaza. Through Careem Pay, users can also donate directly to verified causes inside the app. These partnerships show how Careem uses its logistics network, payments infrastructure, and reach to support urgent humanitarian needs. The approach aligns with Careem’s mission to simplify lives while contributing positively to the communities it serves.

Corporate and Enterprise Partnerships

Careem partners with companies across banking, retail, consulting, and hospitality through Careem for Business and B2B delivery solutions. These organizations use Careem for employee transportation, client travel, and scheduled logistics. The platform helps companies track spend, manage bookings, and ensure reliable service across cities. For Careem, enterprise partnerships provide stable demand and long-term contracts. For businesses, Careem becomes a trusted mobility and delivery partner that supports daily operations across the UAE and other regional markets.

Products and Service Offerings of Careem

Go – Rides, Taxi, Bike, Car Rental, and School Rides

Careem Go forms the foundation of the platform, offering a range of mobility options across the UAE and the wider MENA region. Users can choose from Comfort, Executive, Max, Kids, Bike, and Taxi rides depending on their needs. Real-time tracking, multiple payment options, and trained Captains improve safety and reliability. Careem also offers dedicated School Rides with vetted drivers and child seat support, giving parents peace of mind. Car rental options allow users to book vehicles for short or extended periods directly inside the app.

Eat – Food Delivery and DineOut

Careem Eat serves as a major growth engine for the Super App, offering food delivery from more than 9,000 restaurants across key cities. The service operates 24/7 and covers global chains and local favorites. DineOut expands beyond delivery by helping users discover restaurants and access exclusive in-restaurant discounts. Together, these services move Careem into daily dining decisions rather than occasional orders. For restaurants, Careem provides discovery, demand generation, and reliable delivery during both peak and off-peak hours.

Get – Quik, Supermarkets, Electronics, and Home Services

Careem Get brings everyday shopping and services into one flow. Users can order groceries through Quik, which operates dark stores designed for ultra-fast delivery in as little as 15 minutes. The service also covers supermarket items, electronics, flowers, pharmacy orders, and home services. Careem Box enables scheduled or bulk deliveries for larger items. By integrating all these services into one app, Careem reduces friction and makes it easier for users to handle multiple errands without switching platforms.

Pay – Fintech and Digital Payments

Careem Pay lets users manage everyday payments directly in the app. The service supports wallet payments, bill settlements, prepaid recharges, peer-to-peer transfers, and international remittances to more than 30 countries. Transfers are processed quickly and are often cheaper than traditional banks. Careem Pay operates under the Central Bank of the UAE’s approvals and partners with licensed financial institutions. By embedding payments across rides, food, and shopping, Careem strengthens user trust and increases platform stickiness.

Careem Plus – Subscription Program

Careem Plus is a paid subscription that bundles savings across the entire ecosystem. Members receive unlimited free delivery on food and groceries, ride cashback, and exclusive discounts across services. Many users save hundreds of dirhams each month, making the subscription attractive for daily users.

For Careem, Plus improves retention, increases order frequency, and builds predictable revenue. The program also encourages users to try new services within the app, reinforcing Careem’s position as an everyday Super App.

Express – B2B and On-Demand Delivery

Careem Express supports businesses that need fast and reliable delivery across the UAE and selected regional markets. It offers same-day and on-demand delivery with real-time tracking, dedicated fleets, and 24/7 support. The service operates across 11 cities and works with global brands in retail, food, and eCommerce. Businesses use Careem Express to improve last-mile delivery without building their own logistics infrastructure. This B2B arm adds a strong enterprise layer to Careem’s consumer-focused ecosystem.

Careem’s Technology and Engineering Culture

Careem actively invests in building future tech talent through its Careem Next Gen program. The company recruits young engineers from Pakistan, Jordan, and Egypt into a structured one-year graduate program. During this period, participants work on real products across rides, delivery, payments, and logistics, under the guidance of senior engineers. This hands-on approach helps new talent gain practical experience at scale. By training engineers locally, Careem strengthens its product teams while creating long-term technology talent for the region.

What Challenges Has Careem Faced?

Regulatory Barriers Across Markets

Careem operates across multiple countries, each with its own transport, labor, and digital payment regulations. Securing approvals required deep engagement with local governments and regulators. In many cities, ride-hailing was a new concept, which meant policies did not exist or were unclear. Careem invested time in policy discussions, compliance frameworks, and safety standards to operate legally. This slowed expansion in some markets but helped the company build long-term trust with authorities and position itself as a responsible regional technology platform.

Competing with Uber Before the Acquisition

Before the 2019 acquisition, Uber was Careem’s strongest competitor across several MENA markets. Uber had global scale and strong funding, while Careem focused on local execution. Careem built an advantage by understanding cultural norms, payment preferences, and city-level transport behavior. Services like cash payments, corporate rides, and region-specific safety features helped it win users. The competition pushed Careem to improve efficiency, customer experience, and technology, eventually leading to the landmark acquisition that reshaped the regional startup ecosystem.

Covid 19 and Demand Shifts

The COVID-19 pandemic caused a sharp decline in ride bookings across all markets. Lockdowns and remote work reduced daily mobility, impacting driver earnings and core revenue. Careem responded by rapidly expanding food delivery, grocery services through Quik, and digital payments via Careem Pay. These services met rising demand for home delivery and contactless transactions. The shift helped stabilize revenues and protect Captain’s income, proving the value of the Super App model during periods of sudden economic disruption.

Scaling Operations Across Countries

Managing operations across more than 10 countries created complex challenges in logistics, customer support, and Captain management. Each market had different demand patterns, pricing sensitivities, and service expectations. Careem invested heavily in internal tools, automation, and data systems to maintain service quality at scale. Training programs for Captains, localized customer support, and standardized operational playbooks helped reduce friction. Scaling required balancing speed with consistency, especially while launching new services alongside core ride-hailing operations.

Infrastructure and Mapping Limitations

Several MENA markets lacked accurate digital maps, clear addresses, or standardized road data. This made navigation, pickup accuracy, and delivery timing difficult. Careem addressed this by building custom mapping solutions and integrating local data sources. The company also relied on Captain feedback to improve routing and location accuracy. Over time, these improvements reduced cancellations and wait times. Solving infrastructure gaps became a competitive advantage, allowing Careem to operate reliably in cities where global platforms struggled.

Who Are the Main Competitors of Careem?

Uber

Uber continues to operate in several Careem markets, especially in premium ride categories. The platform competes strongly on pricing algorithms, global brand recognition, and technology scale. Before the acquisition, Uber and Careem competed head-to-head across major cities. Today, Uber continues to influence market dynamics by setting expectations for ride quality and the app experience. Careem differentiates itself through local services, regional payment options, and a broader Super App offering that goes beyond transportation into food, grocery, and payments.

Talabat

Talabat is one of the strongest competitors to Careem in food delivery across the GCC region. Backed by Delivery Hero, Talabat has deep restaurant penetration and strong brand recall. It focuses almost entirely on food and grocery delivery, allowing it to optimize logistics and promotions in that category. Careem competes by bundling food delivery with rides, payments, and subscriptions through Careem Plus. This ecosystem approach helps Careem drive cross usage and retain users beyond single-use food orders.

Deliveroo

Deliveroo competes primarily in the premium food delivery segment in the UAE. The platform is popular among high-end restaurants and customers who prioritize quality, presentation, and curated menus. Deliveroo’s strengths lie in its restaurant relationships and focus on the dining experience rather than scale. Careem competes by offering wider restaurant coverage, integrated discounts through DineOut, and bundled benefits for Careem Plus members. This allows Careem to serve both everyday meals and premium dining use cases.

Instashop

Instashop competes directly with Careem Quik in grocery and supermarket delivery. The platform focuses on connecting users with nearby stores for quick fulfillment. Instashop’s strength lies in its established grocery partnerships and simple user flow. Careem differentiates Quik through its dark store model, faster delivery timelines, and tighter integration with the Super App. By controlling inventory and last-mile logistics, Careem reduces dependency on third-party stores and improves delivery speed and reliability.

Noon Minutes and Noon Now

Noon’s quick commerce services compete with Careem in the ultra-fast grocery delivery segment. Backed by Noon’s e-commerce infrastructure, these services promise rapid delivery of daily essentials. The competition pushes Careem to improve dark store efficiency and delivery times. Careem benefits from its existing Captain network, local market experience, and cross-app usage. The Super App model enables Careem to acquire customers at a lower cost than standalone quick commerce platforms.

Local Taxi and Mobility Apps

Local taxi services such as Hala and Dubai Taxi remain strong competitors in the UAE mobility space. These platforms benefit from regulatory backing, airport presence, and public trust. They appeal to users who prefer traditional taxi services with regulated pricing. Careem competes by offering a better app experience, real-time tracking, multiple ride categories, and bundled benefits through Careem Plus. In many cases, Careem also integrates taxi services into its app, turning competition into collaboration.

What Are the Future Plans for Careem?

Expansion of the Everything App

Careem plans to continue expanding its Everything App by adding more daily-use services that address real, recurring needs. This includes new merchant categories, deeper integrations with local businesses, and smoother service discovery inside the app. The focus remains on convenience and frequency rather than one-time use cases. By increasing the number of reasons users open the app each day, Careem aims to strengthen retention and position itself as the most widely used Super App across the Middle East, with the UAE as a core market.

Fintech Growth Through Careem Pay

Careem Pay is expected to play a larger role in the company’s future growth. Plans include expanding international remittance corridors, introducing lending and credit-based services, and improving access to digital payments for residents and expats. The goal is to reduce dependency on traditional banks and simplify everyday money movement. With Central Bank approval in the UAE and strong usage inside the Super App, Careem Pay is positioned to become a major regional fintech platform serving both consumers and small businesses.

Grocery and Dark Store Expansion

Careem plans to scale its grocery business by launching more dark stores and improving last-mile delivery speed. Faster fulfillment, better inventory accuracy, and stronger quality checks remain key priorities. The company is focused on making grocery delivery reliable enough for daily use, not just emergency orders. By controlling inventory through dark stores, Careem can reduce delays and stock issues. This strategy supports its ambition to compete strongly in the quick commerce space across major UAE cities.

Sustainability and Micro Mobility Initiatives

Careem will continue investing in sustainable transport through the expansion of Careem Bike. Plans include adding more stations, increasing the fleet size, and entering new cities with high short-distance travel demand. Micro mobility helps reduce emissions and reduce traffic congestion in urban areas. Careem sees bikes as a long-term mobility solution, not a side feature. As cities across the UAE focus on sustainability, Careem Bike aligns closely with regional transport and environmental goals.

Frequently Asked Questions (FAQs)

When did Careem start?

Careem started in 2012 in Dubai. The company launched on the first day of Ramadan, focusing on solving the region’s unreliable transportation problems. Since then, Careem has grown into a multi-service Super App serving millions of users across the Middle East, North Africa, and Pakistan.

How does Careem make money?

Careem generates revenue through multiple streams. These include commissions from rides, food delivery, and grocery orders; delivery and service fees; Careem Plus subscription revenue; fintech services through Careem Pay; corporate travel packages; and partnerships with merchants and brands across the region.

What is Careem?

Careem is a Super App built for the Middle East. It offers ride-hailing, taxi services, food delivery, grocery and quick commerce, digital payments, remittances, and B2B delivery. The platform simplifies daily life by bringing multiple everyday services into a single app.

How did Careem begin as a startup?

Careem began in 2012 when Mudassir Sheikha and Magnus Olsson left their consulting jobs to solve unreliable transport in the region. Abdullah Elyas later joined as a co-founder. The company started as a ride-hailing service in Dubai and gradually expanded into food delivery, payments, logistics, and daily use services, becoming a Super App for the Middle East.

Which countries does Careem operate in?

Careem operates in more than 80 cities across 10 countries. These include the UAE, Saudi Arabia, Egypt, Pakistan, Jordan, Iraq, Kuwait, Morocco, Qatar, and Bahrain. The UAE remains Careem’s core and most mature market.

Is Careem only a ride hailing app?

No. Careem started as a ride-hailing company but has evolved into a full Super App. Today, users rely on Careem for transport, food, groceries, payments, deliveries, subscriptions, and business services, making it a daily use platform across the MENA region.

How does Careem support young tech talent in the region?

Careem supports young engineers through the Careem Next Gen program, a one-year graduate scheme for talent from Pakistan, Jordan, and Egypt. Participants work on real Super App products, receive mentorship from senior engineers, and gain hands-on experience in building large-scale technology platforms.

Author

-

Rafiqul is a storyteller with a founder’s mindset. At UAE Startup Story, he crafts deep-dive narratives, interviews, and features that decode what makes startups succeed in the UAE and beyond. He works closely with entrepreneurs to capture lessons, failures, and turning points that can inspire others on their own journeys.