What does it take to turn a startup into the Middle East’s first BNPL unicorn?

This Tabby case study reveals the bold moves behind Tabby’s rise— from a Dubai-born idea to a $3.3B fintech giant.

With 15 million users, 40,000 merchant partners, and a mission to make payments easier and fairer, the this success story is a business masterclass in solving real problems with smart, local solutions.

Let’s get started.

TL;DR – Tabby Tech Case Study

- Founded in 2019, Tabby started in Dubai and moved its headquarters to Riyadh.

- Provides Shariah-compliant, interest-free Buy Now, Pay Later (BNPL) services.

- Reached 15 million users, 40,000 merchants, and $10 billion in annual transaction volume by 2025.

- Raised over $1.8 billion in funding and hit a $3.3 billion valuation in its Series E round.

- Offers a full ecosystem including Tabby Card, Tabby Plus, Tabby Shop, and Tabby Care.

- Stands out with ethical finance, smart tools, and strong growth in the MENA BNPL market.

Company highlights

| Attribute | Details |

| Company Name | Tabby |

| Headquarters | Riyadh, Saudi Arabia |

| Sector/Industry | Financial Technology (BNPL) |

| Founders | Hosam Arab, Daniil Barkalov |

| Year Founded | 2019 |

| Official Website | tabby.ai |

Tabby: About the startup

Founding story

Tabby was founded in 2019 by serial entrepreneur Hosam Arab and technologist Daniil Barkalov. Arab’s prior success with Namshi gave him deep insights into regional e-commerce gaps, while Barkalov brought the tech expertise from his time at Careem.

Problem solved

The startup addressed a key challenge in the Middle East—lack of access to affordable credit and distrust of interest-based finance. By offering interest-free installment payments that aligned with Shariah values, Tabby gave shoppers a flexible and ethical way to manage their purchases.

Product evolution

Tabby began with a simple “Pay in 4” option at online checkouts. It later expanded to offer virtual Tabby Cards, a premium subscription called Tabby Plus, a deals discovery feature named Tabby Shop, and a buyer protection program called Tabby Care. The acquisition of Tweeq signaled Tabby’s shift toward becoming a complete financial services platform.

BNPL industry and market size

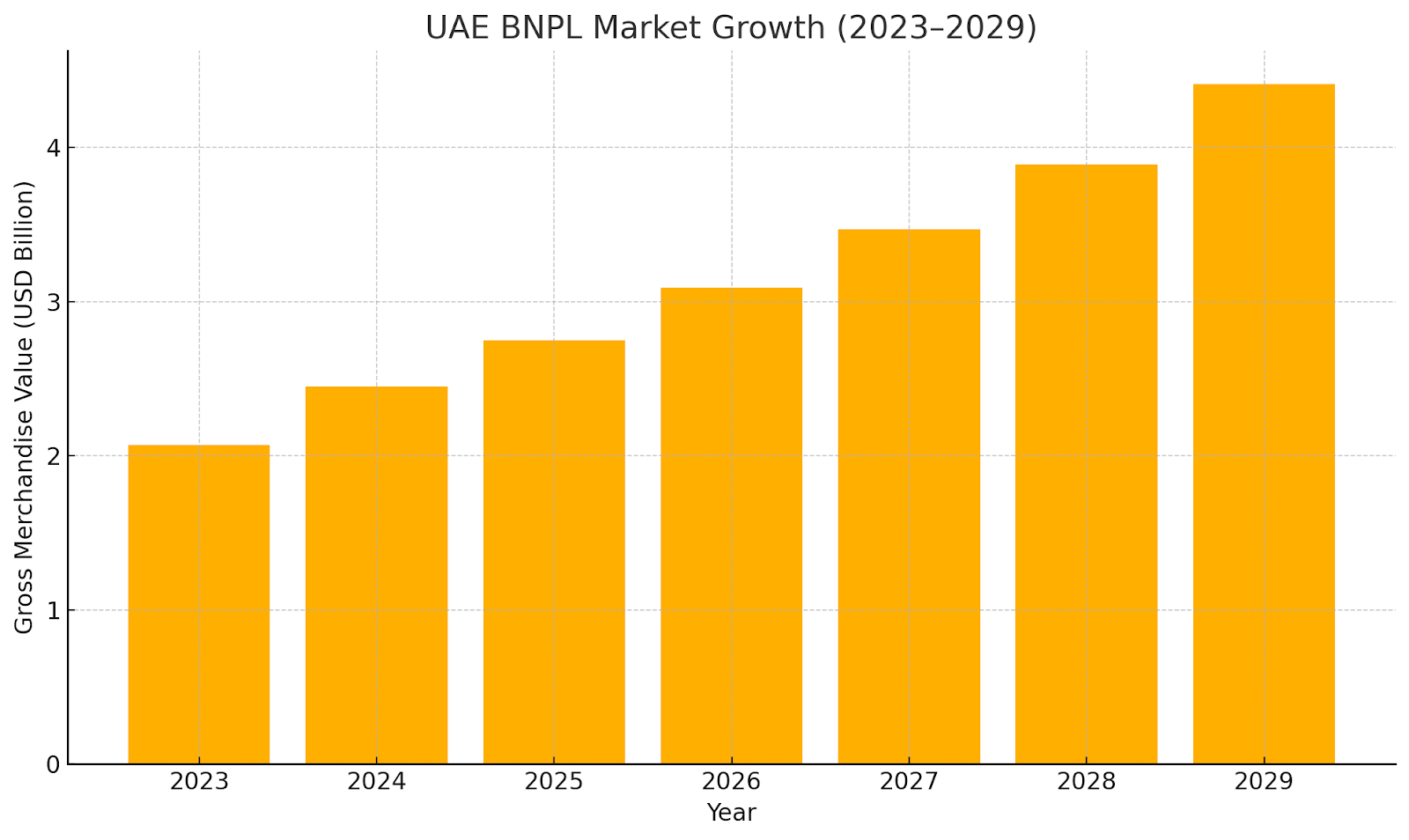

Market size in the UAE

The BNPL market in the UAE is rapidly expanding. It is projected to grow from $2.07 billion in 2023 to $4.41 billion by 2029. This spike is driven by rising consumer demand for flexible payment options, especially among the youth.

Regional trends

Across the Middle East, the BNPL sector is forecasted to reach $11.7 billion by 2030. Young, tech-savvy shoppers, a growing digital retail space, and smartphone penetration are key growth factors contributing to the upward trend.

Target audience and positioning

Tabby serves primarily young, urban consumers in Saudi Arabia, UAE, and Kuwait who seek interest-free, flexible payment solutions. It distinguishes itself by offering Shariah-compliant features and has emerged as the leading BNPL player in the region.

Founders and team of Tabby

Hosam Arab, CEO

Previously co-founded Namshi, a top fashion e-commerce platform in the region. Hosam brought retail insights and a sharp vision for customer-centric fintech.

Daniil Barkalov, COO

An ex-Careem executive, Daniil helped scale Tabby’s tech and operations rapidly. His background in platform scaling proved instrumental.

Rami Farhat, Head of Finance

Rami oversees financial strategy, investor relations, and capital allocation. His experience has been critical in managing debt rounds and driving sustainable profitability.

Product leadership

Tabby’s product team has driven innovations like Tabby Card and Tabby Plus, ensuring the app remains user-friendly while introducing advanced features.

Diverse leadership mix

The leadership team combines local expertise with global fintech experience, supporting scalable growth across multiple regions.

Background story of Tabby

In 2019, Hosam Arab, who had previously co-founded the online fashion store Namshi, started Tabby in Dubai.

He noticed that many people in the Middle East preferred to pay with cash when shopping online because they didn’t have credit cards or didn’t want to use them. Hosam wanted to make shopping easier and more flexible for these customers.

So, he created Tabby to let people buy things now and pay later without any interest.

The founding moment

The idea came after Hosam Arab left Namshi and noticed the lack of flexible financing in local markets. The co-founders saw an opportunity to localize BNPL.

Initial hurdles

Early challenges included building trust in a market wary of debt, securing merchant partnerships, and meeting compliance needs.

First signs of growth

Tabby signed on with big retailers like Adidas and IKEA by 2021. With over 400K users in under two years, their early traction was impressive.

Mission and vision of Tabby

Tabby’s mission is to give people financial freedom. This means they want to help shoppers buy what they need without stress. Tabby lets you split your payments into small parts, with no interest and no late fees (especially in Saudi Arabia). Their goal is to make spending money easier, safer, and more responsible.

Tabby says it wants to help people:

- Shop smart – by paying later in small chunks

- Earn rewards – like cashback or deals

- Save better – by offering tools to manage money

They focus on making their system fair for everyone. That’s why their services follow Shariah rules— which means no hidden fees or unfair charges.

Tabby’s Vision: Becoming a super app for money

Tabby doesn’t want to stop at just “Buy Now, Pay Later.” Their vision is much bigger. They want to build a full financial platform for the Middle East—a one-stop app where you can:

- Shop now and pay later

- Use a digital card in stores

- Save and manage your money

- Track spending and compare deals

They aim to be the app people trust for everyday spending, just like a digital wallet, credit card, shopping assistant, and savings tool all in one place.

Tabby dreams of a future where everyone has access to smart, flexible, and fair money tools—without needing a credit card or going into debt.

Business model and revenue streams: How does Tabby make money?

Tabby works as a Buy Now, Pay Later (BNPL) company. This means it lets shoppers buy things today and pay for them later, usually in four equal parts, without adding any extra interest.

Tabby mainly focuses on:

- Helping customers buy what they need without paying everything at once

- Helping businesses sell more by offering flexible payment options

This model makes both shoppers and sellers happy. Shoppers get more time to pay, and businesses get more sales.

Who are the paying customers of Tabby?

Even though Tabby is free for shoppers who pay on time, it still makes money. But not from the customers.

Instead, Tabby earns from businesses (called merchants) that use its service.

1. Merchant Fees (Main Source of Income)

Every time someone uses Tabby to make a purchase, the shop pays Tabby a small fee. This is called a merchant commission. It’s usually a few percent of the total sale.

For example:

If you buy a ₹1,000 pair of shoes using Tabby, the store still gets paid almost the full amount—but Tabby takes a small cut (maybe ₹50) as a fee.

👉 This is Tabby’s main way of making money.

Other ways Tabby makes money

2. Tabby Plus (Paid Membership)

Tabby also offers a subscription plan called Tabby Plus. Customers pay a small monthly fee to get:

- Higher spending limits

- Extra deals

- More payment options

This gives Tabby regular income from users who want extra benefits.

3. Card Transaction Fees

Tabby created a virtual card with Visa. When people use the Tabby Card in stores, Tabby may earn small fees from these transactions, just like banks do with debit or credit cards.

4. No Late Fees (In Saudi Arabia)

In the past, Tabby charged late fees if customers didn’t pay on time. But to stay Shariah-compliant, it removed all late fees in Saudi Arabia in 2023.

So now, late fees are not a big part of Tabby’s income— at least in Saudi Arabia.

Here’s how Tabby makes money:

| Income Source | Who Pays? | Notes |

| Merchant Fees | Online stores | Tabby earns a fee on every BNPL transaction |

| Tabby Plus | Shoppers | Monthly subscription for extra benefits |

| Card Transaction Fees | Visa card payments | Tabby earns when users pay using Tabby’s virtual card |

| (Old) Late Fees | Some users | Mostly removed to follow Islamic finance rules |

In simple words:

Tabby makes most of its money from businesses, not from shoppers. It gives people an easy way to pay later—and in return, shops pay Tabby for bringing them more sales.

Funding and investors of Tabby

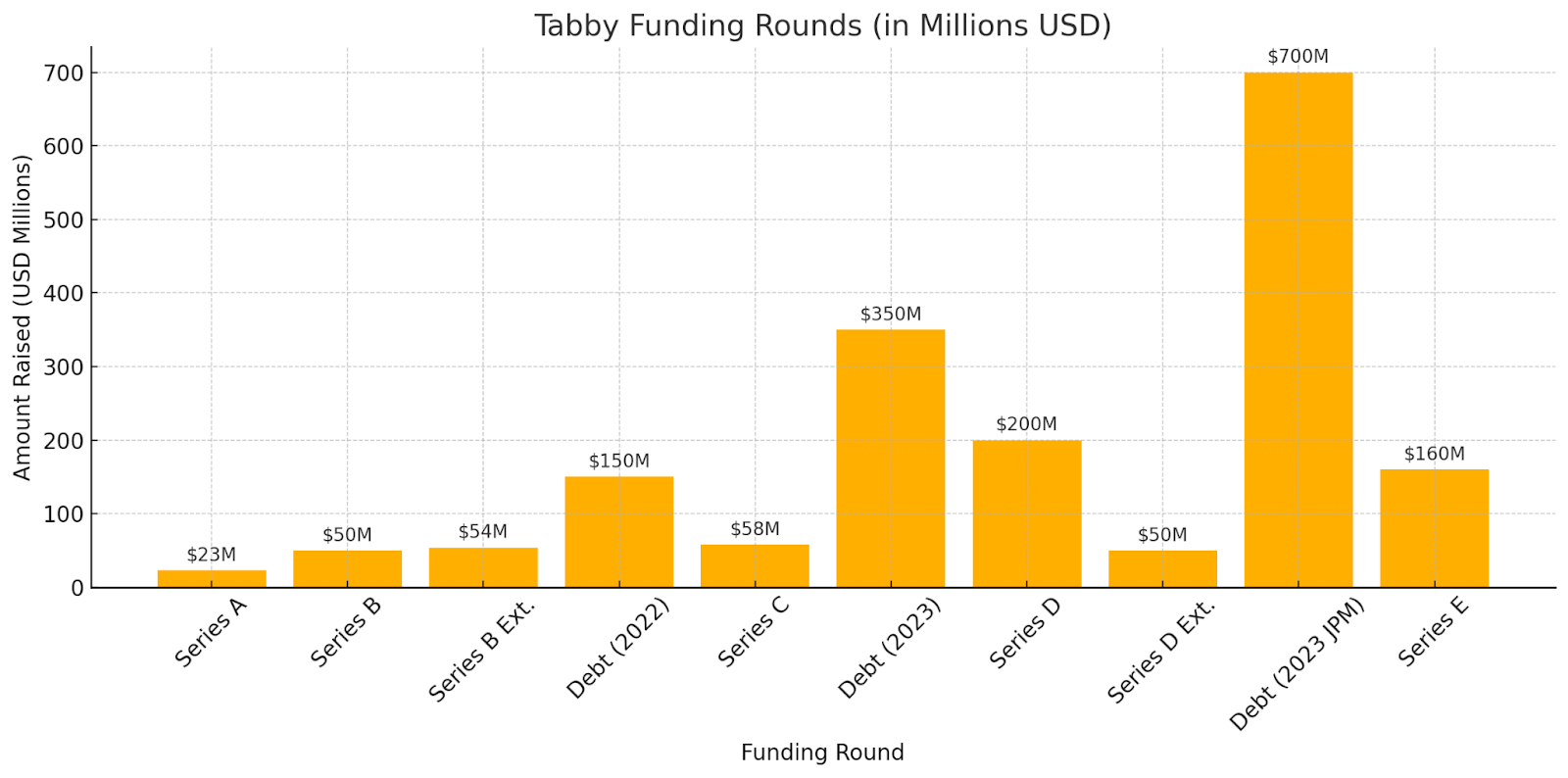

Here is a detailed table outlining Tabby’s funding history, including the amounts raised, dates, lead investors, and key participants:

| Funding Round | Date | Amount Raised | Lead Investors |

| Series A | Dec 2020 | $23M | STV, Arbor Ventures |

| Series B | Aug 2021 | $50M | Global Founders Capital, STV |

| Series B Extension | Mar 2022 | $54M | Peak XV Partners (formerly Sequoia Capital India), STV |

| Debt Financing | Aug 2022 | $150M | Atalaya Capital Management |

| Series C | Jan 2023 | $58M | Peak XV Partners, STV |

| Debt Financing | May 2023 | $350M | Partners for Growth |

| Series D | Nov 2023 | $200M | Wellington Management |

| Series D Extension | Dec 2023 | $50M | Hassana Investment Company |

| Debt Financing | Dec 2023 | $700M | JPMorgan |

| Series E | Feb 2025 | $160M | Blue Pool Capital, Hassana Investment Company |

Total Funding Raised: Over $1.8 billion (including equity and debt financing)

Valuation Milestones:

- Series D (Nov 2023): Valued at $1.5 billion, marking Tabby’s entry into the unicorn club in the MENA region.

- Series E (Feb 2025): Valued at $3.3 billion, solidifying its position as the most valuable fintech company in the region.

Growth metrics and revenues

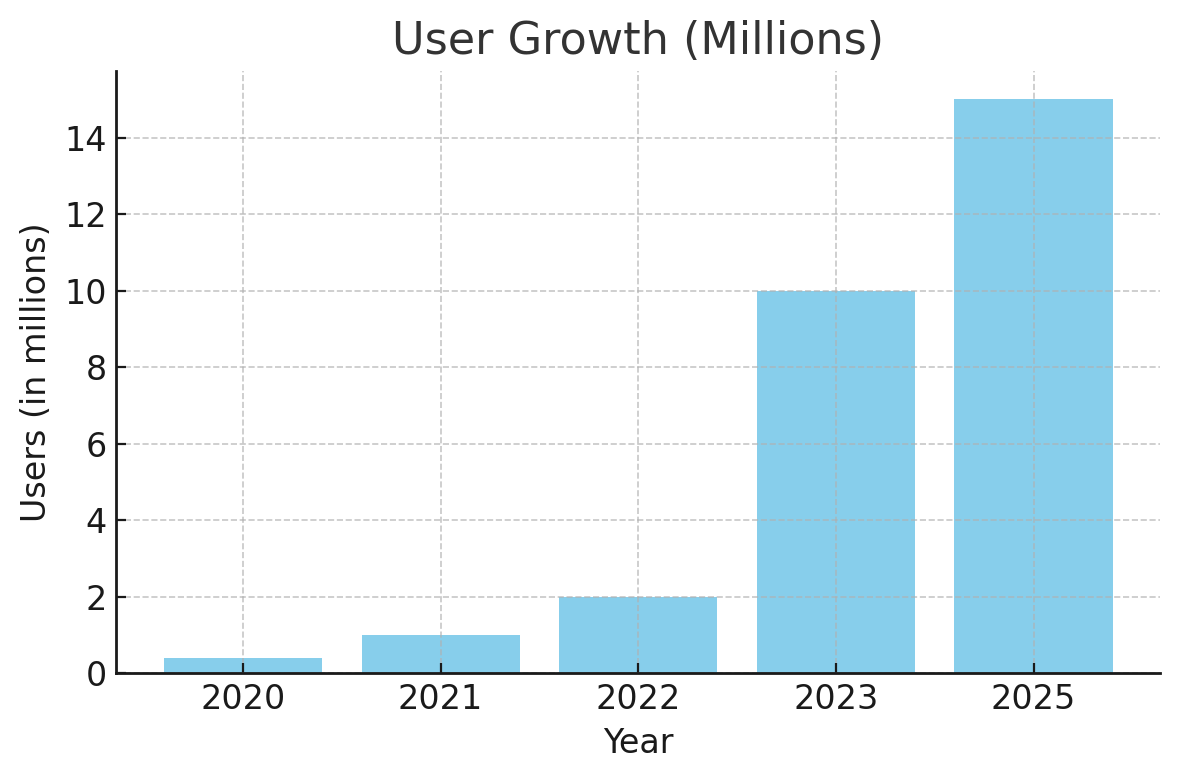

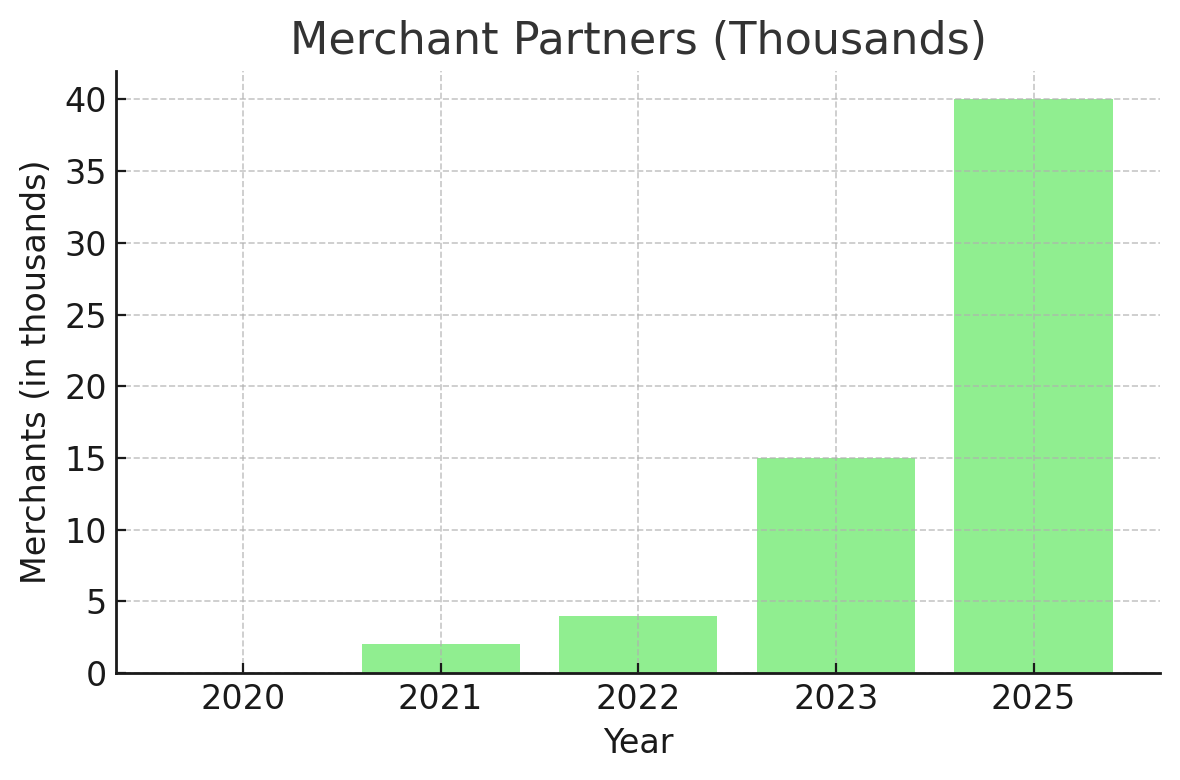

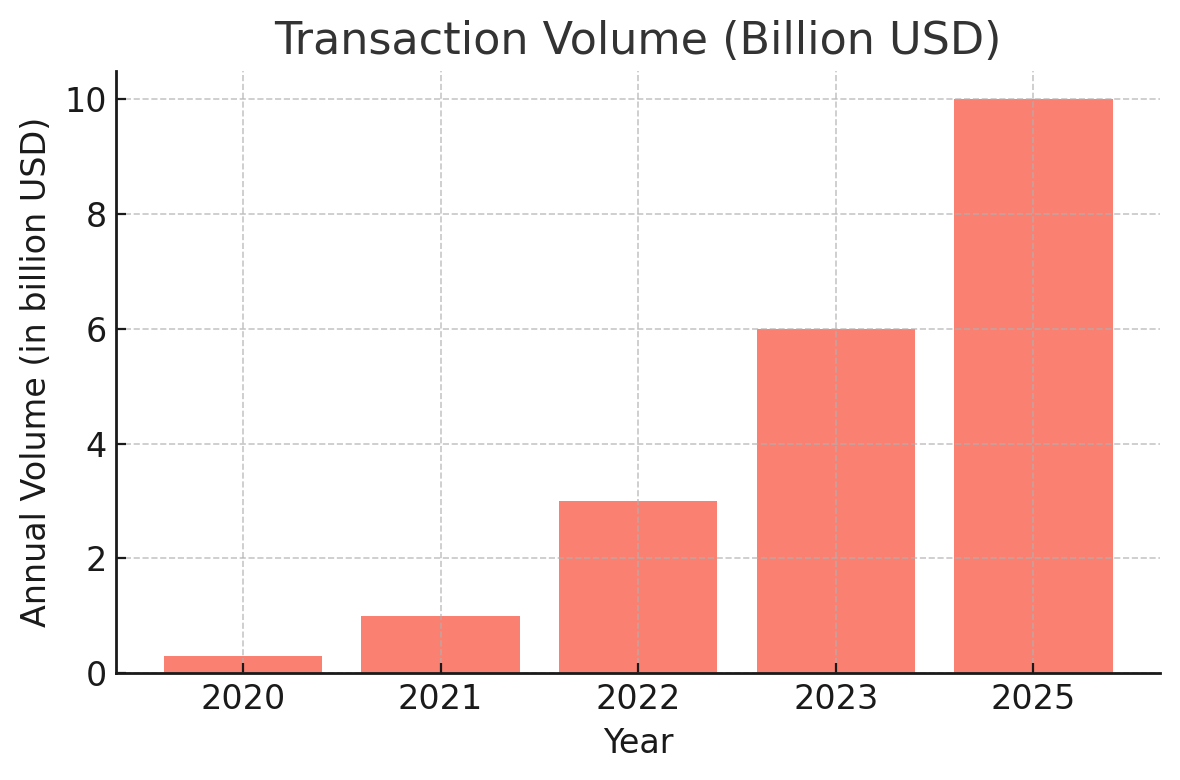

From 2020 to 2025, Tabby grew rapidly across users, merchants, and transaction volume. Users jumped from 0.4 million to 15 million, while partner stores expanded from 2,000 to over 40,000.

The total transaction volume surged from $0.3 billion to over $10 billion annually.

This growth shows Tabby’s strong position as the leading BNPL platform in the Middle East.

User Growth (Millions)

Tabby’s user base grew from just 0.4 million in 2020 to 15 million in 2025. This rapid rise shows how fast the platform gained trust among shoppers across the Middle East.

Merchant Partners (Thousands)

The number of stores partnering with Tabby jumped from 2,000 in 2021 to over 40,000 by 2025. This strong network helped drive more customer adoption and brand visibility.

Transaction Volume (Billion USD)

Annual customer spending through Tabby soared from $0.3 billion in 2020 to over $10 billion by 2025. This highlights Tabby’s massive impact on the region’s shopping and payment habits.

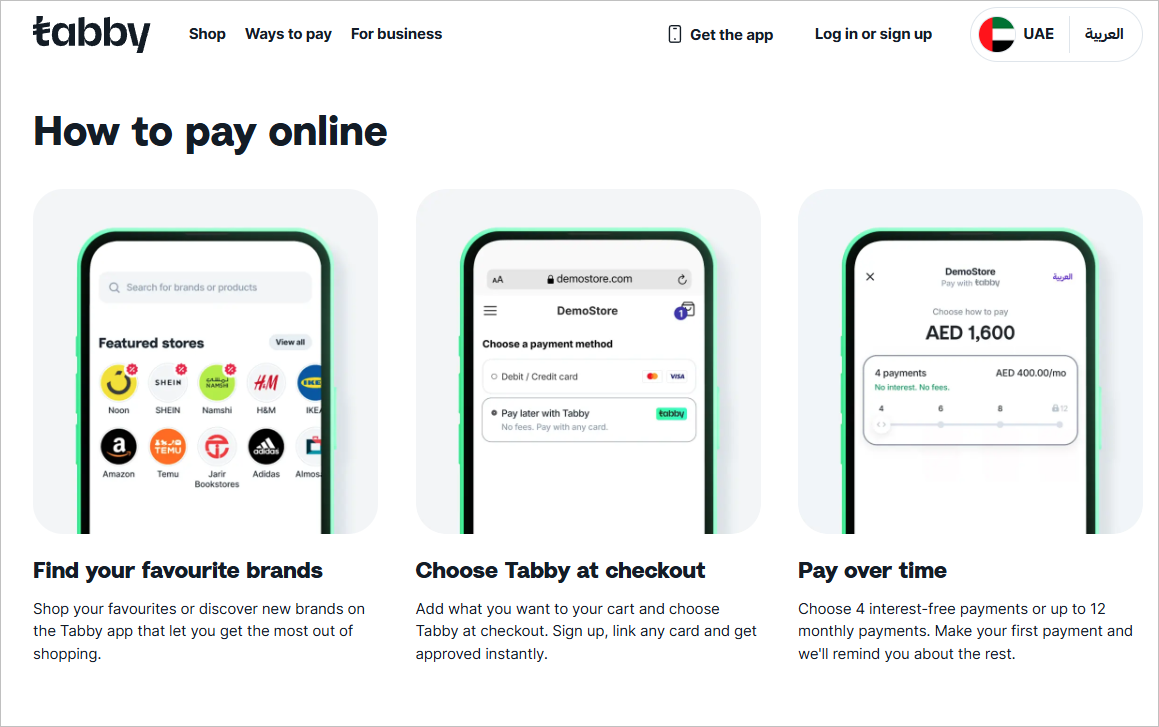

What are the products and service offerings of Tabby?

Core Offering: Buy Now, Pay Later (BNPL)

Tabby’s main product is a flexible Buy Now, Pay Later payment option. It allows customers to split any purchase into four equal payments.

The first payment (25%) is made at the time of purchase, while the remaining three are paid automatically every two weeks or monthly, depending on the user’s choice.

This service is completely interest-free if payments are made on time. It works both online (during checkout) and in-store when linked to the Tabby Card.

This option is very popular among people who don’t have access to credit cards but still want to shop conveniently without paying everything upfront.

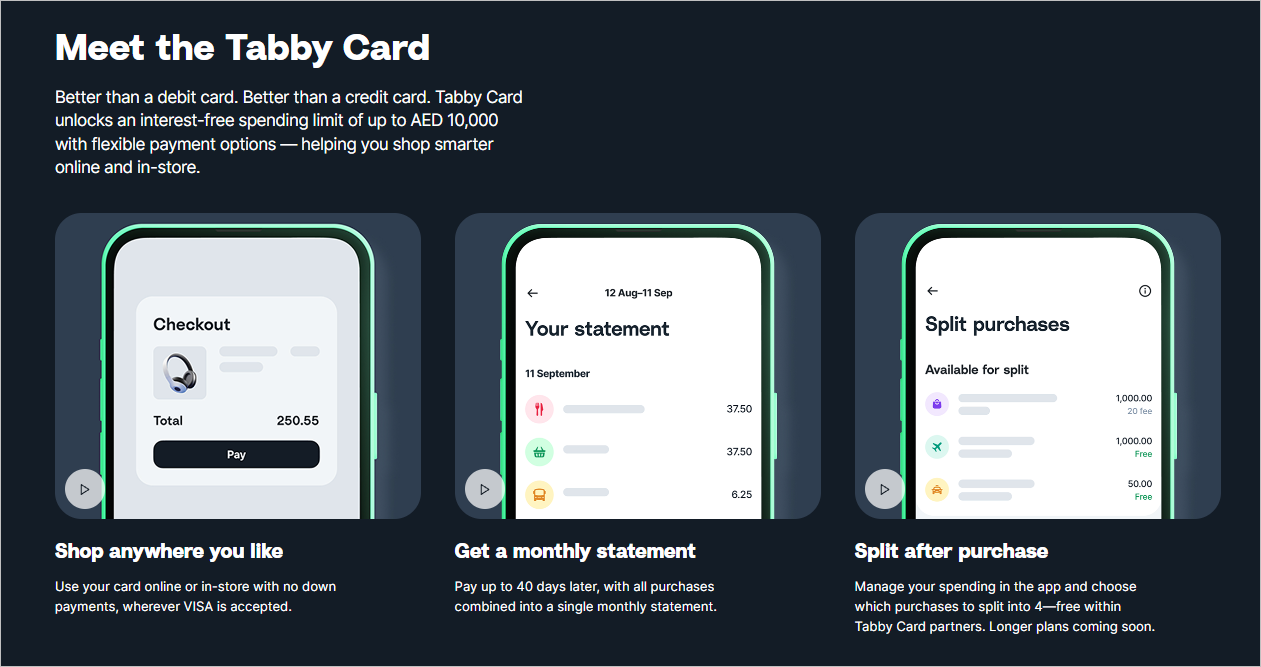

Tabby Card: Virtual Card for In-Store Payments

The Tabby Card is a virtual Visa card that brings the same BNPL service to offline shopping. Once activated through the Tabby app, users can tap and pay at any store that accepts Visa. This card makes it easy to enjoy installment plans in malls, restaurants, and local retail shops—not just online.

It gives customers more freedom to use Tabby wherever they shop, helping Tabby bridge the gap between online convenience and real-world purchases.

Tabby Plus: Premium Membership

Tabby Plus is a paid monthly subscription plan for users who want more from the Tabby experience. With this membership, users get access to:

- Higher purchase limits, so they can buy more expensive items with installments.

- Exclusive discounts and offers from selected brands.

- Additional payment flexibility, like longer repayment periods or extra installment options.

This plan is ideal for regular shoppers who want more control and better deals through the Tabby platform.

Tabby Shop: Smart Shopping Assistant

Tabby Shop is a shopping discovery tool built into the app. It helps users find the best deals, discounts, and trending products across hundreds of Tabby partner brands. Instead of jumping between multiple websites, users can search and compare products all in one place.

It also includes price tracking features, making it easier for shoppers to know when their favorite items go on sale. Tabby Shop turns the app into a smarter way to browse and buy.

Tabby Care: Buyer Protection Program

Tabby Care is a safety net for shoppers. It protects users in case something goes wrong with their order. For example:

- If the product isn’t delivered.

- If the item is broken or damaged.

- If the seller doesn’t respond.

With Tabby Care, users can feel more secure using BNPL, knowing that Tabby will help them resolve issues and ensure they get what they paid for. It’s similar to purchase protection offered by credit cards.

Longer-Term Installment Plans

Originally, Tabby’s installment plan was fixed at 4 payments.

But now, the company has added more flexible options. Customers can choose longer-term plans to repay their purchases over more months, depending on their financial situation.

This is especially useful for bigger purchases like electronics, furniture, or travel bookings. It gives users more breathing room while still avoiding interest fees.

What are the key challenges faced by Tabby?

Regulatory pressure

Tabby operates in a financial services space that is subject to strict government regulations. In 2023, both the UAE and Saudi Arabia introduced new licensing requirements for BNPL companies. Tabby had to secure approvals, such as a BNPL license from the Saudi Central Bank (SAMA), to continue operating legally.

Complying with these evolving regulations demands constant updates to systems, documentation, and internal processes, which can slow growth and increase operational costs.

Market maturity and consumer education

Buy Now, Pay Later is still a relatively new concept in many parts of the Middle East. While e-commerce adoption is growing, many consumers still prefer traditional cash payments and are unfamiliar with digital installment options.

This creates a challenge for Tabby to educate users about how BNPL works, build trust in a credit-based product, and assure customers that the service is interest-free and compliant with Islamic finance principles.

Credit risk and defaults

Since Tabby provides interest-free installment plans, it assumes the risk of users not paying back on time. Managing this credit risk is a major challenge. Tabby must rely heavily on data science and smart underwriting systems to assess who is creditworthy.

A rise in non-payments or defaults could directly impact its financial health and trust among partners and investors.

Competitive pressure

The BNPL market in the Gulf is highly competitive. Key players like Tamara, Cashew, Spotii, and Postpay are all trying to gain market share, especially in Saudi Arabia and the UAE.

Tabby must consistently innovate, offer better customer experiences, and expand its services to stay ahead. The fight for merchants, users, and partnerships is ongoing and intense.

Global BNPL industry trends

Globally, the BNPL sector has faced increased scrutiny and a funding slowdown due to economic uncertainty. Major Western players like Klarna have experienced valuation drops and profitability challenges.

While Tabby operates in a different region, global investor sentiment affects its access to capital and public perception.

Tabby competitors and comparison

Here are key competitors of Tabby in UAE:

- Tamara (Saudi-based): Offers 2 or 4-part Sharia-compliant payments, charges AED 25 late fees, and partners with Farfetch and Diesel.

- Postpay (UAE): Offers 3–4 interest-free payments with seamless retailer integration. Late fee details not disclosed.

- Spotii (UAE): Acquired by Zip; offers 4-part interest-free payments and is expanding globally.

- Cashew (UAE): Provides 3–4 part payments as a credit card alternative; late fees not disclosed.

While all offer interest-free options, Tabby stands out for its extended installment plans, strong retail partnerships, and round-the-clock support.

Tamara appeals to users seeking Sharia compliance. Spotii and Cashew focus on accessibility and global reach.

FAQs

1. What is Tabby and how does it work?

Tabby is a Buy Now, Pay Later (BNPL) platform that lets you shop now and split your payments into four equal parts—without paying any interest or fees. You can use Tabby online or in-store, and the first payment is made at checkout. The rest are auto-debited every two weeks or monthly.

2. Is Tabby a Shariah-compliant payment solution?

Yes, Tabby follows Shariah principles by offering interest-free payments and removing late fees in markets like Saudi Arabia. This makes it a trusted choice for users seeking ethical, compliant financial options in the Middle East.

3. How does Tabby make money if it doesn’t charge interest?

Tabby earns money mainly through merchant fees. When you buy something using Tabby, the store pays a small commission. Tabby also makes money from premium subscriptions (Tabby Plus) and virtual card transactions, not from users who pay on time.

4. Where is Tabby available and who can use it?

Tabby is available in Saudi Arabia, UAE, and Kuwait. It’s designed for young, digital-first users who prefer flexible, interest-free payments over credit cards or cash. Anyone with a valid ID and phone number in these regions can sign up.

5. What makes Tabby different from other BNPL apps?

Tabby offers longer installment plans, a Shariah-compliant model, and strong retail partnerships with brands like IKEA, Adidas, and SHEIN. It also provides tools like Tabby Shop (deal discovery), Tabby Care (purchase protection), and Tabby Plus (premium benefits).

6. Can I use Tabby in physical stores or only online?

You can use Tabby both online and in physical stores. Just activate your Tabby Card through the app, and you can tap to pay at any store that accepts Visa—making it easy to shop anywhere with flexible installments.

7. What happens if I miss a Tabby payment?

In Saudi Arabia, Tabby doesn’t charge any late fees to stay Shariah-compliant. However, in some other markets, late fees may apply. It’s best to pay on time to maintain your credit standing and continue using Tabby services.

8. What is Tabby Plus and is it worth it?

Tabby Plus is a paid subscription for users who want extra benefits like higher spending limits, exclusive discounts, and more payment flexibility. It’s ideal if you shop frequently and want more perks through the Tabby platform.

9. Is my money safe with Tabby?

Yes, Tabby is regulated and licensed by financial authorities like the Saudi Central Bank (SAMA). It uses secure systems and buyer protection programs like Tabby Care to keep your money and purchases safe.

10. How fast is Tabby growing in the Middle East?

As of 2025, Tabby has over 15 million users and more than $10 billion in annual transaction volume. It works with 40,000+ retailers and is the fastest-growing BNPL platform in the MENA region, backed by over $1.8 billion in funding.

Authors

-

Himanshu is a builder at heart who loves turning raw ideas into structured systems. At UAE Startup Story, he focuses on the tech, research, and operations behind every feature and founder story. He’s passionate about spotlighting startups that solve real problems and inspiring the next wave of entrepreneurs across the region.

-

Rafiqul is a storyteller with a founder’s mindset. At UAE Startup Story, he crafts deep-dive narratives, interviews, and features that decode what makes startups succeed in the UAE and beyond. He works closely with entrepreneurs to capture lessons, failures, and turning points that can inspire others on their own journeys.