In just two years, Astra Tech has become one of the UAE’s fastest-growing startups.

By turning BOTIM into the region’s first Ultra App, it combined calling, payments, shopping, and services in one place.

This case study explores how Astra scaled through smart acquisitions, bold leadership, and a clear mission to simplify digital life.

TL;DR – Astra Tech Business Name Case Study

- Astra Tech started in 2022 in Abu Dhabi.

- It turned BOTIM into the region’s first Ultra App.

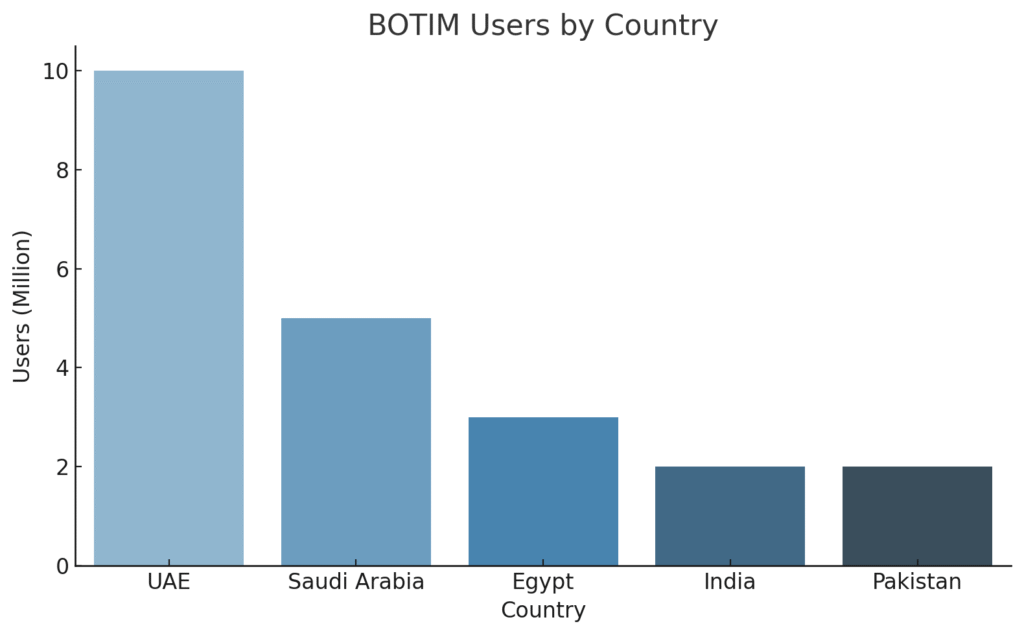

- The app has 150M+ users in 155 countries.

- It offers calls, payments, shopping, and services in one app.

- Astra raised $1B from G42 and Citi.

- It makes money from subscriptions, lending, shopping, and ads.

- BOTIM beats rivals like Careem and WhatsApp with daily use and local focus.

Company highlights

| Attribute | Details |

| Company Name | Astra Tech |

| Headquarters | Abu Dhabi, United Arab Emirates |

| Sector/Industry | Technology, Fintech, Super Apps |

| Founders | Abdallah Abu-Sheikh |

| Year Founded | 2022 |

| Parent Organization | Independent (backed by G42, Citi, and other investors) |

| Official Website | https://astratech.ae |

Astra Tech: About the startup

Astra Tech was born out of a simple but powerful idea—consolidate the digital clutter in consumers’ lives by building an all-in-one platform.

Founder Abdallah Abu-Sheikh identified a regional pain point: users were relying on multiple apps for voice calls, shopping, remittances, bookings, and bill payments.

His solution?

Create a unified experience with BOTIM 3.0, the region’s first Ultra App.

What it does:

Astra Tech builds an all-in-one app called BOTIM that lets users make free calls, send messages, pay bills, transfer money, shop online, book home services, and access government services— all from one platform.

It combines communication, fintech, e-commerce, and AI tools into a single app to simplify everyday digital tasks for people across the Middle East and beyond.

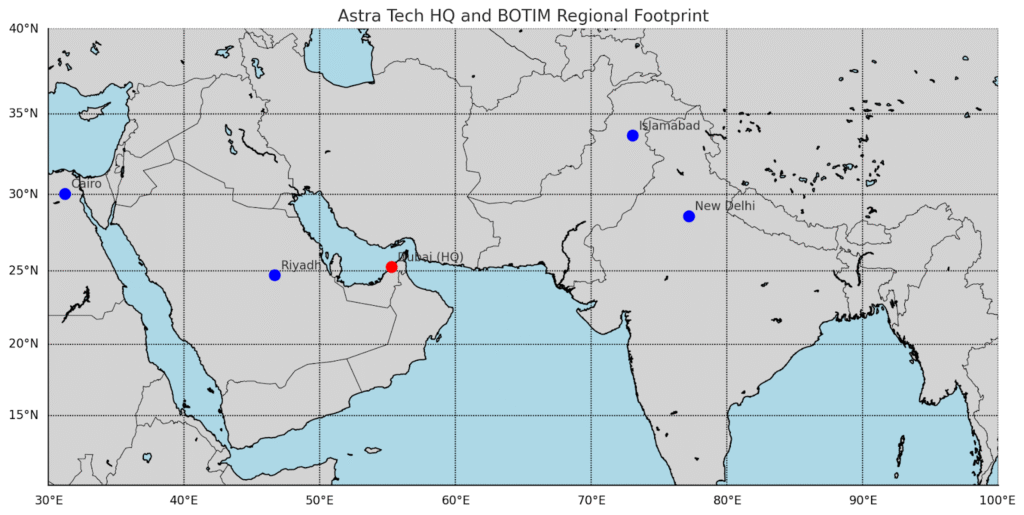

🗺️ The following map shows Astra Tech’s Dubai HQ and BOTIM’s major user regions across the Middle East and South Asia:

UAE tech industry and market size

A digitally saturated landscape

The UAE has one of the world’s highest internet penetration rates—over 99%—with nearly every resident online and 9.7 million smartphone users as of 2023. This highly connected population is also tech-savvy and used to digital services across banking, shopping, and public administration.

E-commerce growth

Valued at $7.5 billion in 2023, the UAE’s e-commerce market is expected to grow to $13.3 billion by 2028. This 12% CAGR is driven by mobile shopping, digital logistics, and a pro-tech regulatory climate. Astra Tech’s BOTIM Stores taps into this growth with 100,000+ merchant listings.

Fintech momentum

Astra Tech entered fintech at a time when digital wallet use and online payments were surging. By acquiring PayBy, they secured vital regulatory licenses and enabled digital wallets, utility payments, and international money transfers through BOTIM.

The UAE’s remittance market—valued at hundreds of billions annually—made BOTIM Money an instant hit.

The super-app opportunity

Unlike Asia’s WeChat and GoJek, the Middle East lacked a dominant super-app. Astra Tech filled that void with its chat-centric Ultra App. It solved the region’s fragmented app ecosystem and quickly gained traction, especially in the UAE where popular apps like WhatsApp are partially restricted.

Founders and team of Astra Tech

Abdallah Abu-Sheikh

Abdullah Abu Sheikh is a Jordanian-born entrepreneur with a global education background in Canada and the UK. Before Astra Tech, he co-founded Rizek and EV startup Barq. Featured in Forbes 30 Under 30, he is known for rapid execution and visionary leadership. He served as CEO until 2024.

Long Ruan

Co-founder and CTO, Ruan built the Ultra App’s tech stack. Long Ruan led platform integrations and was instrumental in ensuring app performance while adding services. He became interim CEO after Abu-Sheikh’s departure.

Dr. Tariq Bin Hendi

As of 2024, Dr. Bin Hendi, a seasoned Emirati executive and ex-Director General of the Abu Dhabi Investment Office, became CEO. His appointment signals Astra’s transition to an enterprise-grade organization.

Background story of Astra Tech

Astra Tech, founded in 2022 by Emirati entrepreneur Abdallah Abu Sheikh, embarked on a mission to simplify digital experiences by integrating various services into a single platform.

Recognizing the fragmentation in digital services, the company aimed to create the region’s first Ultra App, consolidating communication, finance, e-commerce, and more.

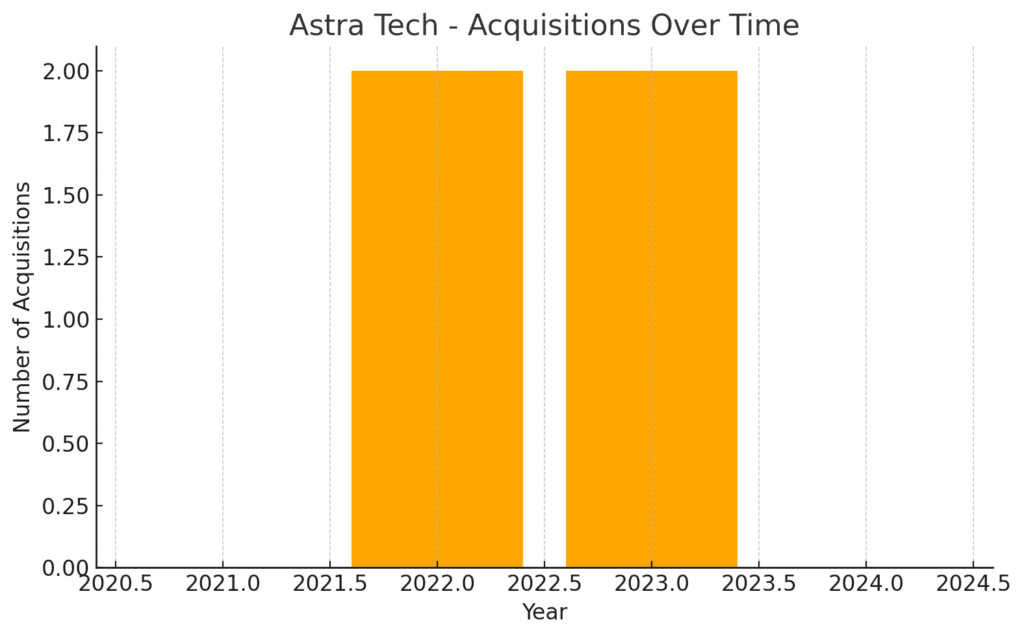

The journey began with strategic acquisitions: Rizek, a home services platform; PayBy, a fintech company; and BOTIM, a popular VoIP app. These acquisitions laid the foundation for the BOTIM Ultra App, offering users a seamless experience encompassing free calls, money transfers, shopping, and service bookings.

In December 2022, Astra Tech secured a $500 million investment led by Abu Dhabi’s G42, fueling further innovation and expansion.

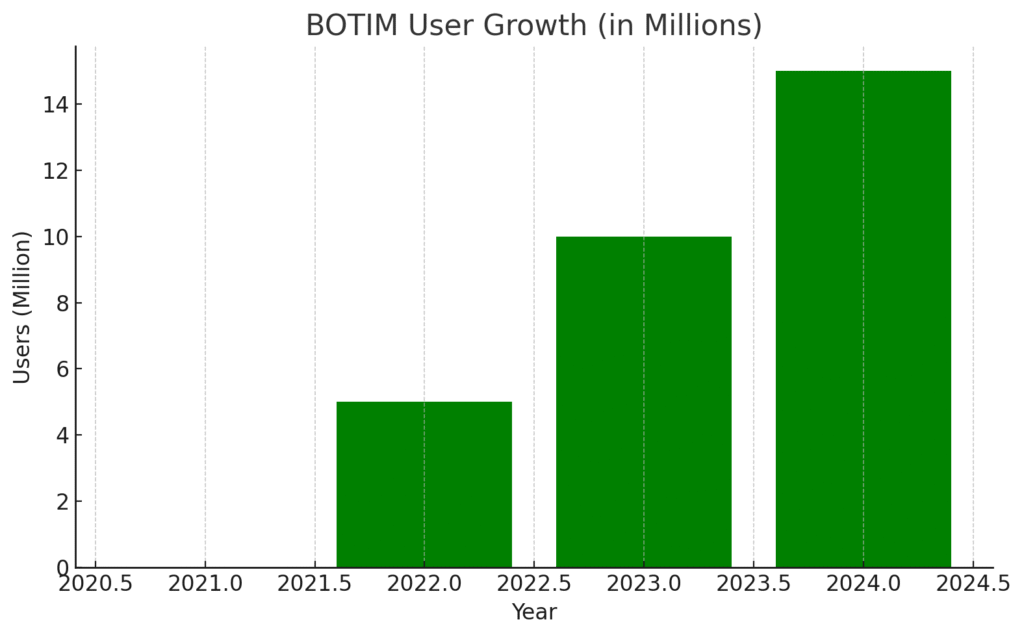

By 2023, the company launched BOTIM 3.0, integrating AI-powered features and expanding its user base to over 150 million across 155 countries.

Astra Tech’s vision extends beyond app development; it’s about creating an inclusive digital ecosystem that empowers users and businesses alike. With continuous innovation and strategic partnerships, Astra Tech is redefining the digital landscape in the MENA region and beyond.

Name, tagline & logo

Astra Tech: “Astra” means star in Latin, symbolizing aspiration and innovation. The name signals a guiding force in the tech space.

Tagline: “Reimagining Tomorrow, Today.” It conveys the brand’s forward-thinking mindset.

Logo: A geometric abstract of mirrored funnels with an “A” in the center symbolizes convergence—bringing services into one seamless point.

The BOTIM logo retained its identity post-acquisition to maintain user recognition.

Business model and revenue streams

Astra Tech has created a strong and diverse business model around its Ultra App, BOTIM. Instead of relying on just one revenue source, Astra makes money through multiple services—each designed to keep users engaged and spending inside the app. Here’s a breakdown using simple words and active voice.

Free VoIP and Messaging

Astra offers free voice and video calls through BOTIM. While this service is free for users, it brings in millions of daily active users. This high traffic helps Astra promote its other paid services.

VIP Subscriptions

Users who want an ad-free experience or access to HD video calls can buy a BOTIM VIP plan. These subscriptions also include early access to new features and special user badges. Astra earns steady income from these paid memberships.

Fintech and Payments

Through PayBy and Quantix, Astra allows users to pay utility bills, transfer money, and top-up their mobile phones inside BOTIM. Each transaction comes with a small fee or margin. The more users spend, the more Astra earns.

International Remittances

BOTIM Money helps users send money abroad—often for free or at low cost. Astra partners with services like MoneyGram and earns a percentage from currency exchange margins and backend remittance fees.

Lending and Credit Services

Quantix, Astra’s finance arm, gives users instant microloans and Buy Now, Pay Later (BNPL) options. Astra makes money from interest, processing fees, and late charges. It also has a $500M fund from Citi to support lending.

On-Demand Services

Users can book cleaning, salon, or maintenance services using BOTIM Home. These services come from verified vendors. Astra takes a commission from every completed booking made through the app.

E-commerce and Shopping

With BOTIM Stores, users can shop from thousands of merchants. Astra earns by charging listing fees, taking a cut from each sale, or earning through affiliate links. The shopping feature turns chats into checkouts.

Travel and Bookings

BOTIM users can book flights and other travel services. Astra earns money through booking fees and travel partner commissions. These features make BOTIM a one-stop travel assistant.

In-App Advertising

For users who don’t pay for VIP, Astra shows ads. Brands pay to place these ads or promote products in BOTIM chat. Astra earns revenue based on views, clicks, or engagement.

Data and Insights

Astra collects valuable data (anonymously) on user habits, purchases, and trends. It can offer insights or analytics to business partners, helping them understand the market better. This data-based income is still developing but holds high future potential.

Funding and investors of Astra Tech

Seed and early-stage capital

Astra Tech began with private capital and founder backing. Abdallah Abu-Sheikh likely reinvested profits from previous ventures, and early institutional backing came from ADQ via its earlier investment in Rizek.

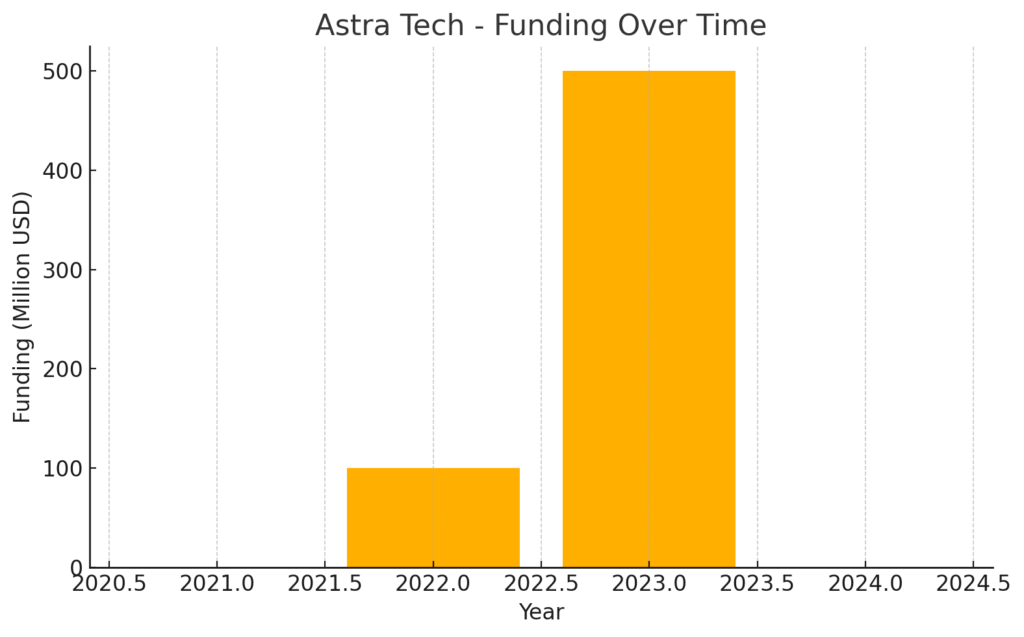

$500M G42-led round (2022)

In late 2022, Astra raised $500 million in a strategic round led by Abu Dhabi’s G42. This gave Astra the capital to acquire BOTIM and expand its Ultra App infrastructure. G42’s board-level involvement reflects deep strategic alignment.

Citi’s $500M debt facility (2024)

In December 2024, Astra’s fintech arm Quantix secured $500 million in asset-backed debt from Citigroup—one of the region’s largest fintech financings. It fuels Astra’s consumer lending and BNPL products.

Shareholding dynamics

Post-2024, founder Abu-Sheikh exited and sold his stake. G42 and other institutional investors likely hold controlling shares. Equity structures include early Rizek/PayBy stakeholders who rolled into Astra’s cap table.

Strategic investors

Rumors suggest Shuaa Capital, Chimera, and other regional funds are indirect backers. Mastercard and Tencent have partnered with Astra, though equity participation remains undisclosed.

Growth metrics and revenues

Here’s Astra Tech’s key growth metrics and revenue figures presented in a table:

| Metric | Value / Status | Notes |

| Annual Revenue (2025) | $35 million | As of May 2025, Astra Tech’s annual revenue reached $35M. |

| Funding Raised | $490 million | Secured in a funding round led by Abu Dhabi-based G42 in December 2022. |

| User Base | 150 million+ users across 155 countries | Achieved through the integration of services like BOTIM, PayBy, and Rizek. |

| Monthly Active Users (MAU) | 25 million | Regular users engaging with the BOTIM Ultra App and associated services. |

| Prepaid Cards Issued | Most issued fintech card in the UAE (2023) | BOTIM prepaid cards became the most issued fintech card in the UAE in 2023. |

| Central Bank License | First fintech to receive Finance Company License from UAE Central Bank (2024) | Quantix, Astra Tech’s fintech arm, received the license in July 2024. |

| Major Investment | $500 million asset-backed facility from Citigroup (Dec 2024) | Received to fund Astra Tech’s fintech arm, Quantix. |

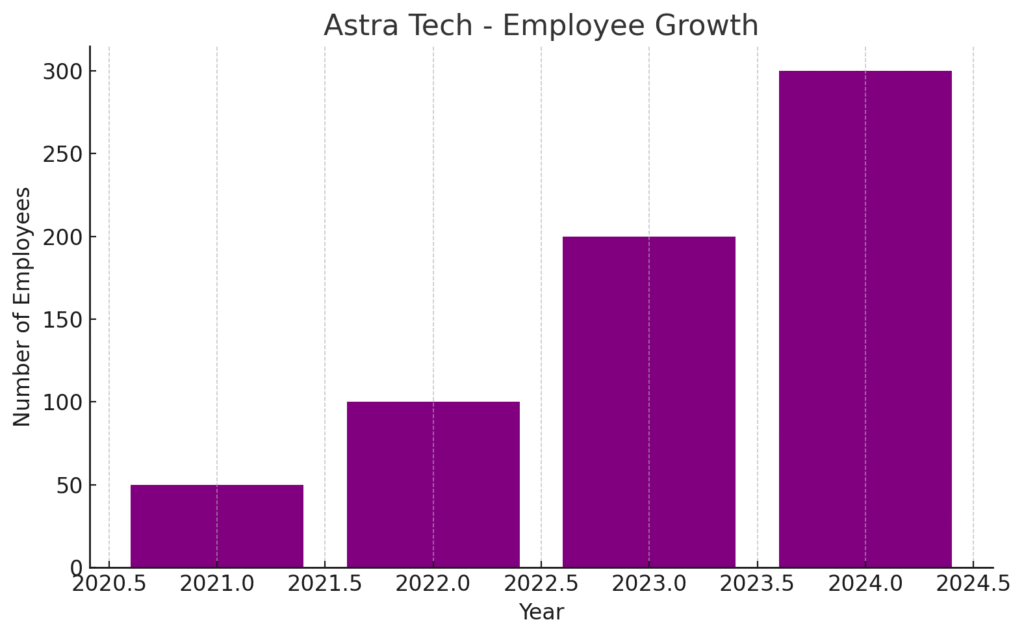

| Employee Count | 201-500 employees | As of May 2025, Astra Tech has approximately 201 employees across 6 continents. |

User growth

From zero in 2022 to over 150 million users globally, BOTIM saw exponential adoption— especially after relaunching as an Ultra App in 2023. MAUs reached 25 million, spanning 155+ countries.

Fintech traction

BOTIM quickly became the most-issued prepaid card in the UAE. With millions using BOTIM Money for cross-border transfers, Astra has become a fintech leader in the region.

Daily usage and transactions

BOTIM saw hundreds of thousands of monthly transactions in utility payments, mobile top-ups, and remittances. It’s now the most actively transacted app ecosystem in MENA.

Profitability

By 2023, Astra Tech became profitable—a rare achievement for a young tech company. The combination of subscription revenue, fintech margins, and service commissions made this possible.

Mergers, acquisitions & investments of Astra Tech

Here’s a comprehensive table detailing Astra Tech’s key mergers, acquisitions, and investments:

| Date | Company/Entity Acquired or Invested In | Type | Description |

| July 2022 | Rizek | Acquisition | Acquired Rizek, a UAE-based platform offering on-demand personal and home services, to enhance service offerings. |

| August 2022 | PayBy | Acquisition | Acquired PayBy, a fintech company, to expand digital payment solutions and integrate financial services. |

| December 2022 | G42 Investment | Investment | Secured a $500 million investment from Abu Dhabi-based G42 to support the development of the Ultra App. |

| January 2023 | BOTIM | Acquisition | Acquired BOTIM, a leading VoIP app in the MENA region, to transform it into an Ultra App integrating various services. |

| July 2023 | Y Finance | Acquisition | Acquired a 90% stake in Y Finance, a Philippines-based financing company, to expand into international markets. |

| December 2024 | Citi Investment | Investment | Received a $500 million asset-backed facility from Citigroup to fund Astra Tech’s fintech arm, Quantix. |

Products and service offerings of Astra Tech

BOTIM Ultra App

BOTIM Ultra App is the centerpiece of Astra Tech’s ecosystem. Originally a messaging and calling app, BOTIM now enables users to chat, shop, transfer money, and access government services—creating a true “Ultra App” experience. Its chat-based interface encourages adoption and engagement without needing users to learn new behavior.

BOTIM Money

BOTIM Money, powered by Astra’s fintech subsidiary PayBy, offers digital wallets, bill payments, international remittances, and a prepaid Mastercard. BOTIM Money also introduced a “Send Now, Pay Later” option for users to remit funds instantly and settle later, improving accessibility and affordability for migrant users.

BOTIM Stores

BOTIM Stores brings e-commerce directly into the app, allowing users to browse and purchase from over 100,000 merchants. It supports conversational commerce where users can shop directly via chat. For merchants, the platform offers storefront creation, digital tools, and customer engagement through BOTIM.

BOTIM AI

BOTIM AI enhances the user experience through an Arabic-language chatbot powered by G42’s AI ecosystem. It supports queries, transactions, bookings, and service navigation—all via conversational inputs. This integration aligns with Astra’s vision of simplified digital life.

Quantix

Quantix, Astra Tech’s finance arm, provides personal lending services such as microloans and Buy Now, Pay Later (BNPL) under the CashNow brand. It is licensed by the UAE Central Bank, making it one of the first fintechs with a full Finance Company License since 2008.

BOTIM Salary & Payroll

BOTIM Salary & Payroll is a new addition aimed at SMEs and unbanked workers. It provides digital salary disbursement and access to financial tools for employees who may not have traditional banking access.

This promotes financial inclusion through Astra’s digital ecosystem.

Astra Tech – employee growth:

BOTIM Home Services

BOTIM Home Services builds on Rizek’s network to allow users to book home maintenance, cleaning, and personal grooming services. These services are available on demand and bookable directly through chat, streamlining the user journey.

BOTIM Travel

BOTIM Travel lets users book flights and other travel-related services via in-app partnerships with providers like Etihad Airways. This feature is integrated into the messaging interface, allowing users to book trips conversationally.. This feature is integrated into the messaging interface, allowing users to book trips conversationally.

Challenges faced by Astra Tech

Integration complexity

Merging multiple platforms—BOTIM for communication, PayBy for fintech, and Rizek for services—into a single seamless Ultra App was a major technical challenge. Each platform had different tech stacks, security models, and user interfaces that needed unification.

Maintaining performance

BOTIM was originally a high-performance VoIP app. Adding fintech, shopping, and AI features without degrading call quality or app speed required sophisticated backend engineering and performance optimization.

Scaling architecture

Astra’s user base grew from 0 to 150M+ in just two years. Scaling the infrastructure to support millions of concurrent users across payments, chats, and remittances involved investing in cloud-native architecture, load balancing, and regional data hosting.

AI integration

BOTIM GPT, Astra’s conversational assistant, had to be developed and trained for Arabic and local dialects. Building a reliable NLP pipeline, ensuring data privacy, and integrating AI into a real-time app posed complex challenges.

Data privacy and security

As a fintech player handling money transfers and lending, Astra needed to comply with data protection laws like UAE Central Bank’s cybersecurity frameworks. Ensuring encryption, secure storage, and KYC processes was vital.

Cross-platform support

Astra had to ensure its Ultra App worked seamlessly across Android, iOS, and web platforms. This involved maintaining multiple codebases, synchronizing updates, and ensuring a uniform user experience across devices.

Astra Tech competitors and comparison

Careem Super App

Careem, backed by Etisalat’s $400 million investment, is Astra Tech’s primary regional competitor. While Careem evolved from a ride-hailing platform into a super app offering food delivery, payments, and transport, Astra’s strength lies in starting with communication. BOTIM’s chat-first model gives it daily user engagement, which Careem lacks.

Official Website: https://www.careem.com

WhatsApp (Meta)

Though globally dominant, WhatsApp’s voice and video calling features are restricted in the UAE. Astra Tech filled this legal and functional gap with BOTIM, gaining a significant local advantage. Additionally, WhatsApp lacks integrated services like bill payments and shopping.

Official Website: https://www.whatsapp.com

Noon and Amazon

In e-commerce, Astra competes with Noon and Amazon. However, Astra’s unique position comes from embedding shopping within a messaging interface. BOTIM Stores turns casual users into shoppers via chat, a level of convenience traditional platforms can’t match.

Official website: https://www.noon.com

Traditional Banks and Fintechs

Astra Tech challenges legacy banks and digital wallets by offering financial services such as money transfers, cards, and loans directly inside BOTIM. With its user-friendly app and no physical branches, it appeals especially to younger and migrant users.

(Emirates NBD): https://www.emiratesnbd.com

WeChat (China)

Though not a direct competitor, WeChat serves as Astra’s global benchmark. WeChat’s all-in-one model in China inspired Astra’s Ultra App. However, Astra’s local-first and Arabic-language AI integration give it a cultural and regulatory edge in MENA.

Official Website: https://www.wechat.com

Etisalat’s Digital Ambitions

As Astra scales, it will continue to compete with telecom giants like Etisalat, which are pushing digital platforms through ventures like Smiles and Careem+. Astra’s nimbleness and acquisitions-driven growth help it stay competitive.

Official Website: https://www.etisalat.ae

Competitor Comparison Table

| Competitor | Strengths | Weaknesses Compared to Astra |

| Careem Super App | Ride-hailing, delivery, e-wallets | No daily-use engagement like messaging |

| Global messaging leader | VoIP blocked in UAE, lacks service layers | |

| Noon & Amazon | E-commerce scale, product range | No integration with daily communication |

| Traditional Banks | Established finance infrastructure | Lack of mobile-first, unified experience |

| Model inspiration, mature ecosystem | Not tailored for MENA market | |

| Etisalat (e&) | Backed by telecom giant, Careem+ | Slower execution, fewer user touchpoints |

FAQs

1. What is Astra Tech?

Astra Tech is a UAE-based technology company that created the BOTIM Ultra App, which integrates communication, fintech, shopping, and AI into one platform.

2. Who founded Astra Tech?

Astra Tech was founded in 2022 by Abdallah Abu-Sheikh, a Jordanian entrepreneur previously known for founding Rizek and Barq.

3. What does the BOTIM Ultra App offer?

The BOTIM Ultra App offers voice and video calls, messaging, bill payments, money transfers, shopping, home services, travel bookings, and government services in one interface.

4. How many users does Astra Tech have?

As of 2025, Astra Tech serves over 150 million users across 155 countries, with 25 million monthly active users.

5. How does Astra Tech generate revenue?

Astra Tech earns revenue through VIP subscriptions, fintech transactions, advertising, lending, e-commerce commissions, and on-demand services inside the BOTIM app.

6. What makes Astra Tech different from Careem or WhatsApp?

Astra Tech integrates daily-use services like payments and shopping directly into a messaging platform, unlike Careem which started with ride-hailing or WhatsApp which lacks fintech and e-commerce features.

7. What is BOTIM Money?

BOTIM Money is Astra Tech’s fintech feature that allows users to send remittances, pay bills, use a digital wallet, and access microloans.

8. How was Astra Tech funded?

Astra Tech raised $500 million in 2022 from G42 and secured an additional $500 million asset-backed facility from Citi in 2024 to support lending services.

9. What industries does Astra Tech operate in?

Astra Tech operates across technology, fintech, e-commerce, AI, and digital services, offering a consolidated solution through its Ultra App.

10. What is Quantix by Astra Tech?

Quantix is Astra Tech’s licensed finance arm that offers personal loans, Buy Now Pay Later (BNPL) options, and salary disbursement services to users and SMEs.

Sources and references

- https://astratech.ae

- https://www.ultrabotim.com

- https://www.forbesmiddleeast.com/leadership/leaders-insights/the-dawn-of-the-ultra-app

- https://www.pymnts.com/acquisitions/2023/astra-tech-acquires-botim-create-mena-super-app/

- https://www.thenationalnews.com/future/technology/2024/12/11/astra-tech-citi/

- https://gulfbusiness.com/astra-tech-launches-botim-ai-for-users/

- https://m.economictimes.com/industry/transportation/airlines-/-aviation/etihad-airways-signs-deal-to-allow-bookings-using-ai-within-chat-app-botim/articleshow/99962559.cms

- https://www.prnewswire.com/news-releases/moneygram-joins-forces-with-botim-to-launch-international-money-transfer-to-over-200-countries-301729934.html

- https://gulfbusiness.com/botim-launches-first-arabic-chatgpt-in-region/

- https://www.astratech.ae/2024/07/24/astra-techs-quantix-becomes-the-first-fintech-to-receive-cbuaes-finance-company-license/

- https://www.careem.com/en-AE/about-us/

- https://kr-asia.com/ant-groups-alipay-bridges-connections-between-local-wallets-and-cross-border-businesses

- https://apps.apple.com/sa/app/botim-video-calls-and-chat/id1263036818

- https://play.google.com/store/apps/details?id=im.thebot.messenger

- https://www.crunchbase.com/organization/astra-tech

- https://www.linkedin.com/in/abdallah-abu-sheikh-7a3b1a1b0/

- https://www.statista.com/statistics/1175153/uae-e-commerce-market-size/

- https://www.digitaldubai.ae/apps-services/details/uae-pass

- https://blog.wego.com/emirates-id/

Authors

-

Himanshu is a builder at heart who loves turning raw ideas into structured systems. At UAE Startup Story, he focuses on the tech, research, and operations behind every feature and founder story. He’s passionate about spotlighting startups that solve real problems and inspiring the next wave of entrepreneurs across the region.

-

Rafiqul is a storyteller with a founder’s mindset. At UAE Startup Story, he crafts deep-dive narratives, interviews, and features that decode what makes startups succeed in the UAE and beyond. He works closely with entrepreneurs to capture lessons, failures, and turning points that can inspire others on their own journeys.