In just seven years, Kitopi turned a single Dubai kitchen into a $1.5 billion food empire.

The Kitopi success story shows how four ex-consultants spotted a gap in the market: restaurants needed to deliver food without opening new locations.

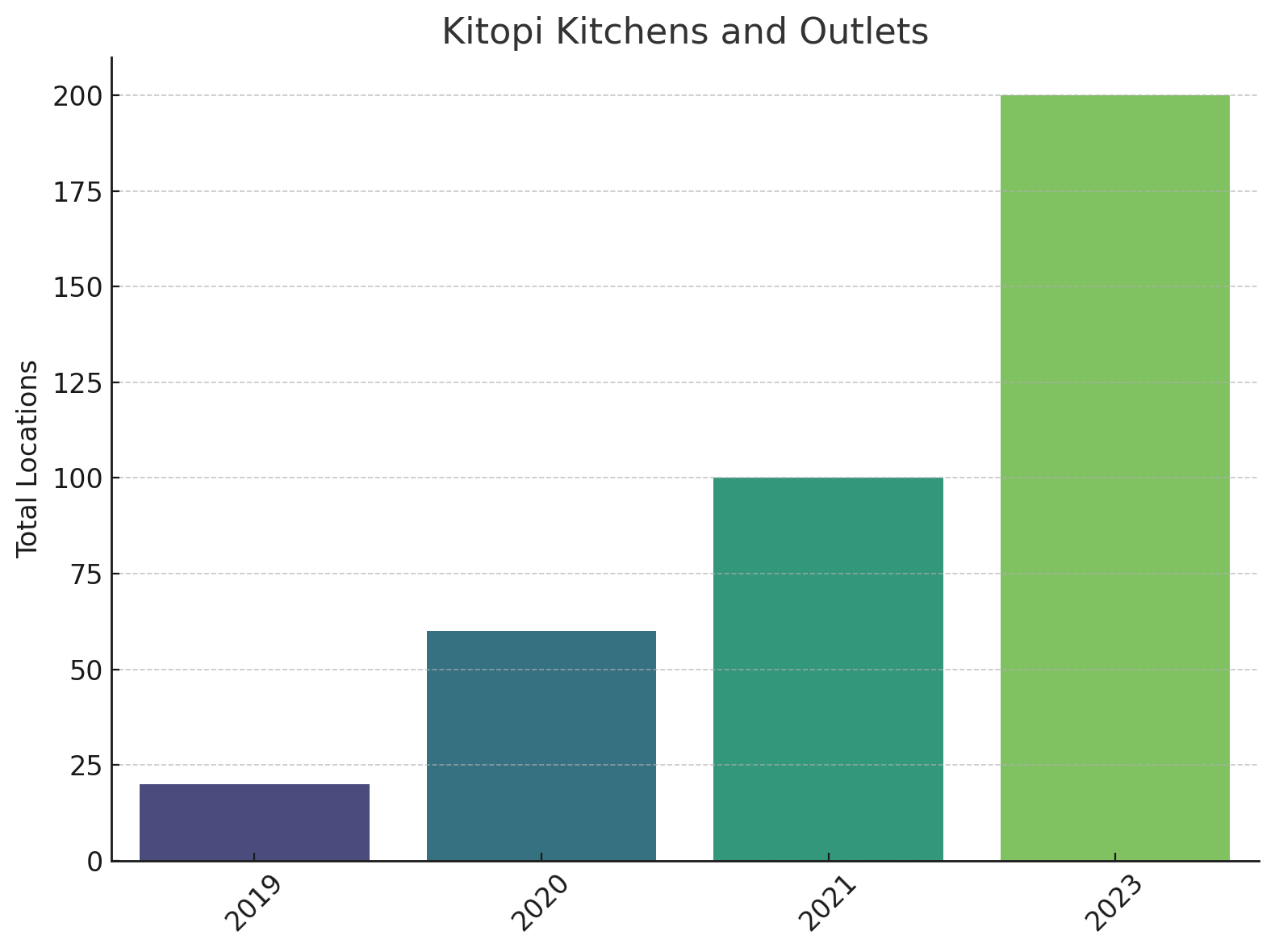

They built a tech-powered solution that now operates 200+ kitchens across five countries, attracting over $800 million in funding and partnering with 200+ restaurant brands.

This business case study reveals exactly how they did it.

TL;DR – Kitopi Success Story (Key Highlights)

- Founded in 2018 in Dubai, Kitopi pioneered the managed cloud kitchen model in the Middle East.

- Helps 200+ restaurant brands expand via delivery without opening physical outlets, using its own kitchens and staff.

- Raised over $800M in funding, achieving unicorn status in 2021 with a $1.55B valuation.

- Acquired brands like Operation Falafel and Right Bite, shifting from pure B2B to a hybrid B2B+B2C model.

- Operates 200+ kitchens and outlets across UAE, KSA, Kuwait, Qatar, and Bahrain.

- Future plans include expansion to Southeast Asia, launching its own ordering app, and pursuing an IPO.

Table of Contents

Company highlights

| Attribute | Details |

| Company Name | Kitopi (Kitchen Utopia) |

| Headquarters | Dubai, United Arab Emirates |

| Sector/Industry | Food Technology / Cloud Kitchens |

| Founders | Mohamad Ballout, Saman Darkan, Bader Ataya, Andres Arenas |

| Year Founded | 2018 |

| Parent Organization | Independent Startup |

| Official Website | kitopi.com |

Kitopi: About the startup

Kitopi was born out of the idea to help restaurants expand delivery without the high costs of setting up physical outlets. The founders, ex-McKinsey consultants, saw an opportunity to streamline food delivery through centralized kitchens.

Kitopi took care of staffing, cooking, and delivery logistics while partners focused on menu and marketing.

Today, Kitopi manages 200+ kitchens, serves 100+ brands, and operates across 7 countries in the GCC. It’s no longer just a cloud kitchen— it’s a tech-powered, multi-brand restaurant empire.

Cloud kitchen industry and market size

Size of the market

The global cloud kitchen market was valued at around $78 billion in 2024 and is set to exceed $229 billion by 2033. In the Middle East, rapid urbanization and high smartphone penetration have made food delivery a dominant sector.

Growth trends

Post-pandemic, food delivery has become a lifestyle. The industry is evolving from delivery-only to hybrid models that combine digital and dine-in. Tech-enabled kitchens, fast prep, and varied menus are driving adoption.

Kitopi’s positioning and target audience

Kitopi operates a full-stack cloud kitchen model. Unlike aggregator kitchens or simple rentals, Kitopi offers end-to-end kitchen management and tech optimization. Its customers are restaurant brands— from local cafes to global franchises—looking to scale without upfront investments.

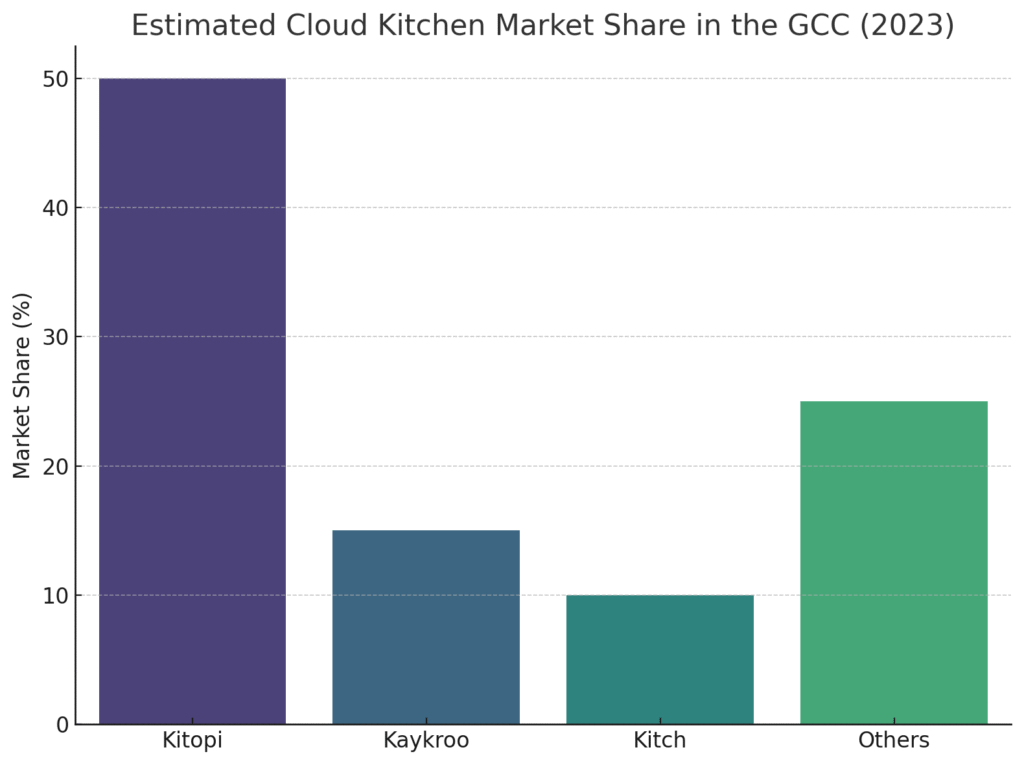

Let’s have a look at the market share of Kitopi and its competitors:

Founders and team members of Kitopi

| Name | Role |

| Mohamad Ballout | Co-founder & CEO |

| Saman Darkan | Co-founder & CTO |

| Bader Ataya | Co-founder & Chief Growth Officer |

| Andres Arenas | Co-founder & Former Chief Property Officer |

Mohamad Ballout (CEO)

Ballout is a serial entrepreneur who previously co-founded BMB Group. After exiting, he incubated Kitopi to solve the scale problem in food delivery. He leads Kitopi’s vision, major investments, and public image.

Saman Darkan (CTO)

With a background in MIS and digital transformation, Darkan built SKOS—Kitopi’s Smart Kitchen Operating System. He oversees all product and tech innovation.

Bader Ataya (Chief Growth Officer)

Ataya is a growth and marketing expert, having co-founded Mumzworld. At Kitopi, he leads restaurant partnerships, marketing campaigns, and regional brand growth.

Andres Arenas (Former Chief Property Officer)

Arenas helped launch Kitopi’s first kitchens and standardized operations. Though less active now, his role was foundational in early scaling.

Other key leaders

The leadership now includes experienced professionals across finance, operations, and legal.

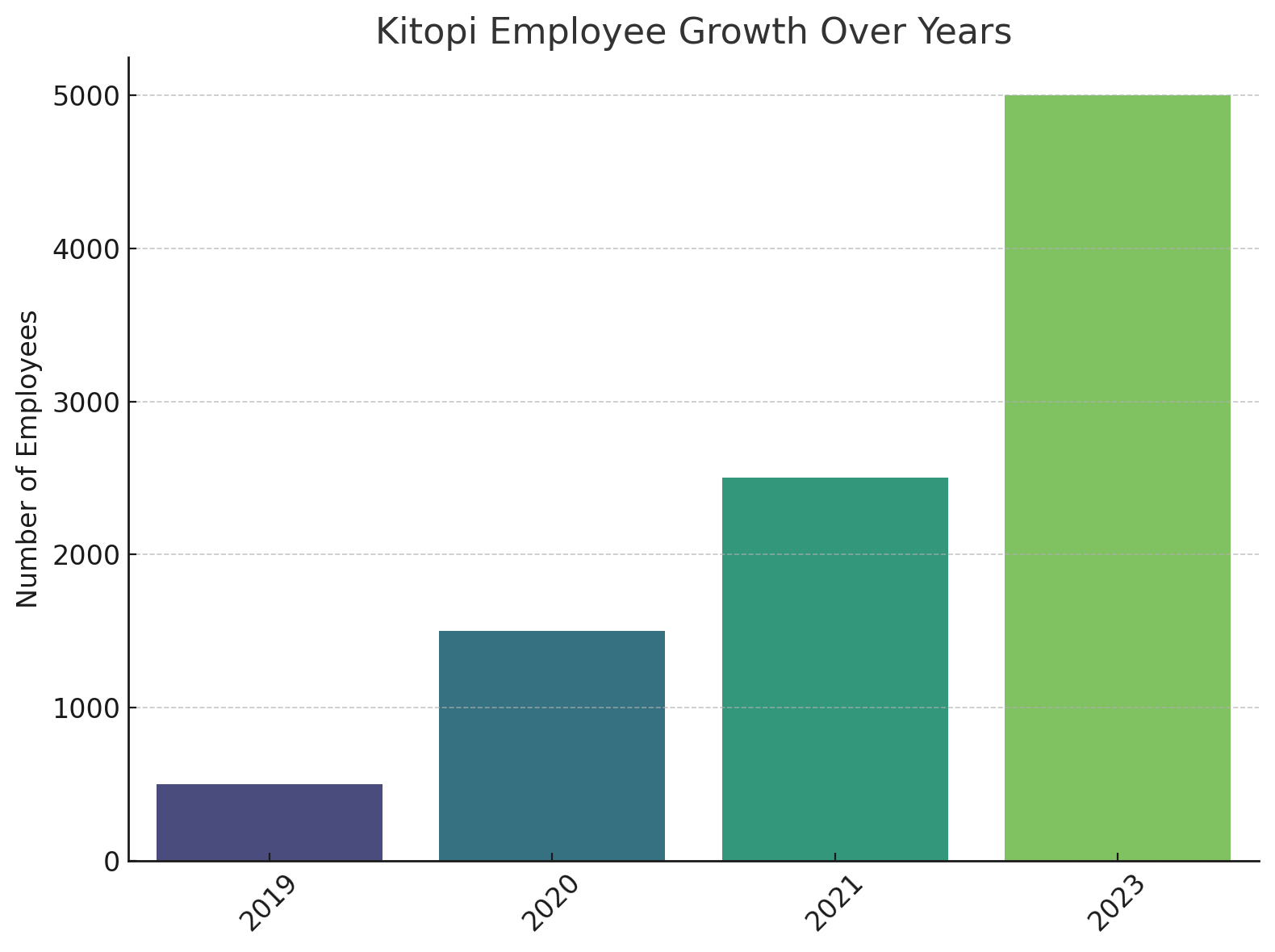

With 5,000+ employees, Kitopi has built a strong mid-management layer and country-specific teams.

Background story of Kitopi

The idea and early days

Launched in 2018, Kitopi’s founders convinced a few restaurant owners to test the model. They ran a single pilot kitchen in Dubai, proving that outsourced cooking could maintain quality and grow delivery revenue.

Initial challenges and pivots

Skepticism from restaurants, recipe confidentiality, and operational complexity were early hurdles. Kitopi overcame them with NDAs, consistent quality, and reliable logistics.

Early growth

By 2020, Kitopi expanded to 60+ kitchens across the GCC. The COVID-19 pandemic, while a challenge, actually boosted delivery demand, helping Kitopi grow 300% that year.

Mission and vision of Kitopi

Kitopi’s mission is to “satisfy the world’s appetite” by enabling access to high-quality, diverse food through smart technology and efficient delivery infrastructure.

The company strives to create delightful food experiences for consumers while helping restaurant partners scale quickly without large investments.

Its vision is to become the world’s leading tech-powered, multi-brand restaurant group. Kitopi aims to bridge the gap between physical and virtual kitchens by leveraging data, automation, and cloud infrastructure.

As it grows, Kitopi continues to focus on operational excellence, innovation in foodservice, and building long-term value through owned and partner brands.

Key pillars of Kitopi’s mission and vision:

- Deliver consistent, high-quality food experiences across borders

- Empower restaurant brands to grow without upfront investment

- Use data and technology to optimize every aspect of kitchen operations

- Expand into new markets while maintaining culinary standards

- Lead the transformation of the global food delivery ecosystem

By mixing kitchen expertise with scalable technology, Kitopi is redefining the future of food delivery and restaurant growth, both in the Middle East and globally.

Name, tagline & logo

- Name meaning: “Kitopi” is short for “Kitchen Utopia”—an ideal kitchen that blends efficiency, scale, and quality.

- Tagline evolution: From “managed cloud kitchen” to “tech-powered, multi-brand restaurant,” the tagline reflects Kitopi’s shift from a backend operator to a consumer-facing food empire.

- Logo design: Kitopi’s logo is clean and modern. Earlier versions featured a chef hat dotting the “i” in Kitopi. The current version uses teal and white colors, aligning with its brand evolution.

Business model and revenue streams: How does Kitopi make money?

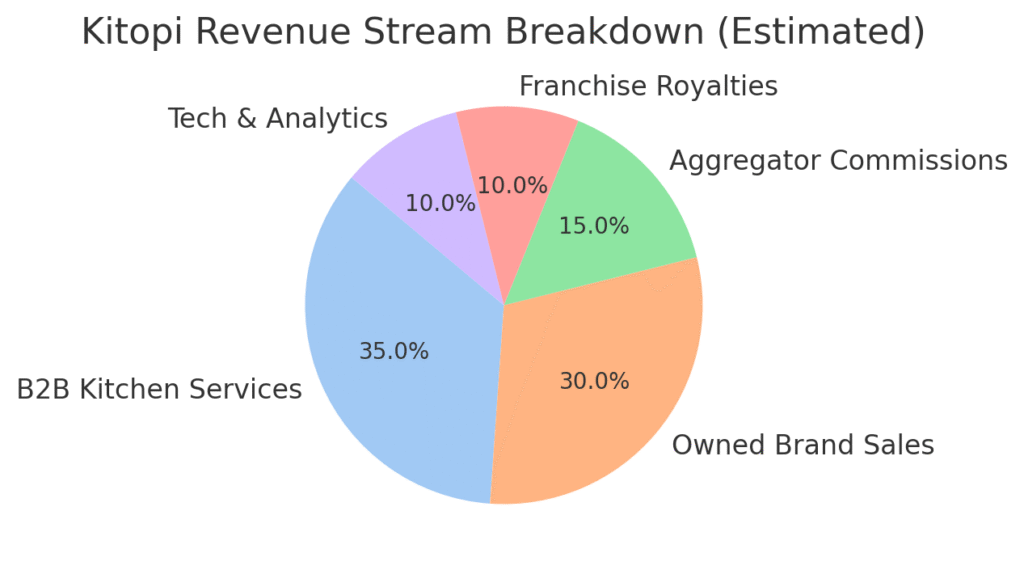

Kitchen-as-a-service fees

Kitopi earns primary revenue by charging restaurant partners for using its cloud kitchens. These fees are typically a mix of fixed base rent (for space and utilities) and variable fees (based on order volumes or revenue share).

This allows Kitopi to maintain predictable revenue while benefiting from its partners’ growth.

Full-service operations management

Restaurants can fully outsource back-of-house operations to Kitopi— including hiring, cooking, quality control, inventory, and dispatch.

In return, Kitopi charges an operations fee or a commission per order fulfilled. This creates a recurring, volume-based income stream that grows with each successful delivery.

Technology licensing and analytics

SKOS, the proprietary software suite, is a revenue driver itself. Restaurant partners using Kitopi kitchens are often provided dashboard access, real-time performance data, and forecasting tools.

Larger clients may pay licensing or service fees for enhanced analytics, integrations, and API access. This SaaS layer supports Kitopi’s positioning as a tech-first platform.

Aggregator-based commissions

Kitopi integrates with leading food delivery apps like Deliveroo, Zomato, and Talabat. When a customer places an order through one of these platforms, Kitopi prepares and packages the food. Kitopi then earns a backend commission from the restaurant partner for fulfillment.

This model scales with demand and contributes to variable revenue.

Brand ownership and consumer sales

Since 2021, Kitopi owns multiple food brands. For these, it captures the entire revenue stream—menu pricing, margins, and customer data. Whether orders come via aggregators, websites, or dine-in outlets, the earnings flow directly to Kitopi.

This direct-to-consumer (D2C) model enhances profit margins and creates brand equity.

Franchising and licensing

Through its franchise partnerships (e.g., FAT Brands), Kitopi earns either a share of franchisee sales, royalty fees, or markups on supply chain services.

Kitopi acts as both operator and master franchisee, giving it multi-layered revenue benefits from each outlet opened under such partnerships.

Value-added and cross-sell promotions

By bundling offerings from different brands (e.g., a burger from Brand A + dessert from Brand B), Kitopi increases average order value and earns more per transaction.

It can also run targeted offers, loyalty discounts, or paid placement for brand visibility within its ecosystem.

Supply chain and bulk procurement margins

Operating at scale enables Kitopi to negotiate favorable terms with food suppliers. It earns margin savings on ingredients, packaging, and equipment, which contributes to its overall profitability, particularly for its owned brands.

Here’s a revenue breakdown of Kitopi:

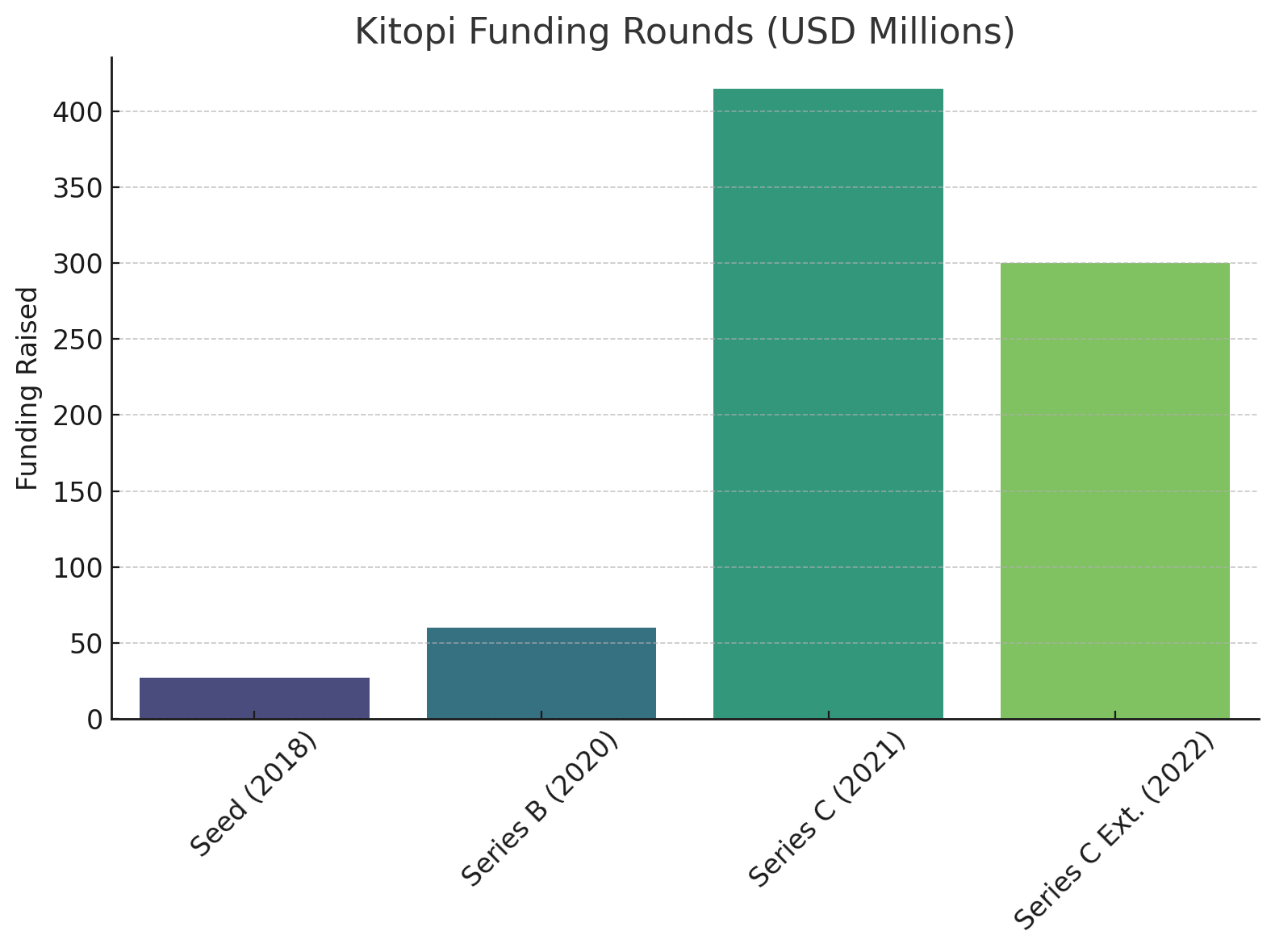

Funding and investors of Kitopi

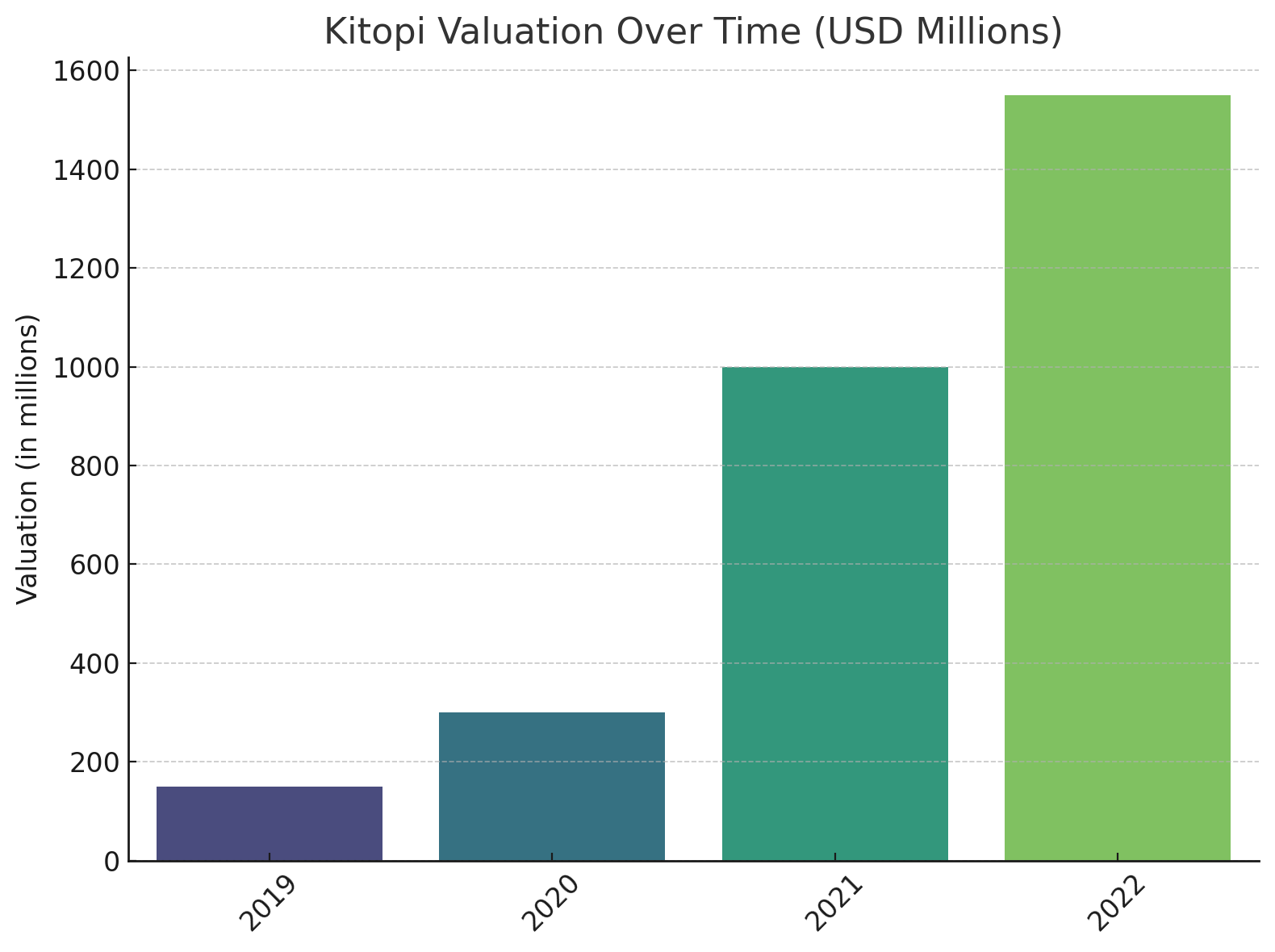

Kitopi has raised over $800 million to date across multiple rounds:

- Seed Round (2018): $27.2M from BECO Capital, Crescent Enterprises

- Series B (2020): $60M led by Knollwood, Lumia Capital

- Series C (2021): $415M led by SoftBank Vision Fund 2

- Series C Extension (2022): $300M at $1.55B valuation

Major investors include SoftBank, Chimera Capital, DisruptAD, GIC, and Next Play Capital. Their support has helped Kitopi expand across markets and acquire F&B brands.

Here’s the Kitopi valuation chart:

Growth metrics and revenues

- Countries: Operates in UAE, Saudi Arabia, Kuwait, Qatar, and Bahrain

- Kitchens & outlets: 200+ locations

- Brands served: 200+ (including partner and owned brands)

- Workforce: 5,000+ employees globally

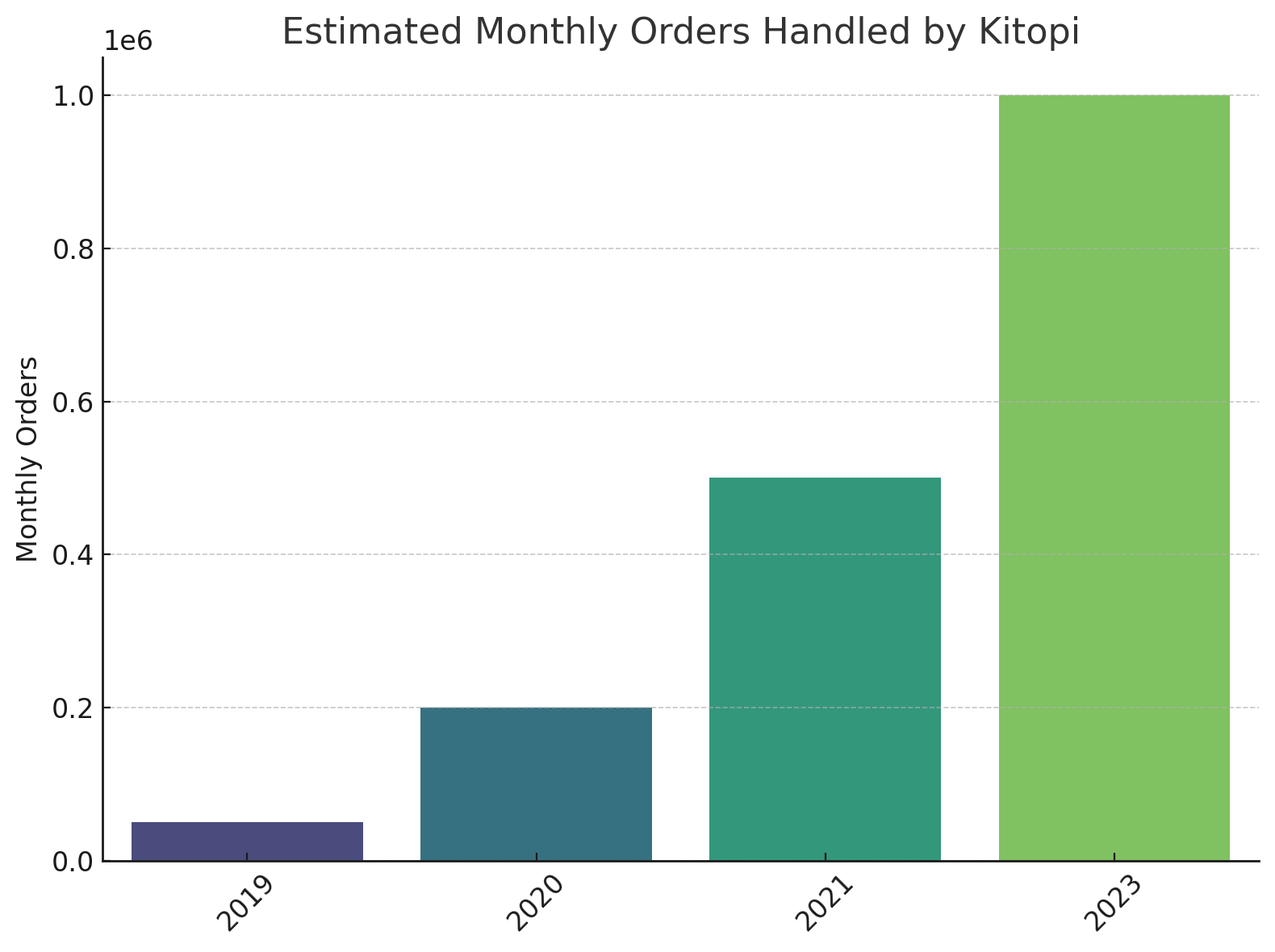

- Orders: 300% YoY growth in 2020

- Valuation: $1.55B (2022)

Here’s the Kitopi employee growth over years:

Mergers, acquisitions & investments of Kitopi

1. AWJ Investments (2023)

Kitopi acquired AWJ, a Dubai-based F&B group behind brands like Operation Falafel, Catch 22, and Awani. This gave Kitopi a strong foothold in the dine-in market and added over 30 restaurants to its network.

2. Under500, Right Bite, Circle Cafe

These acquisitions focused on health-conscious and café-style food brands. They expanded Kitopi’s offering in the wellness and lifestyle category.

3. Taqado and Shobak

Kitopi added these popular regional fast-casual brands to enhance its presence in the UAE and Saudi Arabia, especially in the Mexican and bakery segments.

4. Cloud Restaurants

This strategic acquisition helped Kitopi absorb local competition and gain virtual brand IP and digital kitchen assets.

5. Franchise Partnership with FAT Brands (2021)

Kitopi signed a master franchise deal to open 136 outlets for brands like Fatburger and Johnny Rockets across the Gulf.

6. C3 (Creating Culinary Communities) Partnership

Partnered with U.S.-based C3 to bring virtual restaurant brands like Umami Burger and Krispy Rice to the Middle East.

Business Partnerships of Kitopi

- C3 partnership: Brought U.S. virtual brands like Umami Burger to the Middle East.

- Nathan’s Famous: Kitopi partnered with the iconic U.S. hotdog brand to operate it in Dubai.

- Home in a Bite: Helped Lebanese restaurants expand into Dubai during Lebanon’s economic crisis.

- FAT Brands: Major franchise partnership allowing Kitopi to operate dine-in outlets of global fast-food chains.

- R&D in Denmark: Teamed up with robotics firms to explore kitchen automation.

- Aggregator partnerships: Works closely with Uber Eats, Zomato, Deliveroo, and Talabat to fulfill delivery orders.

Here’s the bar chart to visualize the estimated monthly orders handled by Kitopi:

What are the products and service offerings of Kitopi?

Managed cloud kitchens

Kitopi’s flagship product is its managed cloud kitchen service. It offers fully equipped, commercial-grade kitchen spaces in strategic urban locations, allowing restaurant brands to operate delivery-only kitchens without the cost of setting up their own outlets.

These kitchens are staffed by trained Kitopi employees who follow the brand’s recipe and presentation guidelines, ensuring consistency across every order.

This service allows restaurants to scale into new neighborhoods or cities in as little as 14 days.

Smart Kitchen Operating System (SKOS)

Kitopi’s proprietary software, SKOS, is the backbone of its operational efficiency. SKOS is a full-stack suite that includes modules for order management, kitchen display systems, inventory control, cooking sequences, delivery coordination, and real-time performance analytics.

It integrates with food aggregators, predicts rider arrival times, and sequences dish preparation accordingly. In this way, Kitopi reduces preparation times, increases throughput, and ensures hot, fresh delivery.

Culinary workforce and brand replication

Kitopi’s unique offering includes a pool of trained chefs, line cooks, and kitchen managers who can handle diverse cuisines.

Whether it’s sushi, biryani, or burgers, the Kitopi culinary team can reproduce any partner brand’s dish with precision.

Kitopi uses standardized training modules and quality control measures to maintain flavor and presentation across all locations.

Owned and franchised restaurant brands

Beyond backend operations, Kitopi has ventured into consumer-facing businesses by acquiring popular food brands such as Operation Falafel, Under500, and Right Bite. It operates these brands both as delivery-only and dine-in outlets.

By owning brands, Kitopi controls product development, pricing, and customer experience.

Additionally, through its deal with FAT Brands, it operates international franchises like Johnny Rockets, expanding its offerings to include global QSR chains.

Franchise operations as a service

Kitopi’s expertise in operations, logistics, and tech also positions it as a franchise operator. For global and regional food brands seeking a Middle East presence, Kitopi offers a comprehensive rollout service—from site selection and kitchen setup to operations and marketing.

This “franchise-as-a-service” offering helps brands expand without setting up dedicated teams or infrastructure in the region.

Virtual brand creation

Leveraging its access to consumer data and platform analytics, Kitopi creates delivery-only virtual brands that meet local demand gaps. These brands are built from scratch—name, menu, identity—and are launched exclusively on delivery apps.

Examples include sushi, vegan, or fusion cuisine brands that may not yet exist in a particular market but are trending in customer behavior.

Value-added consumer services

Kitopi is experimenting with consumer touchpoints such as loyalty programs (e.g., Kitopi Rewards), direct-order websites, and bundled offers across its brand network.

This enables upselling, brand discovery, and cross-utilization of kitchen infrastructure to boost per-order profitability.

Challenges faced by Kitopi

The startup had to constantly evolve to address complex operational, financial, and strategic obstacles across its multi-market presence.

1. Operational complexity at scale

Running 200+ kitchens serving hundreds of brands comes with massive coordination demands. Each kitchen must flawlessly replicate brand-specific recipes, follow safety protocols, and handle high volumes without compromising food quality or speed.

2. Earning partner trust and maintaining brand identity

Many early restaurant partners hesitated to relinquish control over food preparation. Kitopi had to reassure them by implementing strict confidentiality agreements and demonstrating consistent performance across kitchens.

3. Overdependence on delivery aggregators

Kitopi’s reliance on platforms like Talabat and Deliveroo initially weakened its brand visibility and profit margins. These platforms charged high commissions and controlled customer data, limiting Kitopi’s direct consumer engagement.

4. Profitability pressure and thin margins

Acting as a backend service provider led to narrow margins, especially when squeezed between aggregator fees and partner expectations. Kitopi responded by acquiring brands to own customer relationships and improve revenue per order.

5. Regulatory complexity across regions

Expanding across UAE, KSA, Bahrain, Qatar, and Kuwait meant navigating different legal and food safety frameworks. Compliance with varying labor laws, kitchen certifications, and trade regulations required dedicated local operations teams.

6. Hypergrowth and cultural alignment

Scaling from a few founders to over 5,000 employees in just five years created challenges in hiring, training, and preserving company culture. Kitopi had to build strong internal systems to manage performance and engagement across geographies.

Kitopi competitors and comparison

Kaykroo (UAE)

Kaykroo operates multiple virtual brands and delivery-only kitchens in the UAE. Its focus is on creating proprietary food brands rather than hosting third-party restaurants.

Unlike Kitopi’s hybrid model, Kaykroo is less diversified and lacks large-scale tech infrastructure or investor backing on the same level. Kitopi’s broader portfolio and ownership of dine-in outlets give it a competitive edge.

Kitch (Saudi Arabia)

Kitch is a Saudi-based cloud kitchen startup offering shared infrastructure and brand partnerships. Its geographic focus is narrower, and its footprint is smaller compared to Kitopi.

While Kitch is strong in localized operations and growing quickly, it doesn’t yet offer the same full-service tech stack or portfolio of owned brands.

Reef Technology / iKcon

REEF is a U.S.-based urban infrastructure company that acquired iKcon to enter the GCC.

While REEF’s model centers on repurposing parking lots into kitchens, it often relies on restaurant staff or brand-led cooking.

In contrast, Kitopi operates a fully managed kitchen system and owns brand experience from prep to packaging. This gives Kitopi tighter control over quality and scalability.

Sweetheart Kitchen

Once a prominent player in Dubai’s foodtech scene, Sweetheart Kitchen focused on delivery-only virtual brands. It faced operational and funding challenges and has since downsized or pivoted.

Kitopi’s ability to raise significant funding, expand to physical outlets, and attract global brands has positioned it ahead.

CloudKitchens (Global)

Founded by Travis Kalanick, CloudKitchens operates globally with a real estate-focused approach—leasing kitchens to restaurants.

However, it offers limited operational support compared to Kitopi’s managed model. Kitopi’s end-to-end fulfillment, tech integration, and ownership of consumer-facing brands create a more comprehensive service stack that appeals to both B2B and B2C stakeholders.

Differentiators

- Tech-first operations: Kitopi’s SKOS platform is a key asset.

- Vertical integration: From cooking to customer delivery.

- Brand diversification: Owned, franchised, and third-party brand portfolio.

- Investor credibility: Backed by SoftBank and other global funds.

- Multi-market presence: Active across GCC with expansion plans for Southeast Asia and Europe.

Kitopi’s blend of technology, culinary management, and strategic investments has positioned it as the most well-rounded and dominant player in the Middle East’s cloud kitchen space.

Future Plans: What’s Next for Kitopi?

Southeast Asia expansion

Kitopi has set its sights on Southeast Asia, targeting high-growth markets such as Singapore, Malaysia, and Indonesia. These countries have rapidly growing food delivery sectors and a tech-savvy, urban population.

Kitopi plans to replicate its Middle East success by either acquiring local kitchen operators or launching from scratch using its established tech and kitchen infrastructure.

With increasing demand for international cuisines and scalable delivery logistics, Southeast Asia represents a lucrative next step in Kitopi’s global strategy.

Brand development and acquisitions

Kitopi aims to grow its portfolio of owned and licensed brands. It will continue acquiring popular regional food businesses that align with delivery-first and hybrid dining models.

Additionally, Kitopi’s data-backed approach allows it to develop its own virtual or in-house brands to meet unmet demand in specific cuisines or formats—like vegan, high-protein, or ethnic fusion brands.

This not only increases margin potential but also gives Kitopi more control over brand marketing and customer loyalty.

Automation and robotics

As a tech-driven foodtech company, Kitopi is actively exploring the use of robotics and kitchen automation. The goal is to enhance speed, precision, and cost-efficiency in food preparation.

Pilot initiatives may include robotic arms for ingredient assembly, automated frying stations, or AI-driven inventory and cooking management systems.

These technologies will help Kitopi reduce labor costs, ensure hygiene, and handle higher order volumes without compromising on quality.

Consumer-facing digital channels

To reduce dependency on third-party delivery platforms, Kitopi plans to launch its own consumer-facing applications. These may include a centralized Kitopi ordering app where users can browse multiple brands, apply loyalty rewards, and access exclusive combo deals.

A proprietary loyalty program—such as Kitopi Rewards—can also incentivize repeat business and collect valuable first-party data to further personalize promotions and menu development.

FAQs

1. What is Kitopi?

Kitopi is a tech-powered, multi-brand restaurant company that started as a managed cloud kitchen platform. It provides kitchen-as-a-service solutions to restaurants, handling food preparation and delivery logistics.

2. When was Kitopi founded and where is it based?

Kitopi was founded in 2018 and is headquartered in Dubai, United Arab Emirates.

3. Who are the founders of Kitopi?

Kitopi was founded by Mohamad Ballout, Saman Darkan, Bader Ataya, and Andres Arenas, all former consultants from McKinsey & Company.

4. What services does Kitopi offer to restaurants?

Kitopi offers managed cloud kitchens, end-to-end kitchen operations, ingredient sourcing, cooking, packaging, and delivery coordination. It also provides access to its proprietary Smart Kitchen Operating System (SKOS).

5. How does Kitopi make money?

Kitopi earns revenue through service fees from restaurant partners, kitchen rental, order commissions, technology subscriptions, and sales from its owned restaurant brands.

6. What is SKOS?

SKOS stands for Smart Kitchen Operating System. It’s Kitopi’s proprietary software that manages kitchen operations, order flow, inventory, and logistics in real time.

7. How many locations does Kitopi operate?

As of 2023, Kitopi operates over 200 kitchens and outlets across five countries in the Gulf region: UAE, Saudi Arabia, Kuwait, Qatar, and Bahrain.

8. What brands has Kitopi acquired?

Kitopi has acquired several brands including Right Bite, Under500, Ichiban, 800 Pizza, Circle Cafe, Taqado, and AWJ (Operation Falafel, Catch 22, Awani).

9. What is Kitopi’s mission?

Kitopi’s mission is “to satisfy the world’s appetite” by delivering diverse food experiences quickly and efficiently through technology.

10. What is unique about Kitopi’s business model?

Kitopi combines cloud kitchen operations, technology, and brand ownership to control the entire food delivery value chain, offering efficiency and scalability to partner and owned brands.

11. Has Kitopi received any major investments?

Yes, Kitopi raised over $800 million in funding, with major investments from SoftBank Vision Fund 2, Chimera Capital, and DisruptAD. It reached unicorn status in 2021.

12. Does Kitopi own restaurants or only operate cloud kitchens?

Kitopi owns and operates both cloud kitchens and physical restaurant outlets, especially after its strategic shift in 2021 to a hybrid B2B/B2C model.

13. What is Kitopi’s international presence?

Kitopi operates in five Gulf countries and has plans for expansion into Southeast Asia. It also maintains a technology hub in Poland.

Authors

-

Himanshu is a builder at heart who loves turning raw ideas into structured systems. At UAE Startup Story, he focuses on the tech, research, and operations behind every feature and founder story. He’s passionate about spotlighting startups that solve real problems and inspiring the next wave of entrepreneurs across the region.

-

Rafiqul is a storyteller with a founder’s mindset. At UAE Startup Story, he crafts deep-dive narratives, interviews, and features that decode what makes startups succeed in the UAE and beyond. He works closely with entrepreneurs to capture lessons, failures, and turning points that can inspire others on their own journeys.